Contributed by: BariS, FreeTaxUSA Agent, Tax Pro

Many kinds of insurance premiums, if paid out of pocket, may qualify as a medical itemized deduction. We’ll look at different types of insurance premium payments so you can determine what your situation may be. Perhaps you’ll find an additional itemized medical deduction.

Personal and/or family health insurance premiums

Personal and/or family health insurance premiums, including dental and vision, paid through an employer, are usually deducted from your paycheck before tax. This is also known as “pre-tax.”

These pre-tax health insurance premiums aren’t included in your taxable wages on Form W-2. Because they aren’t included in taxable income, they aren’t a deductible medical expense.

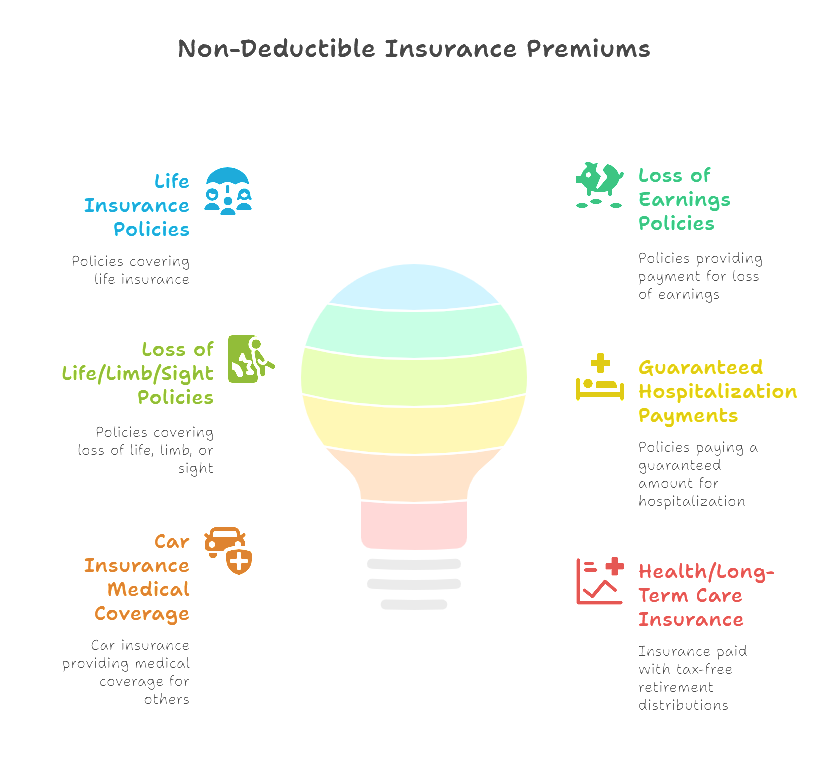

You may pay health insurance premiums other than those deducted from your paycheck. Some of these separately paid premiums are deductible and can be included as medical expenses. However, some separately paid premiums (per IRS rules) are specifically not deductible.

IRS Publication 502 (Medical and Dental Expenses) includes the list of health insurance premiums that are deductible and can be included as itemized medical expenses. The publication also lists premiums you can’t include as itemized deductions.

Note 1: If you are self-employed, do not deduct self-employment health insurance premiums with your Itemized Deductions. These should be included as expenses for your business.

Note 2: Did you obtain health insurance through the Marketplace or a state-based exchange? If you received advance payments of the Premium Tax Credit or you think you may be eligible to claim the Premium Tax Credit, you'll need to determine how much of your premiums you actually paid out of pocket after taking the credit into consideration.

Your medical deduction will be limited

One important IRS rule is that you’re only able to deduct the portion of your medical expenses that exceeds 7.5% of your adjusted gross income (AGI). FreeTaxUSA software will do the calculations for you. Simply enter your deductible medical expenses, and we’ll figure out what portion can be claimed on your tax return, based on the information you previously entered about your income.

Example: Your AGI is $50,000, and 7.5% of $50,000 is $3,750. You can only deduct the amount of your total medical expenses that are greater than $3,750. If your total deductible medical expenses are $4,200, you’re able to deduct $450 ($4,200 - $3,750 = $450) of those expenses on your tax return.

You might think that, because of this limitation, it’s not even worth keeping track of all your medical payments. However, several states allow medical expenses as an itemized deduction with a smaller limit or no limit at all.

To find out whether your state has a lower limit or no limit, you’ll want to look at the rules for your state. If you’re still unsure when preparing your state return, enter your medical expenses in the federal portion of your account. The information entered there will also be used to complete your state return.

To enter your medical expenses, follow menu path: Deductions/Credits > Itemized Deductions > Medical Expenses. Enter the information as it applies to you and select Save and Continue.

Click on the little blue question marks throughout the software for further clarification as you go through the filing process. If additional questions come up, you’re always welcome to reach out to our customer support team for help.

Summary

FreeTaxUSA’s goal is to make sure you take all allowable deductions under the tax law. Once you’ve entered all your eligible medical expenses, the software will help determine if you qualify to claim any medical expenses as an itemized deduction.