Contributed by: TriciaD, FreeTaxUSA agent, Tax Pro

In 2025, President Trump enacted the One Big Beautiful Bill Act (OBBBA), introducing significant revisions to deductions related to energy-efficient home improvements. This legislation reduced or eliminated numerous tax credits and deductions previously provided under the Inflation Reduction Act of 2022. Consequently, both individuals and businesses that formerly benefited from property energy efficiency incentives are now subject to changes in available tax relief.

Due to these changes, receiving tax savings for energy-efficient home upgrades, solar panel installation, or commercial building improvements will become more difficult. If you want to take advantage of these tax breaks, you’ll need to act quickly, as opportunities for valuable tax credits will be eliminated.

What residential energy credits are available through 2025?

The energy efficient home improvement credit and residential clean energy property credit are set to expire for systems installed after December 31, 2025. Credits scheduled to end after December 31, 2025, include:

1. Energy efficient home improvement credit

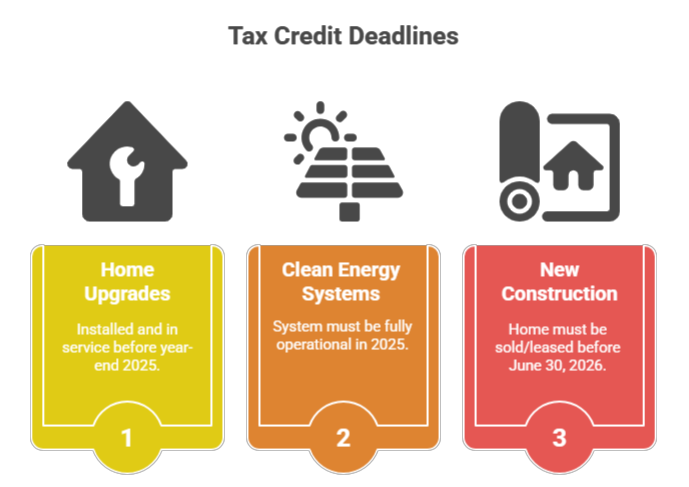

OBBBA Deadline: The equipment must be installed and placed in service by December 31, 2025, to qualify for the credit. Eligible energy efficient systems include:

- Energy efficient home improvements eligible for credits (2022–2025): Heat pumps and HPWHs (heat pump water heaters, which use ambient air to efficiently heat water like a reverse refrigerator)

- Electrical panel upgrades (when paired with heat pumps)

- Insulation, doors, windows, and air sealing

- Home energy audits that meet IRS requirements

2. Residential clean energy property credit

OBBBA Deadline: Systems must be installed, operational, and in service by December 31, 2025, to qualify for the credit.

Residential clean energy property eligible (2022–2025):

- Solar panels and solar water heaters

- Geothermal heat pumps

- Battery storage systems

- Small wind turbines

- Fuel cells (capped by system size)

How are credits for builders and commercial properties affected?

If you’re a homebuilder, you can receive a credit of $2,500 to $5,000 for each new house or apartment you build that meets certain energy-saving standards like ENERGY STAR or DOE Zero Energy Ready.

Commercial building owners are eligible to claim deductions for energy efficiency improvements that result in at least a 25% reduction in building energy use. These incentives remain unchanged by the OBBBA.

OBBBA Deadline: To get this credit, the home must be sold or rented by June 30, 2026.

What are credit deadlines?

What is required when filing your 2025 taxes?

Beginning in 2025, some new energy-saving products will have a 17-digit Product Identification Number (PIN). The PIN confirms the product meets energy-saving standards. When filing taxes, individuals must report the PINs for items installed during the tax year. However, for specified property placed in service in 2025, a Qualified Manufacturer code (QM code) may be used in place of a PIN. Guidelines for the PIN are as follows:

- Not all products require a PIN. For instance, insulation and air sealing materials do not need a PIN, while windows, doors, and heat pumps do.

- If a PIN is not present on a product, the manufacturer should be contacted for assistance.

Conclusion

As energy-efficient home improvement and clean energy tax credits change under the OBBBA, homeowners, builders, and businesses should review federal incentives, as some may expire or change. FreeTaxUSA will update its software to reflect new regulations. Staying updated and consulting tax professionals can help identify savings and requirements.

Related articles:

What should I know about the residential clean energy credit before I buy my solar panels?

What are the top 10 changes introduced by the One Big Beautiful Bill Act (OBBBA)?

Qualifying for and claiming a clean vehicle (CV) credit – what do I need?

What is the difference between nonrefundable and refundable tax credits?