Contributed by: PhillipB, FreeTaxUSA Agent, Tax Pro

Whether you run an online boutique or sell homemade goods at local markets, understanding what qualifies as cost of goods sold on Schedule C is important for anyone who makes or resells products.

What counts as cost of goods sold?

Cost of goods sold (COGS) refers to direct costs of products you sell. This includes items you buy for resale (like clothing) or materials and supplies you purchase to make your own products (such as ingredients for jam).

Inventory and the small business exception

Typically, you must keep accurate inventory records and use an accrual method to track purchases and sales. However, many small businesses qualify for an inventory tracking exception to make things simpler. You can use this exception if:

- Your annual gross receipts are $30 million or less (averaged over the previous three years, with the figure adjusted for inflation each year).

- Your business isn’t a tax shelter. A tax shelter is any strategy by which businesses or individuals reduce taxable income. For Schedule C businesses, a tax shelter could be a business that generates deductible losses each year for the individual.

If you qualify for the exception, you have two options:

- Treat inventory as non-incidental materials and supplies: Deduct COGS only when the product sells.

- Account for inventory using your regular bookkeeping method: Use the same way you track inventory for your business records.

Qualifying small businesses can deduct inventory costs as purchases including all purchases, materials, and supplies when items are sold and don’t need to report formal inventory on their tax return.

What to report for COGS without tracking inventory

When using the non-incidental materials and supplies method:

- Report Beginning Inventory Value as $0 on Schedule C since you aren’t reporting inventory.

- Report only the cost of goods that were sold during the year as Purchases.

- Don’t report anything for Manufacturing Labor, Materials and Supplies, and Other Costs.

- Report Ending Inventory Value as $0 as well.

- The amount you deduct for COGS is the total cost of items sold.

Example: If you buy 500 dresses for your boutique at $50 each and sell 100 dresses during the year, your COGS is $5,000 for the year ($50 x 100). If you sell the remaining dresses next year, deduct those costs on the subsequent year’s tax return in the year they were sold.

If you track inventory

If you don’t qualify for the exception (or choose not to use it), you must track inventory using an IRS-approved method:

- FIFO (first-in first-out): Oldest inventory sold first.

- LIFO (last-in first-out): Newest inventory sold first.

Choose a way to value your inventory, such as cost, lower of cost or market, retail method, or perpetual or book inventory.

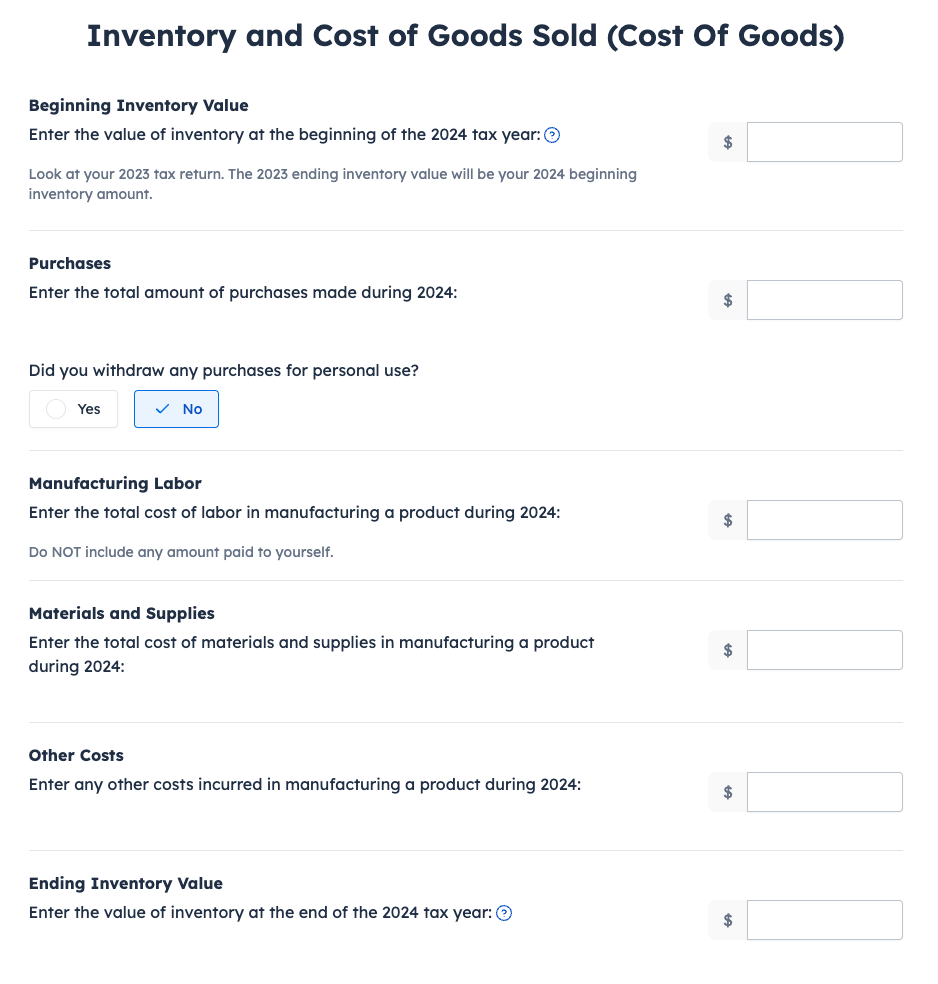

What to report for COGS with tracking inventory

When you must or choose to track inventory, COGS is reported as:

Beginning Inventory Value (value of products on hand at the start of the year)

+ Purchases (goods or raw materials bought, including shipping/freight and minus returns/allowances)

+ Manufacturing Labor (wages for those directly making your goods)

+ Materials and Supplies (used in making products or packaging)

+ Other Costs (factory rent, utilities, equipment maintenance, quality control, storage)

– Ending Inventory Value (value of unsold products at year-end)

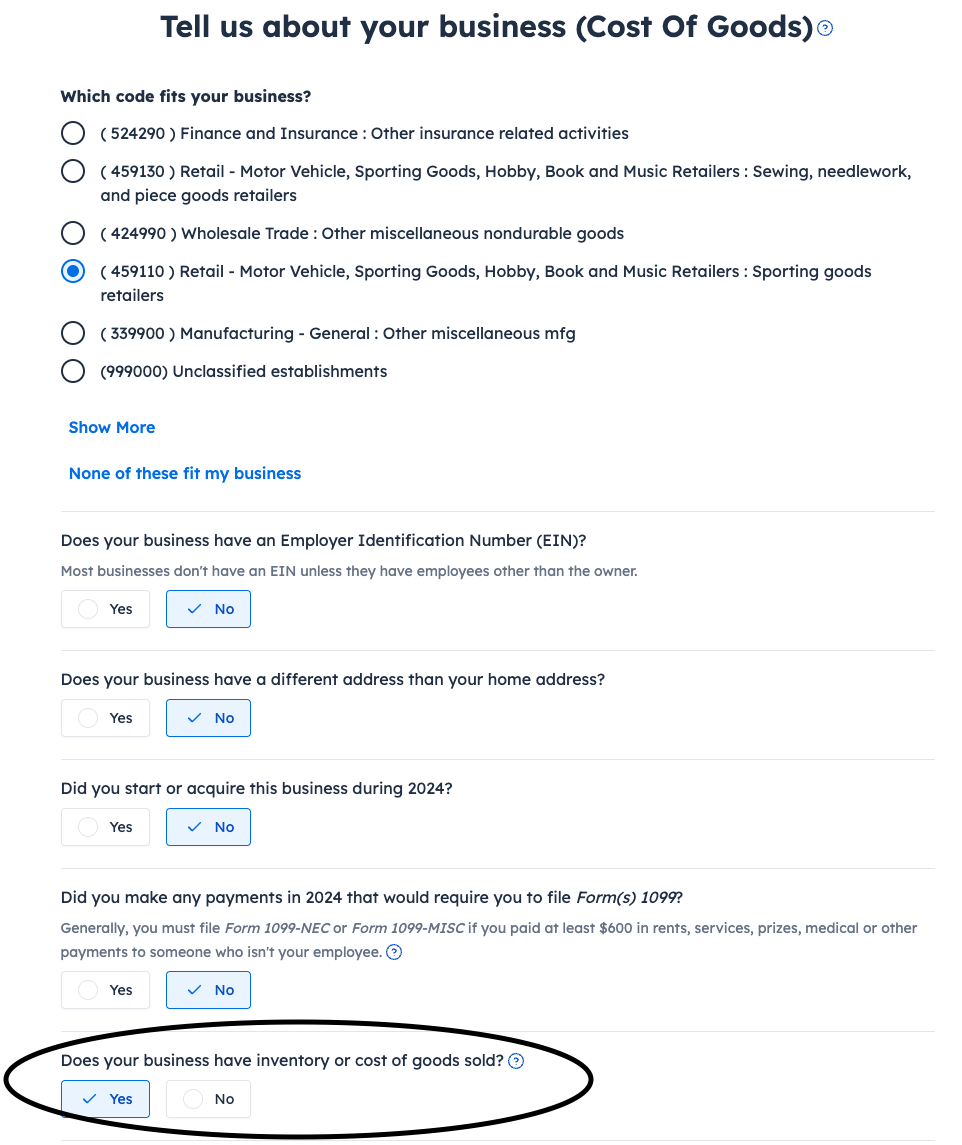

When you're working on your return in the Business Income (Schedule C) section, follow these instructions:

- On the screen labeled “Tell us about your business” check yes on the box labeled “Does your business have inventory or cost of goods sold?

2. Continue to the screen labeled Inventory and Cost of Goods Sold, and enter your information.

Example calculation

Suppose Janet sells homemade jam. She buys ingredients for $420, jars and designs labels for $700, and makes 150 jars worth of jam to sell, selling all but 10 jars (which she gives as gifts). She’ll calculate the following to report her COGS:

- Add ingredient and packaging costs: $420 for ingredients and $700 for packaging for a total of $1,120 of total costs.

- Subtract the cost of jars used for personal purposes (not deductible):

- Total cost of $1,120, divided by 150 jars ($1,120 ÷ 150 = $7.47). The cost per jar is $7.47;

- She gave 10 jars to friends and family, so $75 ($7.47 x 10)--rounding to whole dollar-- is subtracted from the total cost ($1,120 - $75 = $1,045). Total remaining cost is $1,045.

- Janet wouldn’t include the value of her own unpaid labor.

- Since she sold and used all the jars during the year, her inventory is zero. If she has products left over at year-end, their value becomes the ending inventory and isn’t deducted until sold.

Her total COGS is $1,045, which is the cost of all jars sold in the year.

Key takeaways

When you sell products, you can deduct what they cost by reporting cost of goods sold (COGS) on Schedule C. Most small businesses qualify for an IRS exception and can avoid the hassle of reporting inventory by simply deducting product costs when items are sold. If you don’t qualify—or choose to keep inventory—you’ll need to use an IRS-approved method like FIFO or LIFO and an approved inventory value method. Either way, the key is simple: your deduction equals the cost of the products you actually sold, not what you still have on hand.