Contributed by: AndyS, FreeTaxUSA Agent, Tax Pro

You may have heard the term per diem before, but it may be a little unclear what that means. Per diem is Latin for ‘by the day’ or ‘for each day’ and is, in the simplest terms, daily allowance of expenses for an employee for things like food, lodging and incidentals when you’re working away from home. We’ll look at how per diem works and what that means for your tax return if you’re self-employed (gig work).

What does per diem look like?

The US General Service Administration (GSA) determines the per diem rate nationwide each year. They have a set standard per diem amount, but there are exceptions for more expensive cities. Check their website for current per diem rates. There’s even a tool to help you figure out your allowed rates for your work trip.

As long as you provide a detailed expense report to your employer for work related trips, stay within the federally mandated amounts, and follow federal requirements, none of the per diem paid to you count as wages and isn’t taxable. However, if you don’t follow all the requirements, reimbursement will be taxable as wages.

The 2025 standard per diem rate is $178 per day which breaks down to $110 for lodging and $68 for meals and incidentals. There are some exceptions to that rate if you travel to a city the US GSA has determined has a higher cost of living, making their set rate too low. For example, Los Angeles, CA, has a daily rate of $277: $191 for lodging and $86 for meals and incidentals. If you only have a day trip away from the office, an employer can opt to pay the meal and incidental rate only.

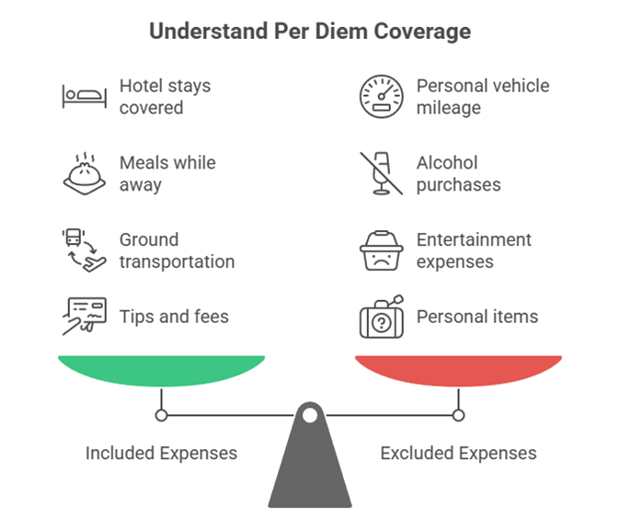

Per diem typically consists of several items:

- Hotel stays for overnight jobs - this can include an Airbnb or apartment for extended stays,

- Meals while you’re away such as restaurants, room service, or groceries for hotel eating,

- Ground transportation such as airport shuttles, rideshare services, or public transit between your hotel, worksite, and airport,

- Tips and service fees for things like restaurant tips, dry cleaning, parking, and tolls.

There are some things not included in per diem:

- Mileage for personal vehicles. Employees are reimbursed using current federal mileage rates instead.

- Alcohol purchases.

- Entertainment expenses, even if there’s a business purpose.

- Personal items like souvenirs.

- Anything not related to business.

What if I’m self-employed?

If you work for yourself, you can usually write off business travel costs on Schedule C of your tax return to save money at tax time. For lodging and transportation, you’ll need documentation such as receipts and these can be deducted as actual expenses, not per diem.

There is a slight difference for meals when you are self-employed. You can use IRS per diem rates, but it's limited to 50% of the current federal rate and only applies when you're away from your tax home overnight for business. The exception to this is if you are subject to the Department of Transportation’s “hours of service” limits. Then you can deduct 80% of your business-related meal expenses.

To be an eligible individual for the Department of Transportation’s limits, you must be:

- Air transportation workers: These are individuals such as pilots, crew, dispatchers, mechanics, and control tower operators who are under Federal Aviation Administration regulations.

- Drivers: This includes interstate truck operators and bus drivers who are under Department of Transportation regulations.

- Railroad employees: This encompasses engineers, conductors, train crews, dispatchers, and control operations personnel who are under Federal Railroad Administration regulations.

- Merchant mariners: Those who work under Coast Guard regulations would typically qualify.

Make sure you keep track of where and why you went, and the business purpose. For the latest rules and rates and access to graphs to help track your expenses, view IRS Publication 463.

Things to keep in mind

The most important thing to remember when you’re claiming per diem is to make sure you keep accurate records of your expense report. Turn the required paperwork into your employer within 60 days of the work trip to avoid being taxed and keep careful track of receipts.