Contributed by: TriciaD, FreeTaxUSA Agent, Tax Pro

Imagine finishing a busy week of driving for Uber or Lyft and wondering how all those fares and tips translate into your tax return. If filing taxes as a rideshare driver seems overwhelming, you’re not alone—this guide will give you step-by-step instructions for reporting your income and expenses.

The IRS requires rideshare drivers to file their taxes as small business owners using a form called Schedule C. Let’s break it down in simple steps.

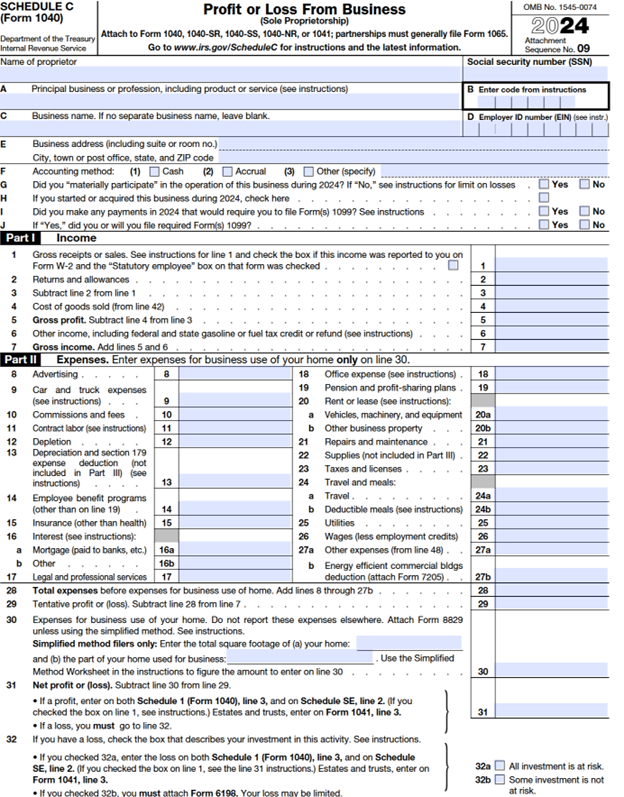

What is Schedule C?

Schedule C is a form included with your federal tax return. This form is used by people who are self-employed to report income and expenses and calculate profit or loss from their business. As a rideshare driver, you're considered a small business owner, and Schedule C is where all money you earned and spent while driving for the rideshare is reported.

Reporting your income

Properly reporting and recording income and expenses is important. Doing so ensures you pay the right amount of income tax. If you don’t report income and expenses correctly, you could have less money in your pocket by paying too much tax or owing interest and penalties to the government by not paying enough.

First, calculate the total income you earned from your rideshare business. Your rideshare platform, like Uber or Lyft, will usually provide a tax summary or a 1099 form. This form shows the total amount of money you earned, including fares paid by passengers and any tips received. Be sure to include all sources of income related to your rideshare driving.

For example:

- Passenger fares

- Tips

- Referral bonuses

Typically, rideshare companies provide a list of the type of income and forms they provide for tax purposes on their website.

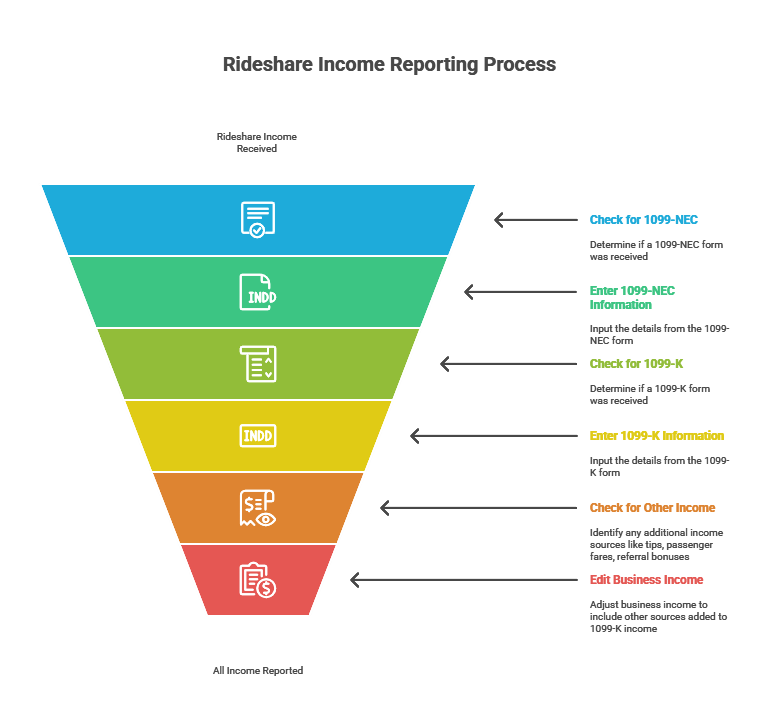

If you receive a 1099-NEC or 1099-MISC from the rideshare company, enter information from the form you received in our software by following this menu path: Income > Business income > 1099-NEC/1099-MISC. Continue through the screens provided by the software, entering information as it applies to you.

If you received a 1099-K, follow this menu path: Income > Business Income > 1099-K Income. Continue through the screens, entering the information the software requests.

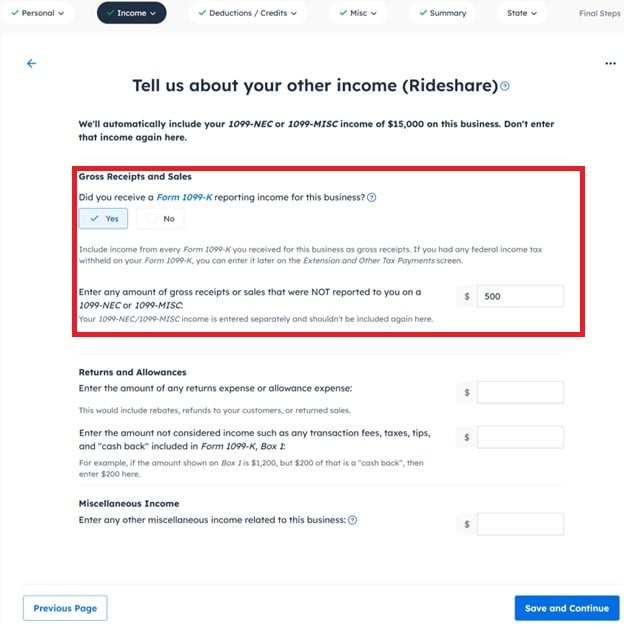

As you go through the Schedule C portion of the software, you'll come to the Tell us about your income page, where you'll be prompted to enter any amount of gross receipts or sales that were NOT reported to you on a 1099-NEC or 1099-MISC. Enter the total income, including the amount reported on the 1099-K you received, in the box. Do not include 1099-NEC or 1099-MISC income already entered in this box.

Let's look at an example of how to enter each form and type of income in the FreeTaxUSA software.

Todd received the following:

- Form 1099-NEC: $15,000 from Uber rideshare income

- Form 1099-K: $200 in credit card transactions

- $300 in additional tips recorded personally, not included on the forms above

In this case, Todd will enter his income as shown below:

- Form 1099-NEC: Follow this menu path: Income > Business Income >1099-NEC/1099-MISC.

- Form 1099-K: Follow this menu path: Income > Business Income >1099-K Income.

- $300 tips and $200 from Form 1099-K: Follow this menu path: Income > Business Income > Business Income (Schedule C).

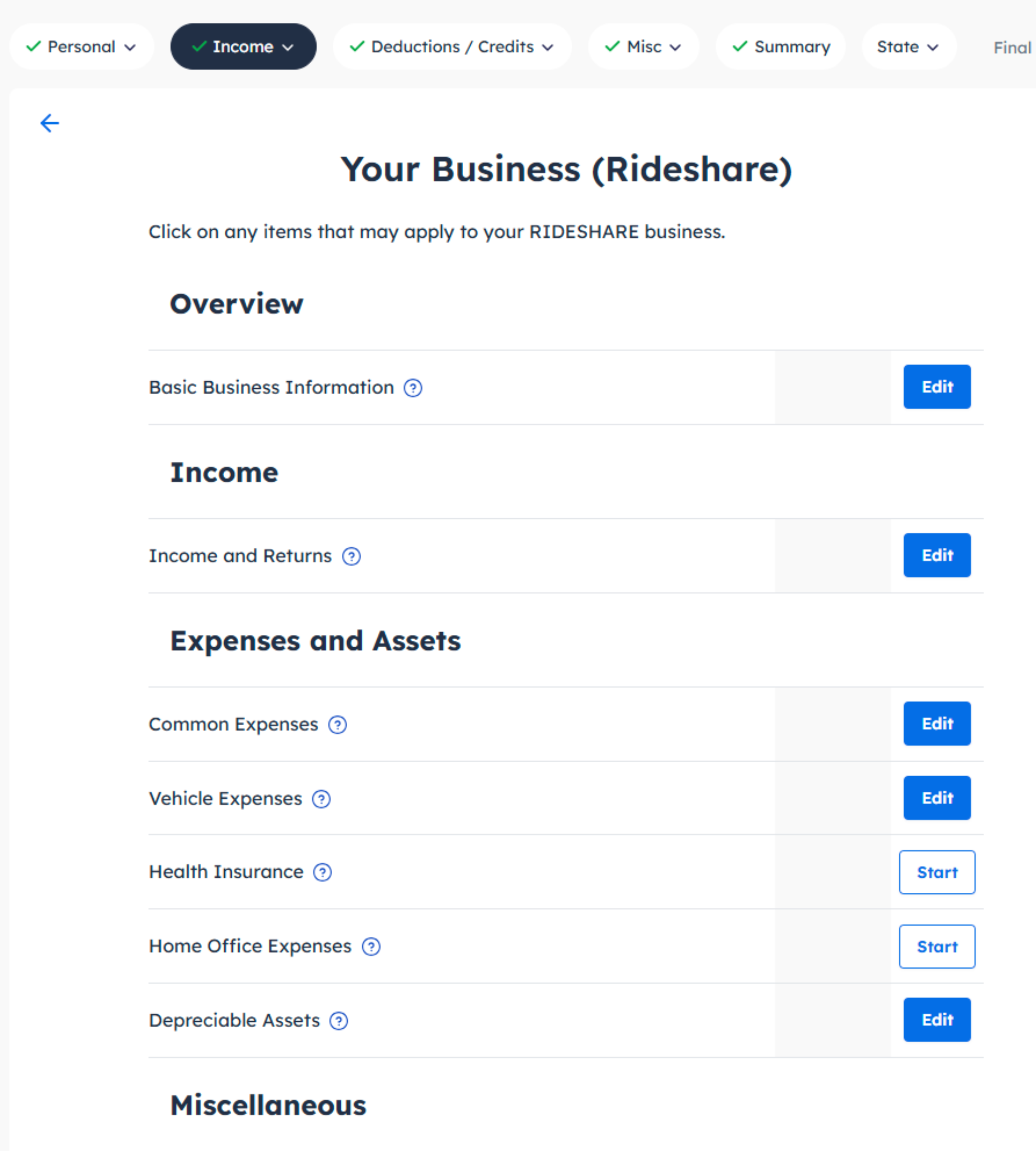

- If a rideshare business is already entered, select ‘Edit’ next to the business and then ‘Edit’ next to ‘Income and Returns.’ Be sure the box is checked next to the 1099-NEC belonging to this business.

On the Tell us about your other income screen, enter $500 ($300 tips + $200 from Form 1099-K) in the box for gross receipts or sales that were NOT reported to you on a 1099-NEC or 1099-MISC.

Tracking your expenses

Expenses are costs you pay for your rideshare business, such as cell phone, vehicle, and cleaning. Keeping track of these costs is important because they can lower the amount of tax you owe. The IRS allows you to subtract expenses from your income, so you only pay tax on your profit.

Common expenses for rideshare drivers include:

Vehicle costs

Your vehicle is a significant part of your business. Expenses such as gas, oil changes, repairs, and maintenance can be deducted. The cost of car insurance and registration fees can also be deducted. We'll go over some common expenses for rideshare drivers.

- Standard Mileage Rate: Keep track of miles driven and multiply them by the IRS mileage rate. To use the standard mileage rate, you must choose that expense method the first year the car is available for use in your business.

- Actual Expenses: Deduct the actual costs of operating the vehicle based on the portion used for business. Costs include gas, oil, repairs, tires, insurance, registration fees, licenses, and depreciation attributable to the portion of total miles driven for business.

Choose the method that gives the bigger deduction!

Cell phone and app costs

If you receive rideshare requests on your phone, you can deduct the business use percentage of the cost, data plan, and any apps used for driving.

Other expenses

Don’t forget other costs related to your rideshare business, such as:

- Car washes

- Parking fees

- Tolls

- Snacks or water for passengers

Depreciable assets

You may also have depreciable assets as a rideshare driver. A depreciable asset is an item used in your business that loses value over time because it gets old, worn out, or less useful. When an item is depreciated, the cost is spread out over the time it’s used.

The IRS allows you to recover the cost or other basis (your cost for the item) over the time you use the item. It’s an allowance for the wear and tear, deterioration, or age of the item. These assets include items such as computers, phones, machinery, etc.

Vehicles are also depreciable assets. However, vehicle expense information entered in the software is used to calculate depreciation for your vehicle, so it isn’t necessary to enter your vehicle as a depreciable asset.

Recordkeeping

Keep receipts and/or documentation for all business expenses. They are proof of expenses reported if the IRS requires additional information about an expense.

Enter rideshare expenses in the applicable section in our software. To enter and/or review entries, follow this menu path: Income > Business Income > Business Income (Schedule C) and select ‘Edit’ next to the business. You'll be brought to the Your Business menu page. Choose ‘Edit’ or ‘Start’ next to the menu items for expenses which need to be added or edited.

Paying taxes

As a rideshare driver, you’re responsible for paying all taxes since you don’t have an employer withholding them from a paycheck. This includes:

- Self-employment tax: Social Security and Medicare tax,

- Income tax: Based on your profit and tax rate.

Because the U.S. is a pay-as-you-go system, you might need to pay estimated taxes throughout the year. Estimated taxes are like small payments to the IRS that are due on a quarterly basis, much like having tax withheld by an employer. This prevents you from owing a large amount all at once and possibly owing an underpayment penalty.

Keeping good records

Good recordkeeping makes tax time easier. The IRS requires keeping a log of vehicle business miles. We recommend you keep a folder for your receipts and copies of your 1099 forms. Apps or spreadsheets are helpful in organizing information, receipts, and documents.

Records should include:

- Date and purpose of each expense

- Miles driven

- Receipts from expenses

Tips for success

Here are some tips to make reporting your taxes simple:

- Start organizing your records early in the year.

- Check the IRS website for updates. Tax rules can change!

Reporting your income and expenses as a rideshare driver doesn’t have to be hard. By understanding a Schedule C and keeping good records, you can file your taxes like a pro. Follow these steps, and you’ll be ready for tax season!