Contributed by: AndyS, FreeTaxUSA Agent, Tax Pro

Expenses for schooling can add up, especially when it’s not public K-12 schooling, which is subsidized by county taxes. When it comes to filing your tax return, it would be nice to be able to get a deduction or credit for some of those out-of-pocket expenses. But is it allowed? There are different rules for federal and state returns that could possibly give you that tax break you’re looking for!

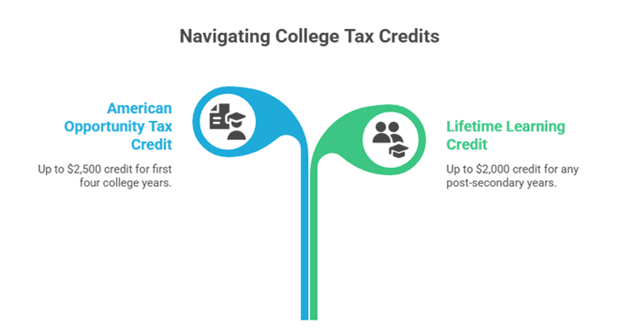

College tuition and expenses

The federal tax return does offer tax credits for college tuition and qualifying educational expenses. The IRS offers an American opportunity tax credit or the lifetime learning credit. The American opportunity tax credit (AOTC) can only be claimed for a maximum of 4 years, which is each year during the first four years of college, and can be a credit up to $2,500. The lifetime learning credit can be up to $2,000 and can be used for any number of years at a post-secondary school. Here are a few important things to remember about these credits for your tax planning:

- If you are being claimed as a dependent by your parents—or you as a parent are claiming your college student on your tax return as a dependent—the parent claims the education credit, not the student.

- There are income limits for the credit where you may not be able to claim the credit or are only eligible for a reduced credit if your income is too high.

- Most of these credits are non-refundable, meaning it can only reduce your tax due. If you’re a non-dependent college student that works part-time, you may not have any taxable income or tax due. If this is the case, you won’t be able to claim a non-refundable credit even if you’re eligible. Up to $1,000 of the American opportunity tax credit is refundable and given to you as a tax refund, if you qualify.

- You can only use out-of-pocket qualifying educational expenses. Any expenses covered by a scholarship or Pell grant are not considered out-of-pocket expenses.

- You can only claim one of these credits on your return, so you’ll want to see which will give you the best tax break. Our software will automatically default to the credit that will give you the best tax advantage.

Can I claim college expenses on my state return?

While most states don’t offer a credit or deduction for college expenses, if you live in Arkansas, California, Kentucky, Massachusetts, New Jersey, New York, or South Carolina, you may qualify for a credit or deduction on your tax return.

Homeschool expenses

It’s not possible to claim any homeschool expenses on your federal tax return, but there are several states, such as Illinois, Indiana, Iowa, Louisiana, Minnesota, Ohio and Oklahoma, that do offer some sort of credit or deduction on your state tax return. The amount of the credit/deduction and the eligible expenses vary from state to state. You’ll want to look at the specifics for your state to see if you can enter your expenses on your tax return.

Private school expenses

Like homeschool, the federal tax return does not allow a credit for private schooling. Only a few states offer a credit or deduction if you have a K-12 student attending a private school. If you live in Alabama, Illinois, Indiana, Iowa, Louisiana, Minnesota, Ohio, South Carolina or Wisconsin, you may be able to get a tax break. You’ll want to review the rules for your state to make sure your expenses qualify for the credit or deduction offered.

What if my K-12 child attends public school?

If you live in Arizona, Illinois, Iowa, Louisiana or Minnesota, you are in luck! These are the few states that offer a credit or deduction for qualifying expenses you may have incurred while you have a K-12 student attending a public school. Check the rules for your state to see what is needed and how much your credit may be!

Are there any other education-related tax breaks I can take?

Yes, there are education savings accounts you’re allowed to contribute to that can give you a deduction or credit on your state return. These are called 529 plans and Coverdell savings accounts. Every state that has individual income tax requirements offers a deduction or credit for contributing to a 529 plan except California, Hawaii, Kentucky and North Carolina.

While originally established to assist with saving for college, you may be able to also use the funds for K-12 expenses to private schools. In addition, 529 plans are great for more than just giving you a deduction or credit on your state tax return when you contribute. They also allow you to use the invested money tax-free on your federal return if the withdrawals are used for qualified education expenses.

Coverdell Education funds function in a similar way, however they do not give you a deduction or credit on your state tax return when you make contributions. Still, they generally have a broader range of educational expenses allowable than a 529 plan and are likely to be tax-free when distributed.

Final thoughts

You’ll want to take some time to look over the rules for the credits or deductions for your situation to make sure you meet the qualifications to claim the credit or deduction on your tax return. Each state and federal tax return has different requirements. For example, there are times when you may qualify for a college credit on your federal tax return, but you might not for your state return, even if they offer a credit. It’s important to be informed about your options so you can ensure your tax return receives the best possible outcome.