Contributed by: WrenD, FreeTaxUSA Agent, Tax Pro

If you're working and earning a low to moderate income, the Earned Income Tax Credit (EITC) could put money back in your pocket. It's a valuable tax credit designed to help working individuals and families, but the rules can be a little confusing. In this article, we’ll walk you through the key factors that determine eligibility — such as your income, filing status, and whether you have qualifying children — so you can quickly figure out if you might qualify.

Who can claim the EITC?

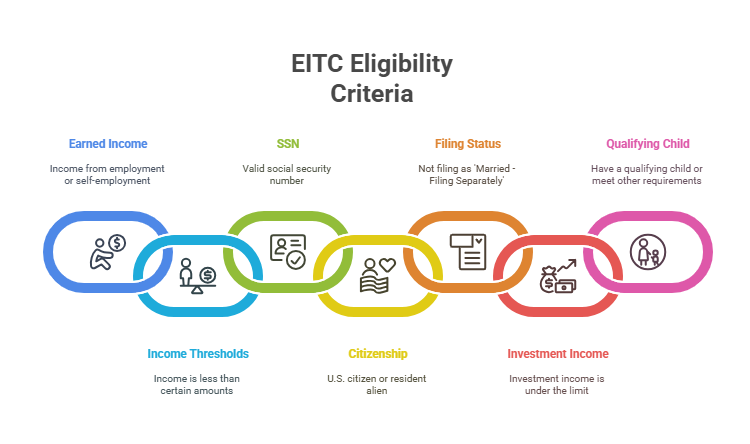

To determine if you're eligible for the EITC, you need to meet several requirements. The rules cover areas such as your income, family size, and your citizenship status. Here's a breakdown of the main qualifications:

1. You must have earned income

You need to have earned income to claim the EITC. This includes money you make from:

- Working for someone else (wages, salaries, tips)

- Running your own business (self-employment income)

- Some disability benefits

Unearned income (for example, investment income, pensions, unemployment compensation, and most Social Security benefits) doesn't count as earned income for the EITC.

2. Your income must be within certain limits

The EITC is designed for people with low-to-moderate incomes. To qualify, your income must fall below a specific threshold. The exact limits change each year and depend on your filing status and the number of children you claim, if any.

For example, as of 2025, someone with no children typically needs to earn under $20,000, while a married couple with three kids might still qualify with income close to $60,000. These numbers aren’t exact, but they give you a ballpark idea.

To see the current year’s income thresholds, check the official IRS EITC income tables.

3. You must have a valid Social Security number

You (and your spouse if filing jointly) must have a valid Social Security number (SSN) that allows you to work in the United States, and each qualifying child must have an SSN by the due date of the return (including extensions). Individual Taxpayer Identification Numbers (ITINs) don't qualify for the EITC. Even if an SSN is issued later, you can’t go back and qualify for the EITC for any year before the SSN was received.

4. You must be a U.S. citizen or resident alien

The EITC is only available to U.S. citizens and resident aliens. If you’re filing a joint return and one spouse is a nonresident alien, you might still qualify under certain circumstances.

5. You can't file as “married filing separately”

If you’re married, you must file a joint tax return with your spouse to claim the EITC, unless you meet certain rules.

6. You can't have too much investment income

If your investment income (such as dividends, interest, or rental income) is too high, you won’t qualify for the EITC. In recent years, the limit has been investment income of less than $12,000.

7. Special rules for those without children

If you don’t have children, you can still qualify for the EITC, but there are additional requirements:

- You must be at least age 25 but under age 65 at the end of the tax year.

- You cannot be claimed as a dependent on someone else’s tax return.

- You must have lived in the United States for more than half the year.

How to claim the EITC

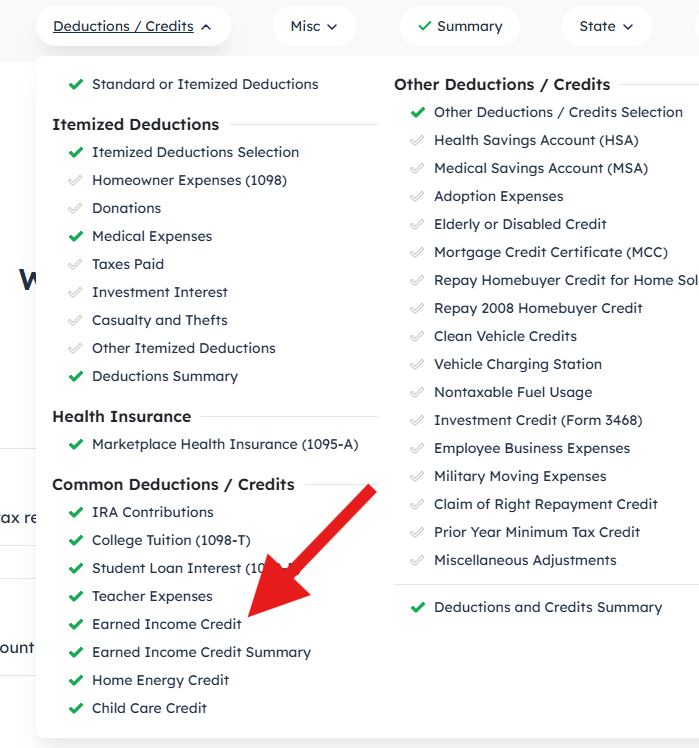

FreeTaxUSA software will calculate the EITC on your tax return if you qualify based on your filing status, dependents, and income. To check the EITC being applied to your return, and answer extra qualification questions as needed, follow this menu path: Deductions/Credits > Common Deductions/Credits > Earned Income Credit.

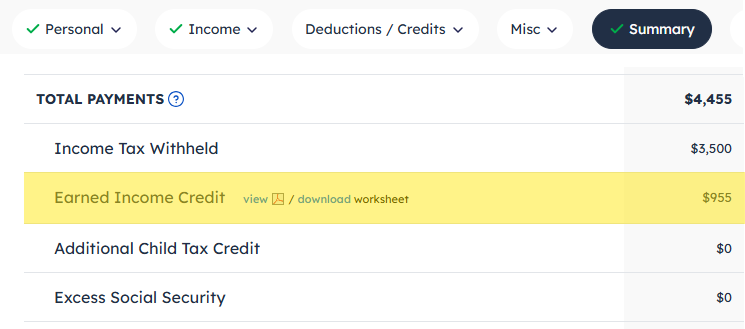

You can also see the amount of EITC on the Summary screen. Scroll down to the 'Total Payments' section and find the Earned Income Credit line. From there, you can view the worksheet used to check your eligibility and the calculated amount.

Final thoughts

The Earned Income Tax Credit is a benefit for working individuals and families with low to moderate incomes. It can reduce your tax bill or provide a refund, assisting your finances. Our software will determine your eligibility, and you may also find the IRS EITC Assistant useful for additional guidance.