Contributed by: LynR, FreeTaxUSA Agent, Tax Pro

As the usage of cryptocurrency and other digital assets continues to grow, the IRS is continually issuing guidance on reporting transactions along with gains and losses from these transactions. Unfortunately, some cryptocurrencies or exchanges fail or go bankrupt leaving a digital asset frozen or worthless. Are these losses tax deductible? They can be and we will address the details in this article.

Nature of virtual currency

The IRS defines virtual currency as “a digital representation of value that functions as a medium of exchange, a unit of account, and/or a store of value.” Although it can function as currency, it’s treated as property for tax purposes.

If you held cryptocurrency for investment purposes, it’s considered a capital asset. Any gain or loss from selling or exchanging it should be reported as a capital gain or loss. If you held it for any purpose other than investment, it’s considered a business or personal asset.

Ordinary losses from business and/or personal assets were historically claimed as a deduction on Schedule A. However, the Tax Cuts and Jobs Act (TCJA) disallowed ordinary losses from business and personal assets from being reported as an itemized deduction for years 2018-2025. Whether this deduction will return in 2026 is an ongoing debate in Congress.

For the purposes of this article, we’ll assume cryptocurrency losses, purchased as investment property, make them a capital asset.

When can I deduct a capital loss from cryptocurrency transactions?

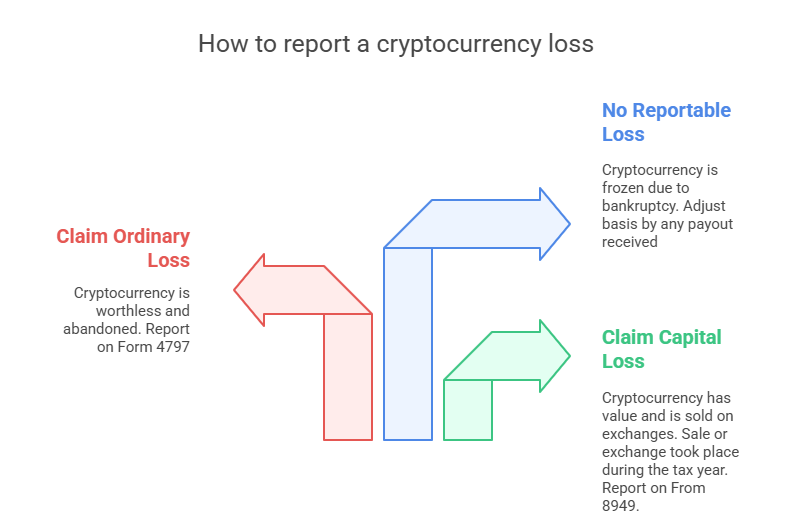

If you have cryptocurrency in which the value has plummeted, a capital loss can be claimed if:

- The value is greater than $0 (even if the value is less than $0.01),

- It’s still being sold on at least one exchange,

- It’s sold or exchanged during the tax year you’d like to claim the loss,

- It was purchased with an investment intent.

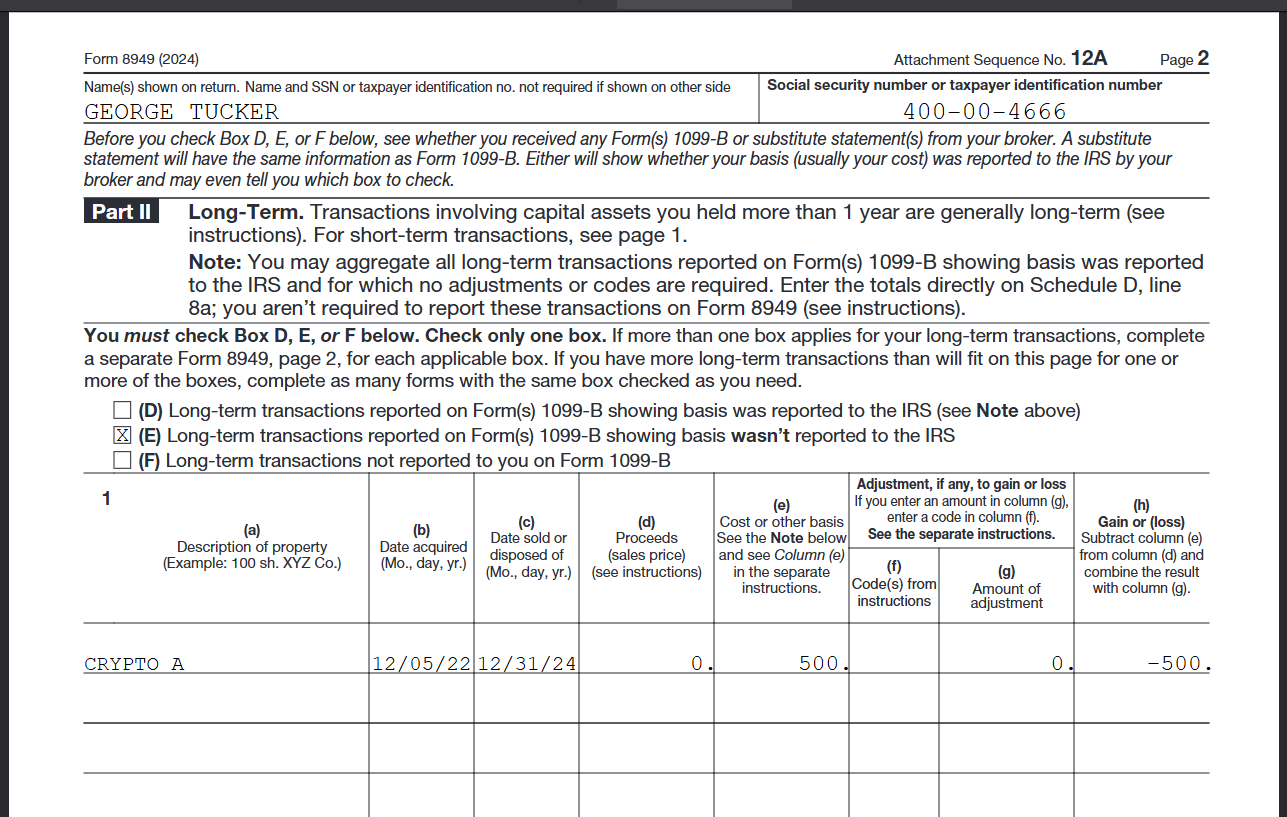

If you meet the above criteria, a capital loss can be claimed on Form 8949 and Schedule D. The loss will be limited to the basis (amount you paid).

For example, if you purchased cryptocurrency “A” for $500 and later its value becomes $0.001, but it’s still being sold on an exchange, you can sell the coin and claim a capital loss for $499.999 (which rounds up to $500) on Form 8949. Your capital loss is limited to your basis in the cryptocurrency.

Entering a cryptocurrency capital loss into FreeTaxUSA

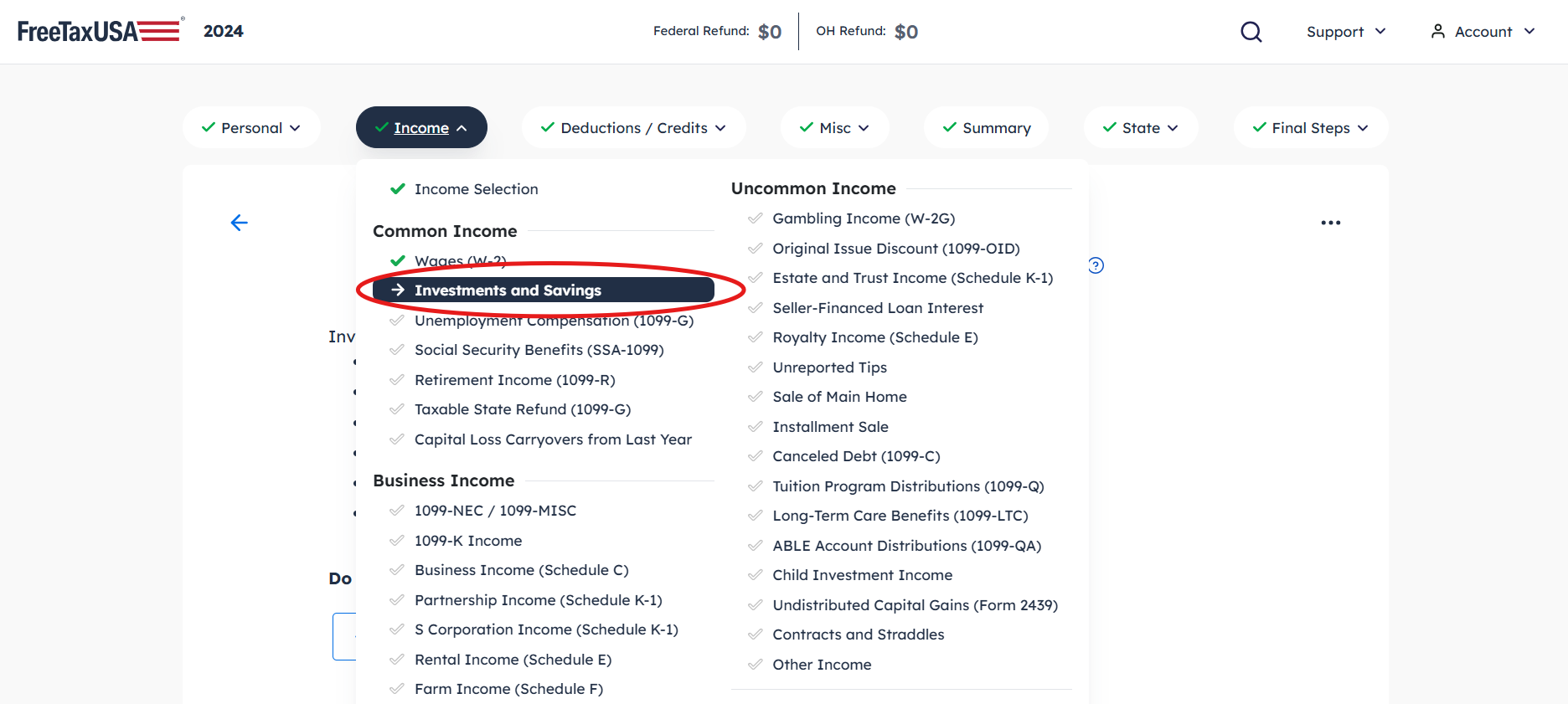

To enter your capital loss from sold or exchanged cryptocurrency, go to: Income > Investments and Savings

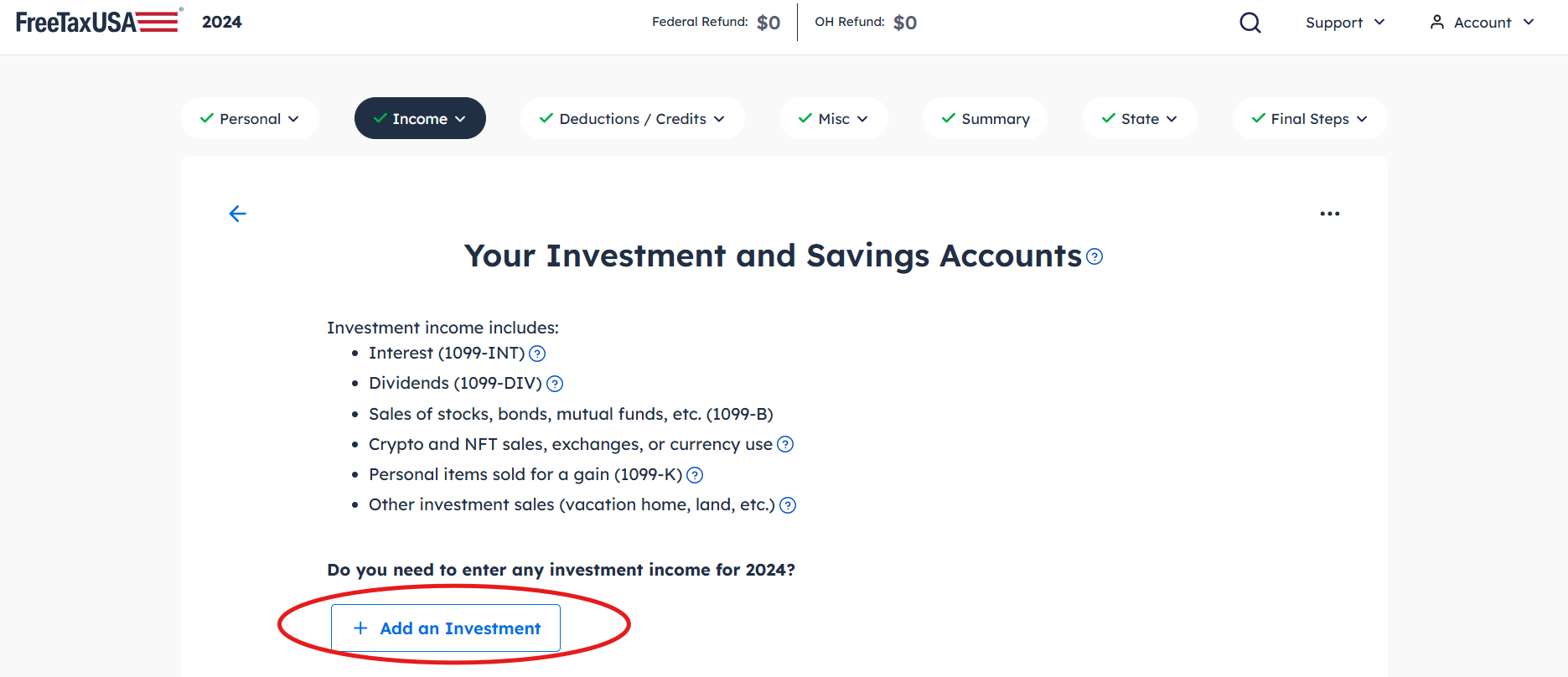

Next, click on Add an Investment

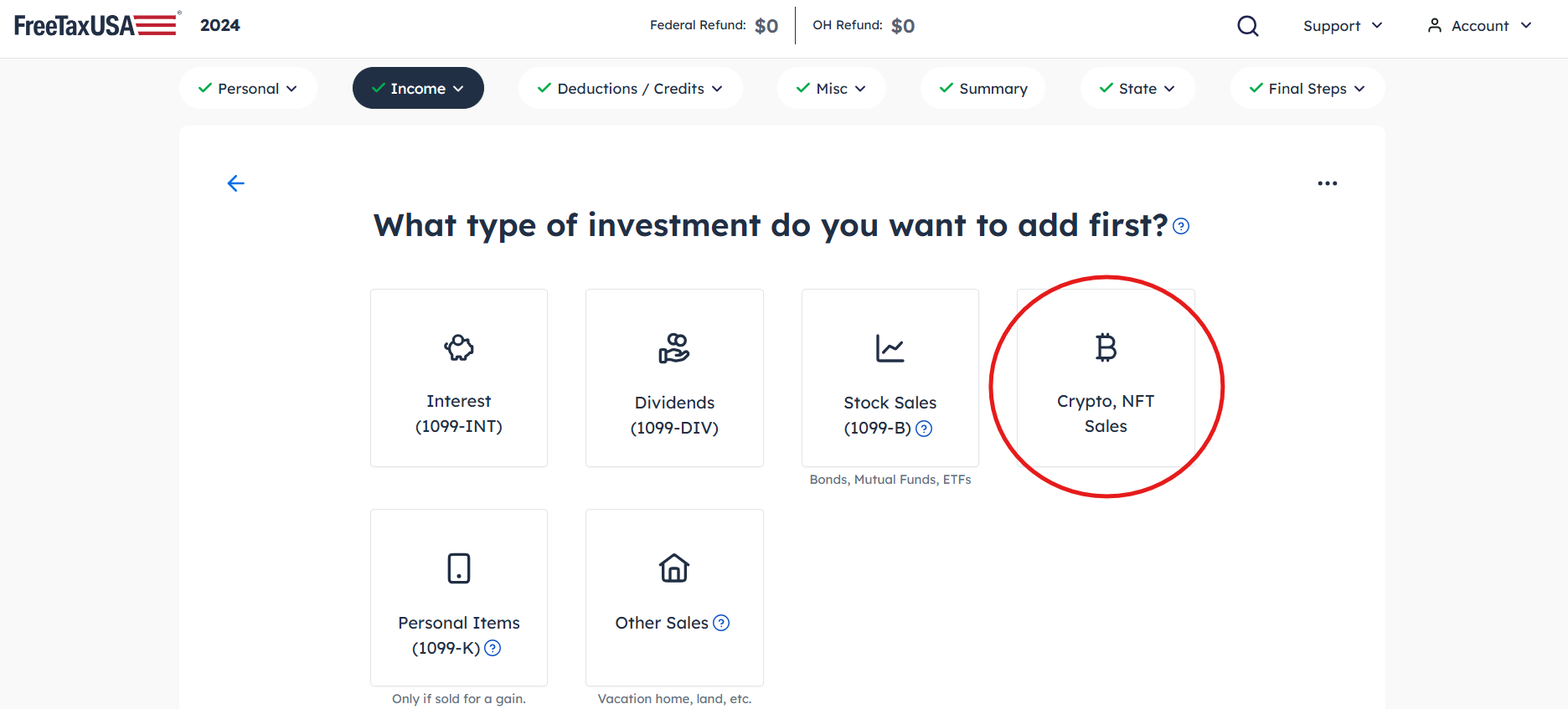

On the following screen select Crypto, NFT Sales

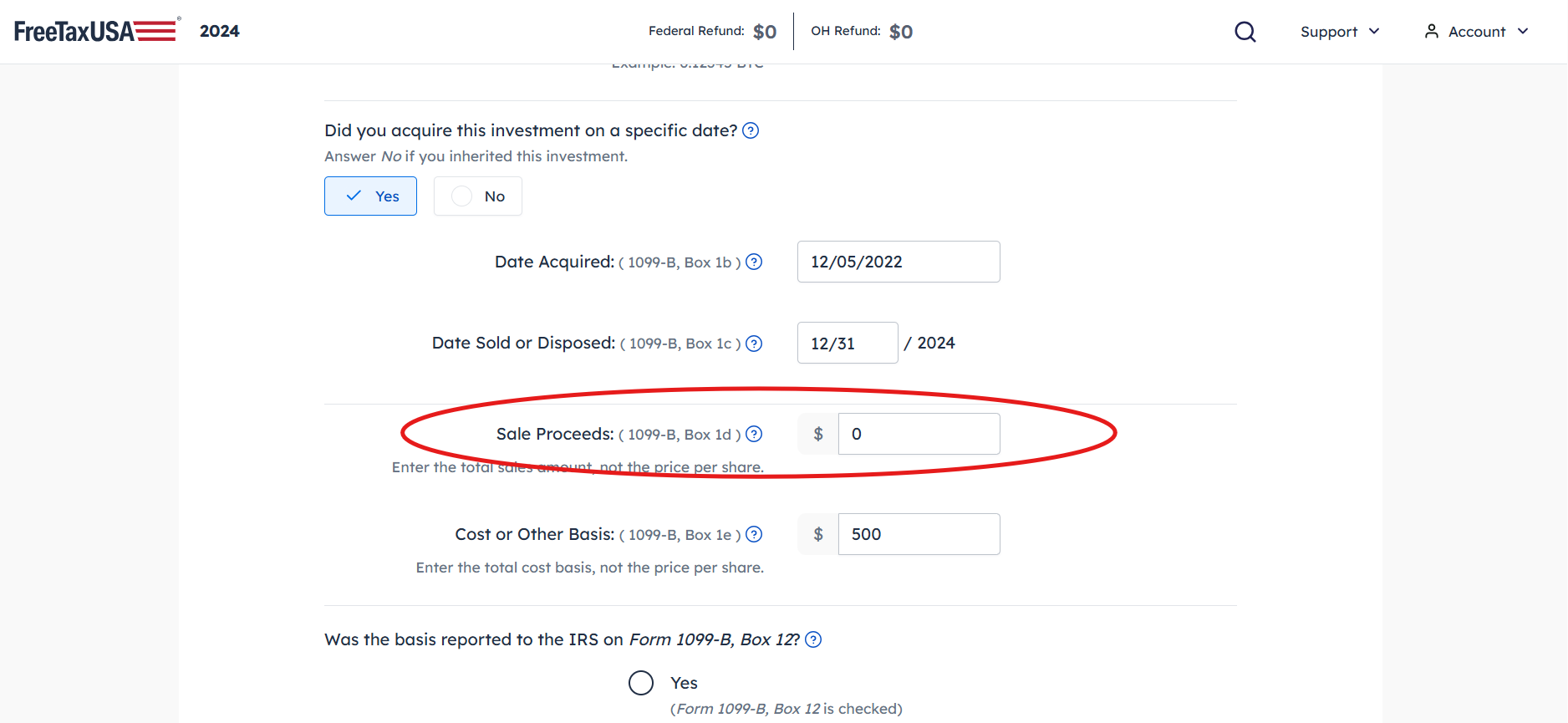

The subsequent screens will ask for details regarding your cryptocurrency transactions. If your total proceeds from selling were less than $0.50, then you’ll enter $0 as your sales proceeds.

Be sure to NOT indicate that this is the disposal of a worthless stock. This option applies to stocks/securities only.

Your finalized tax return will include Form 8949 as well as Schedule D reporting this loss.

What if my cryptocurrency is completely worthless?

The IRS rule for deducting worthless securities on Form 8949 doesn’t apply to cryptocurrency since it isn’t considered a security and isn’t sold on the securities market. If your cryptocurrency is truly worthless (has a value exactly $0 or is no longer sold on an open exchange), you can’t claim a capital loss. Instead, you can abandon it and claim an ordinary loss due to abandonment.

To claim an ordinary loss from cryptocurrency abandonment on your tax return, you must:

- Take an action of abandonment during the tax year when you’ll claim the loss. This is typically done by “burning” the cryptocurrency. In other words, intentionally making cryptocurrency tokens or coins unusable or inaccessible, effectively removing them from circulation.

- The cryptocurrency must‘ve been held for investment purposes.

Report the loss on Form 4797, line 10, as well as Schedule 1, line 4. The loss is limited to your basis in the cryptocurrency and is also subject to the net operating loss limitation rules. Currently, FreeTaxUSA doesn’t support entering an ordinary loss on Form 4797.

What if my cryptocurrency or exchange is going through bankruptcy?

Bankruptcies of Celsuis, FTX, BlockFi, and others have many taxpayers wondering how these situations affect their tax return. The bottom line is this:

If your cryptocurrency or wallet is simply frozen and has the possibility of a payout, then you have no reportable capital loss.

In most cryptocurrency related bankruptcies, the coin or exchange will be frozen until the bankruptcy is final. Once it’s final, the coin’s value is typically reassessed and can be sold, exchanged, or burned at that time.

If you’ve received a partial payout for your cryptocurrency during the bankruptcy, but the coin remains in your wallet, then you’ll adjust your basis in the cryptocurrency by the payout amount.

Once you can sell, exchange, or abandon/burn your cryptocurrency, you’ll follow the reporting instructions above depending on your specific situation.

Note: Although you won’t report a capital gain/loss for frozen digital assets that cannot be sold, you may still need to report as income any digital assets awarded to you as income during the year. If you received digital assets/cryptocurrency from mining, staking, participating in Initial Coin Offerings (ICOs) or Security Token Offerings (STOs), or as incentives for work, you will need to report these awards as income on your tax return even if your exchange or platform freezes the digital asset due to bankruptcy. How these awards are reported on your tax return will depend on the nature of the award.

Takeaways

Navigating the tax world of cryptocurrency is complex and ever changing. The IRS is constantly issuing new guidance on cryptocurrency reporting. If you need further assistance, our Pro Support team is here to help you through your specific situation.