Contributed by: TriciaD, FreeTaxUSA Agent, Tax Pro

Health Saving Accounts (HSAs) are popular for managing healthcare costs with tax benefits. Taxpayers with high-deductible health plans (HDHPs) can contribute pre-tax money to an HSA for qualified medical expenses.

However, annual IRS contribution limits apply (plus catch-up contributions for taxpayers over 55), and exceeding these limits may result in tax penalties. This guide provides an overview of HSAs, addresses excess contribution issues, and outlines steps for making necessary corrections.

What are advantages of contributing to an HSA?

- All HSA contributions, whether made by you or on your behalf, are tax-deductible — even if you don’t itemize deductions.

- Employer contributions, including those made through a cafeteria plan, aren’t included in your income.

- Funds in your HSA remain in your account until you need them, with no “use it or lose it” rule.

- Interest and/or earnings accrued in your HSA are tax-free.

- Distributions used for qualified medical expenses are generally exempt from taxes.

- Your HSA stays with you if you change jobs or retire.

Who is eligible to contribute to an HSA?

To qualify for HSA contributions, you must:

- Have an HDHP by the first day of your tax year's last month (usually December 1),

- Not have other health coverage (with certain exceptions explained later),

- Not be enrolled in Medicare,

- Not be claimed as a dependent on another person’s tax return.

You remain eligible even if your spouse has non-HDHP coverage, as long as you're not covered by their plan. Additional allowed insurance includes coverage for:

- Workers’ compensation, property liability, or specific diseases/illnesses,

- Fixed payments for hospitalization,

- Accidents,

- Disability,

- Dental, vision, or long-term care.

How do HSA distributions work and what are the tax implications?

Generally, you pay for medical expenses out of pocket until you meet your HDHP deductible. Most HSA administrators provide a credit card for paying qualified medical expenses directly from your HSA, or you can use personal funds and request reimbursement for qualified expenses incurred after the account is opened. Distributions for qualified medical expenses are typically tax-free, while those for non-qualified expenses are subject to income tax and may incur an additional tax. There's no requirement to take a distribution from your HSA each year; you may leave the money to grow for future medical needs.

How to report HSA distributions on your return

Form 1099-SA is typically issued by the HSA trustee to report distributions you received throughout the year. Distributions from an HSA must be reported on Form 8889, which should be included with your tax return.

Enter your Form 1099-SA in FreeTaxUSA by following menu path: Deductions/Credits > Other Deductions/Credits > Health Savings Account (HSA). Enter the information exactly as shown on your form.

What is an excess HSA contribution?

Excess HSA contributions occur when total yearly deposits from all sources exceed IRS limits (refer to IRS contribution limits each year). The limit varies based on the HDHP coverage type (single or family), age, and eligibility. All deposits (employee pre-tax or deductible contributions, employer contributions, and any other contributions) count toward the maximum contribution.

What causes excess contributions?

- Failing to update contributions when switching between single and family coverage.

- Multiple employers making independent contributions.

- Both spouses making catch-up contributions to a single HSA (each must use their own account).

- Contributions made after becoming ineligible, such as enrolling in Medicare.

What are tax consequences of excess contributions?

- The excess contribution amount isn’t tax deductible,

- A 6% excise tax applies in the year of the excess contribution and each subsequent year, unless the excess is resolved.

For example, Jake (age 40), with family HDHP coverage in 2024, contributes $9,000 to his HSA. Given the contribution limit is $8,300, there’s an excess contribution of $700. If this excess isn’t corrected before the filing deadline (including extensions), a 6% penalty ($42) will be assessed annually until the excess is resolved.

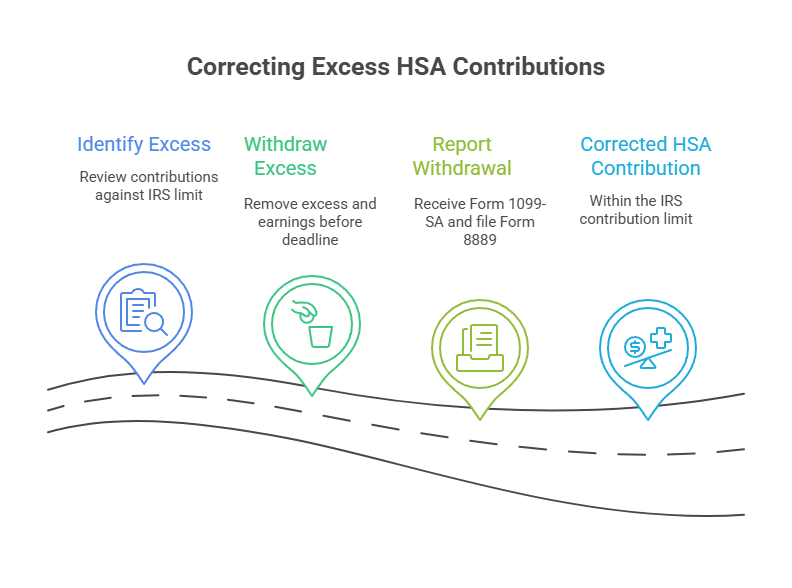

How are excess HSA contributions corrected?

- Identify the excess by reviewing your contributions, including employer contributions, to see if you’ve exceeded the IRS limit.

- Withdraw the excess contributions and earnings by the tax filing deadline (including extensions) for the year in which the excess was made, typically April 15th following that tax year. For instance, if excess contributions occurred in 2024, they should be withdrawn by April 15th, 2025 (or October 15th if an extension was filed). By doing so:

- Excess contributions you made (not through an employer plan) aren’t included in your gross income. The earnings must be reported as taxable income in the year you withdraw them.

- Excess contributions made through an employer plan (by employer and/or employee) are added to your taxable income in the year of the contribution due to the tax advantage associated with these contributions. Earnings on excess contributions must be reported as taxable income in the year you withdraw them.

- The 6% penalty is avoided.

- Report the withdrawal using information from Form 1099-SA. Report the withdrawal on Form 8889 and any earnings as “Other Income” on your tax return.

Options for resolving the excess after the filing deadline will be covered later in this article.

Example 1 – Personal excess contribution withdrawal

Sarah (age 32), with self-only HDHP in 2024, mistakenly contributes $5,000 (not through an employer plan). IRS limit is $4,150. In February 2025, she withdraws the $850 excess contributions plus $20 earnings and receives a check for $870.

She’ll receive a 2025 Form 1099-SA from her HSA provider reporting an $870 HSA distribution. The $20 earnings will be reported on her 2025 tax return as “Other Income”. By acting before the deadline, she avoids the 6% penalty.

Example 2 – Employer excess contribution withdrawal

Mark (age 45), has family HDHP coverage in 2024. His employer contributes to his HSA. After changing jobs, his new employer also makes contributions to his HSA. These contributions are reflected on his W-2 forms (Box 12, Code W) from each employer.

Mark’s total HSA contributions for 2024:

- Employer 1: $4,500

- Employer 2: $5,000

- Total HSA contributions: $9,500

- 2024 IRS limit for family HDHP: $8,300

- Excess contributions: $9,500 - $8,300 = $1,200

In March 2025, Mark withdraws the $1,200 excess contribution (plus earnings) before the tax filing deadline (April 15, 2025), avoiding the 6% excise tax. The earnings on the excess must be included in income for the year in which the withdrawal occurs (2025).

Mark will report the following:

2024 tax return:

- $1,200 withdrawn excess contributions as taxable income on Form 8889, line 13 (carried to Form 1040). Excess contributions through an employer plan, once withdrawn, lose their tax-advantaged status and must be reported as income.

- No 6% excise penalty because the excess was withdrawn before the deadline.

2025 tax return:

- 2025 Form 1099-SA in early 2026, showing the distribution of excess and earnings.

- The earnings on the excess amount should be reported as “Other Income” on his 2025 tax return.

How do I report a withdrawal of excess HSA contributions in FreeTaxUSA?

To report excess HSA contributions and earnings:

- Follow menu path: Deductions/Credits > Other Deductions/Credits > Health Savings Account (HSA) to enter details from Form 1099-SA. Indicate whether you took an HSA distribution.

- If you received a regular HSA distribution (not related to excess contributions), you'll get Form 1099-SA and should answer Yes.

- If the excess contribution was corrected within the same tax year in which it was made, a Form 1099-SA should report the HSA distribution, and you would respond Yes to this question.

- If you correct the excess contribution in the following tax year before the filing deadline, you'll get Form 1099-SA for the distribution next year, and it will appear on next year's tax return. In this case, select No.

- If you didn't get a Form 1099-SA, go to step #7.

- If you received Form 1099-SA, enter the details as prompted.

- When asked if all HSA distributions were used for medical expenses Answer No if you withdrew excess HSA contributions or earnings.

- Lower on the page, answer Yes if you contributed to your HSA in the tax year and then withdrew them.

- When prompted, enter all excess contributions and earnings withdrawn by the tax return deadline.

- Next, report your HSA contributions. Employer contributions from Box 12 (Code W) on your W-2 are carried over automatically and don’t need to be entered. Only enter additional employer or personal contributions not shown on your W-2.

- The software detects excess HSA contributions and prompts you to enter the withdrawn amount (excluding earnings) by the filing deadline, including extensions.

- Report excess earnings (if withdrawn in the tax year). Follow menu path: Income > Uncommon Income > Other Income. Select Yes under Miscellaneous income and enter the income description and withdrawn excess earnings in the box provided.

What if you miss the deadline?

If excess contributions and earnings aren’t withdrawn by the tax filing deadline, you’ll owe a 6% excise tax each year until it’s resolved. There are several options to correct excess contributions that can’t be withdrawn, thereby avoiding year-to-year penalties:

- Treating the excess as a contribution for the following tax year: if you have room in next year’s contribution limit, the excess is applied to that year and will stop a further 6% excise.

- Paying for medical expenses with your HSA can help reduce your HSA balance to $0; the excise tax applies to the lower of your excess contributions and your HSA balance. When your balance is $0, you won't have to pay any more excise tax.

- Taking a distribution for non-medical purposes, which would be taxable income and subject to a one-time 20% penalty.

💡Note: The 20% additional tax does not apply to individuals who are disabled, age 65 or older, or deceased.

Let’s alter the earlier example with Sarah:

Sarah discovers an excess HSA contribution of $850 in June 2025, without filing a tax extension.

Penalty for 2024: Sarah owes a 6% excise tax on the excess contribution. Calculation: $850 x 6% = $51 penalty.

She reports this penalty on Form 5329 with her 2024 tax return. Note: The 6% penalty continues each year unless resolved by one of the above methods.

Action Sarah takes to correct the excess contribution:

Sarah takes an $850 distribution for non-medical expenses in 2025 after the tax filing deadline. The distribution is taxable income on her 2025 tax return. She’s assessed a one-time 20% penalty on $850. Her 2025 return will no longer show an excess, and the 6% excise tax will not be assessed.

What are potential mistakes that may create an excess contribution?

Should your HDHP coverage change during the year, your contribution limit will adjust proportionally according to the number of months you’re covered. Over-contributions are common in these cases.

Example: Maria has self-only HDHP for 6 months and family HDHP for the remaining 6 months in 2024. Her allowed limit is:

- (6/12 x $4,150) + (6/12 x $8,300) = $2,075 + $4,150 = $6,225.

- If she contributes $8,300, she has $2,075 excess contributions.

Example: Lisa (age 47) holds family HDHP coverage in 2024. The IRS HSA contribution limit for the year is $8,300. Lisa's employer contributes $6,500 to her HSA, and she adds an additional $2,175 during the year. This results in total contributions of $8,675, which exceeds the annual limit by $375. Because all contributions are included in the yearly maximum, Lisa has $375 in excess HSA contributions that must be withdrawn to prevent penalties.

If an employer contributes more than intended, the excess contribution remains the employee’s responsibility to address. Notifying HR can help ensure similar errors are avoided in the future.

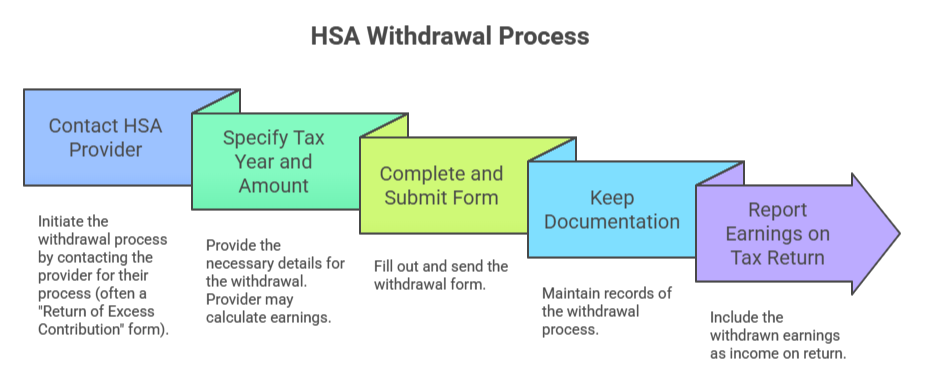

How do I request a withdrawal?

Key points to remember

- Withdraw excess contributions and earnings before the tax deadline to avoid penalties.

- Review annual contribution limits each year.

- Consult your provider or tax advisor if you’re unsure.

Conclusion

HSAs offer valuable tax savings, but you must follow annual contribution limits. If you contribute too much, act quickly to fix the error and avoid penalties. Always monitor your contributions and keep accurate records so your HSA continues to benefit you and support your healthcare needs.