Contributed by: Daniel_L, FreeTaxUSA Agent

In this article, we’ll discuss the following topics:

- Basic Form 1099-K information

- Help to identify business income

- Use of Schedule C to report business income

- Directions for entering 1099-K business income; and

- Tip and extended example

Form 1099-K

Form 1099-K reports electronic payments received for goods or services through credit cards, debit cards, or any other third-party payment network like Square, Venmo, or PayPal.

The filer or issuer shown on your form records these transactions. When the threshold is met, the issuer sends a copy of Form 1099-K to you, the IRS, and any necessary state tax entity providing a summarized total of income received during the year.

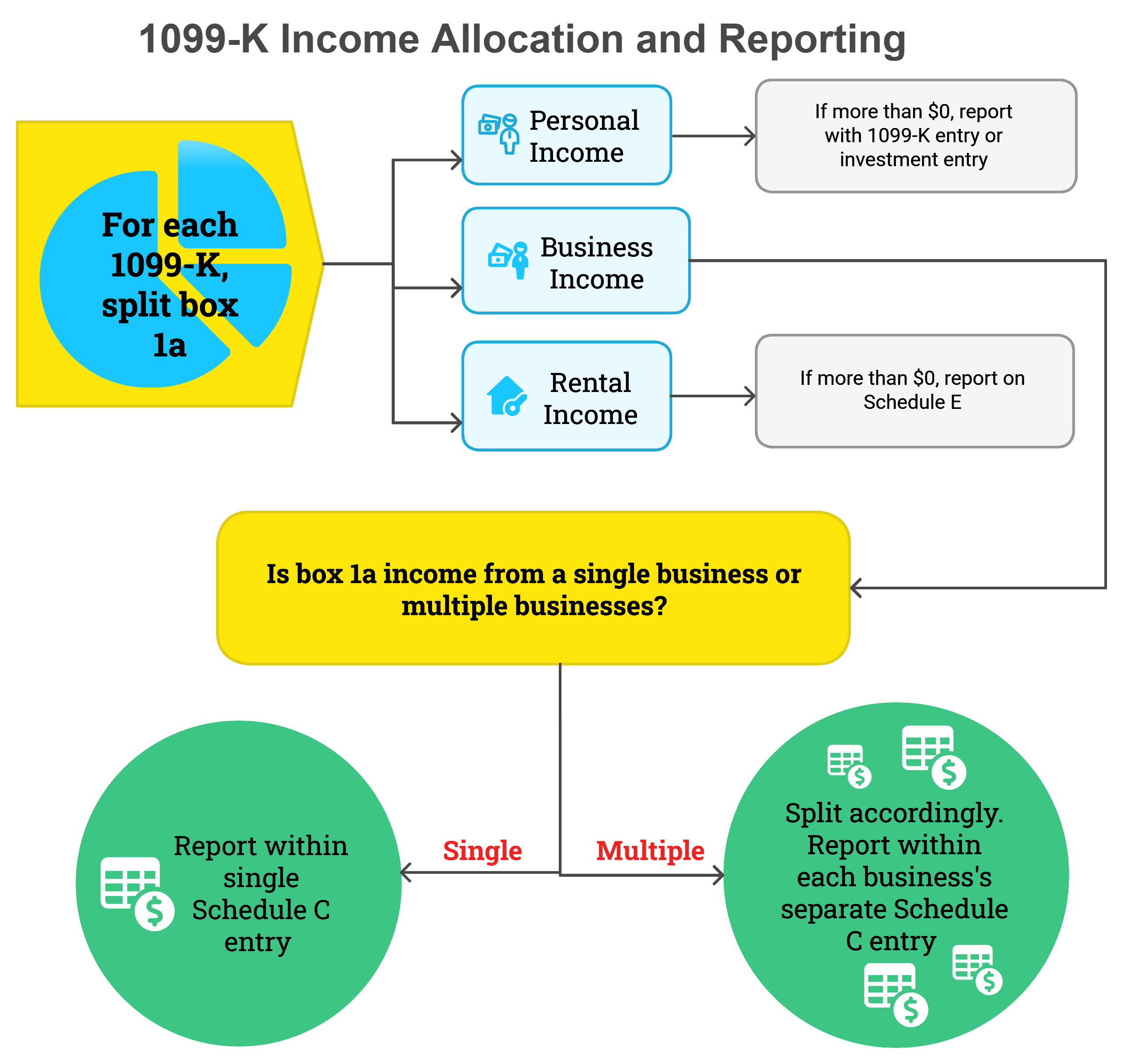

These electronic transactions are commonly identified and reported on your tax return as one of three income types:

- Personal, which may be further identified and entered as follows:

- Personal payments for shared costs (amounts reported in error and nontaxable) are entered using menu path: Income > Business Income > 1099-K Income

- Personal items sold for loss (nontaxable) are entered using menu path: Income > Business Income > 1099-K Income, and/or

- Personal items sold for gain (taxable) are entered using menu path: Income > Common Income > Investments and Savings

- Business (taxable) received payments are entered using menu path: Income > Business Income > Business Income (Schedule C)

- Rental (taxable) received payments are entered using menu path: Income > Business Income > Rental Income (Schedule E)

Year-end or other statements from the 1099-K issuer plus your personal records will help you identify the type(s) of income reported in box 1a.

💡Note: Usually all of box 1a should be accounted for on your return, but in this article, we’re only concerned with the business income transactions reported on all received 1099-K forms.

Business income?

The IRS considers your work a business and treats you as self-employed for tax purposes if any of the following apply:

- You complete full-time, part-time, or only periodic work and you’re not an official employee (e.g. contracted worker),

- You work in what the IRS calls the gig economy,

- You simply consider your work a side hustle (i.e. you don’t think you have a business), or

- You officially run your own business

When you’re self-employed or treated as self-employed for tax purposes, you’re required to report the income from this work as business income using Schedule C.

If you think your income isn’t business income but is the result of pursuing a hobby, you won’t report it using Schedule C. Hobby income may be entered in FreeTaxUSA using menu path: Income > Uncommon Income > Other Income.

💡Note: Hobby income doesn’t allow for deduction of expenses like business income does.

Schedule C

Schedule C is used to report business income and is included with your tax return. It’s used to report the business’s basic information, income, and expenses. Schedule C calculates the business’s net income or profit.

When your business shows a profit, the net income from Schedule C is transferred to other appropriate forms on your tax return so it can be assessed for both income tax and self-employment tax.

Directions for entering 1099-K business income

First gather all received 1099-K tax forms. You may have one or more forms depending on the number of payment vendors (e.g. PayPal, Venmo, Square, etc.) used to receive payments during the year.

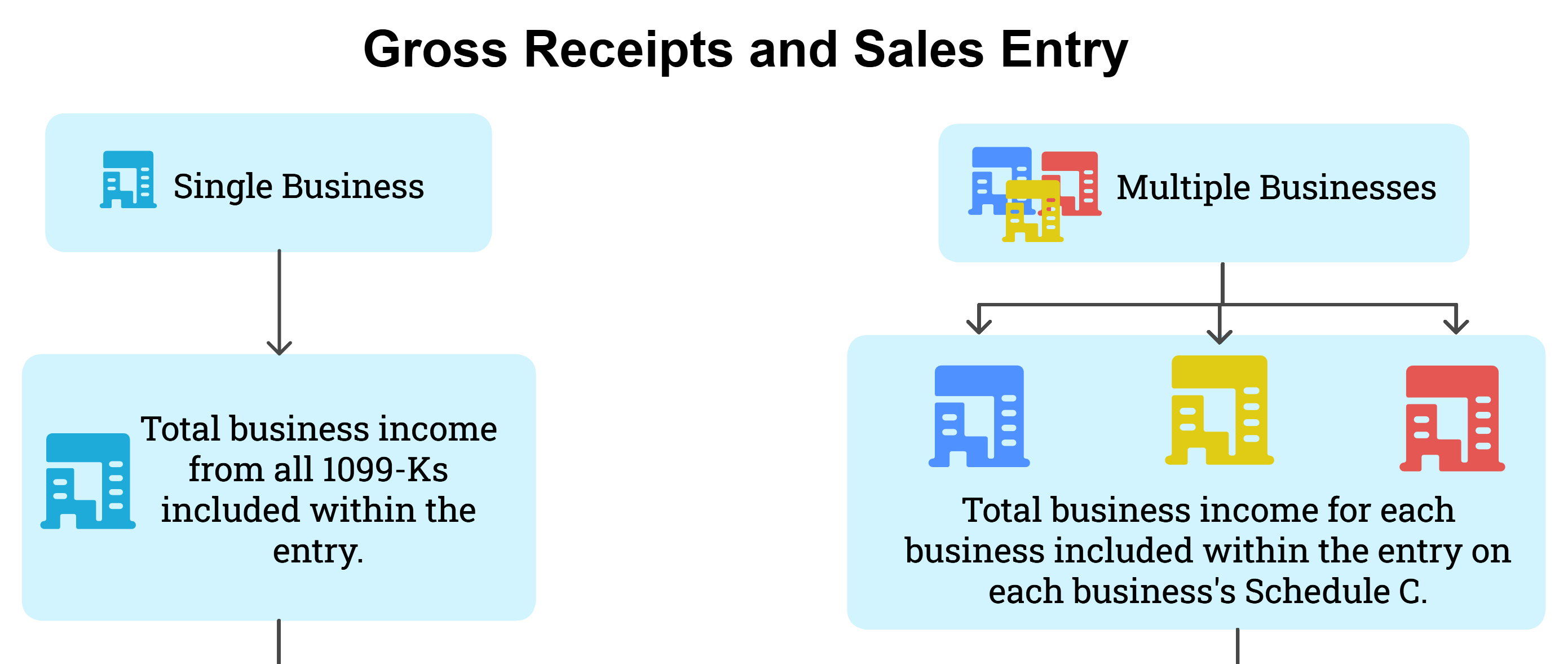

You’ll need to determine the total business income reported on each 1099-K you receive and whether that total is from one business or multiple businesses as illustrated in the image below.

Start with the total business income reported on each 1099-K. If it’s a single business you operate, you won’t need to split it any further. If the business income reported is sourced by multiple businesses, you’ll split the 1099-K box 1a business income total by what belongs to each business accordingly. Then include each business’s total from all 1099-Ks in the corresponding Schedule C’s Gross Receipts and Sales entry.

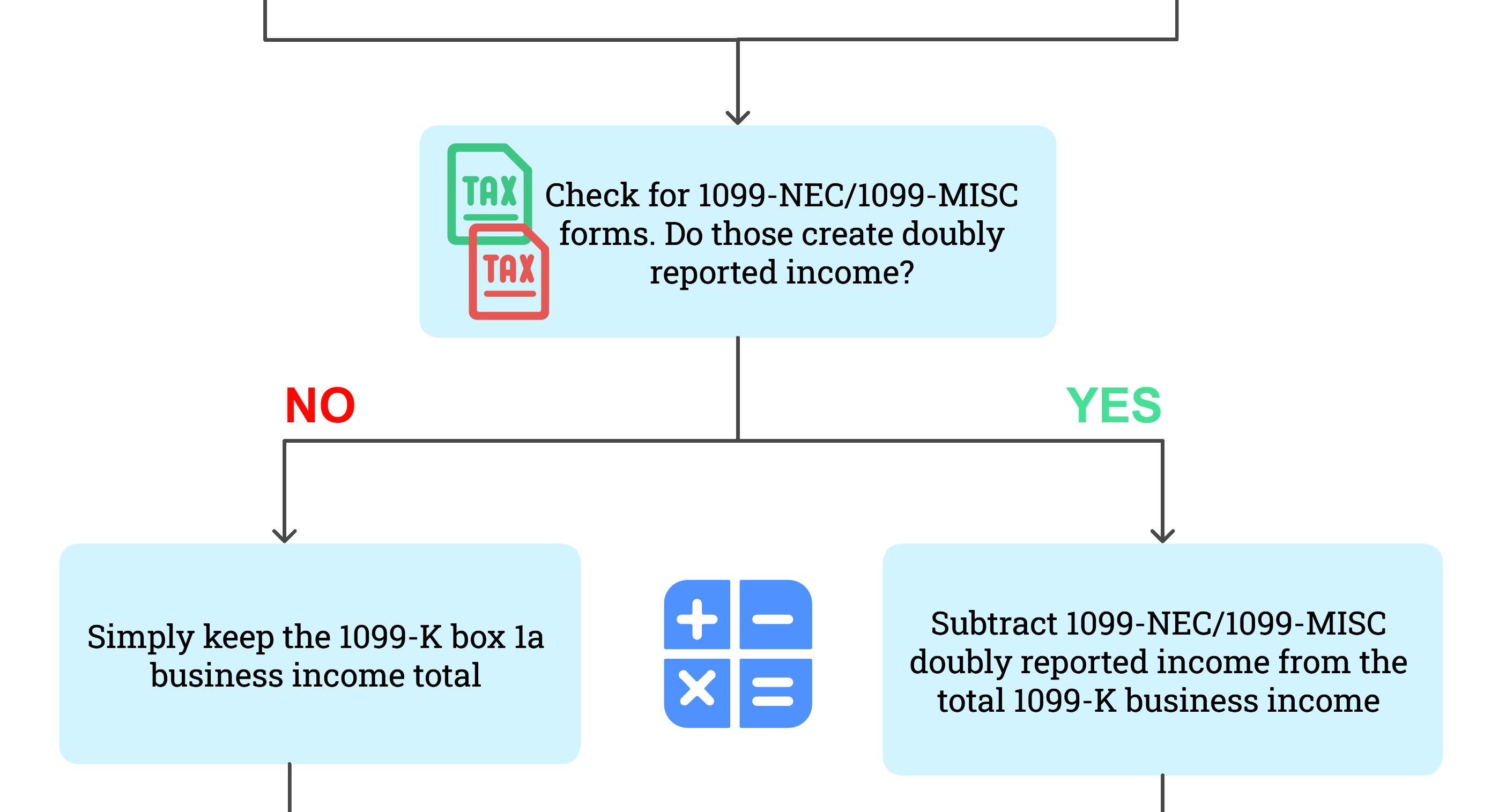

Use caution when making this entry. You may need to adjust it for any of the following situations:

- Doubly reported income. Income reported on more than one tax form requires a subtraction. It’s important to verify if the total 1099-K box 1a amount includes income reported on a 1099-NEC or 1099-MISC. For example, you may take payment via PayPal transactions. A client who paid via PayPal issued you a 1099-NEC reporting their payment. Due to reporting requirements, PayPal issued you a 1099-K and this client’s transaction is included in box 1a. Thus, the same income was reported on the client’s issued 1099-NEC and PayPal’s issued 1099-K. Because you’ll enter and report the 1099-NEC, you’ll subtract the amount on the 1099-NEC from the total business income reported on your 1099-Ks for this business’s entry.

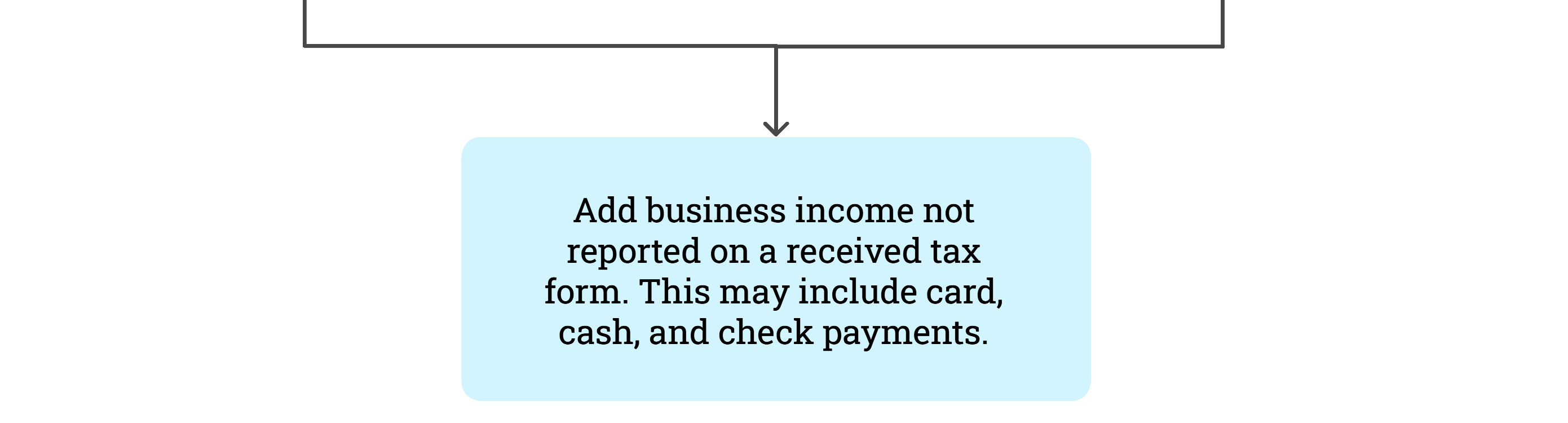

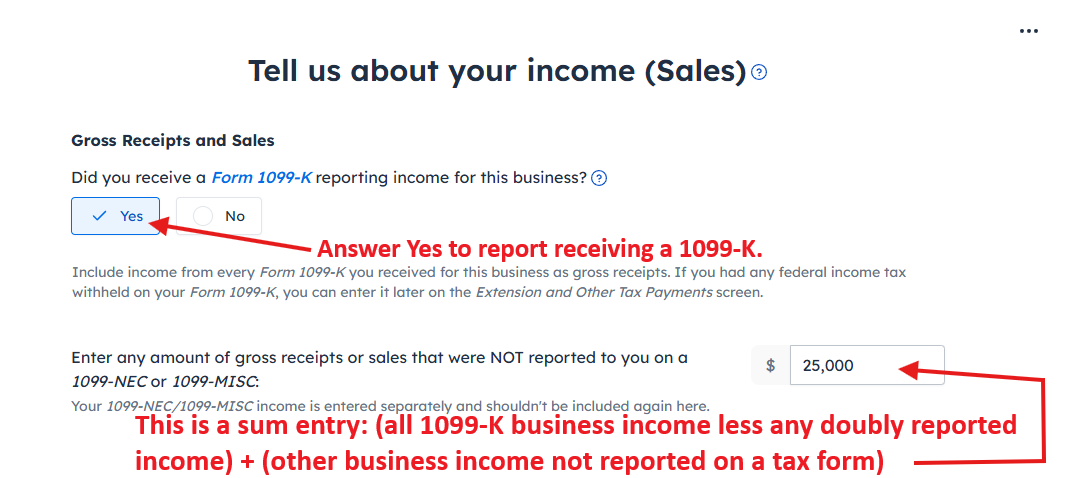

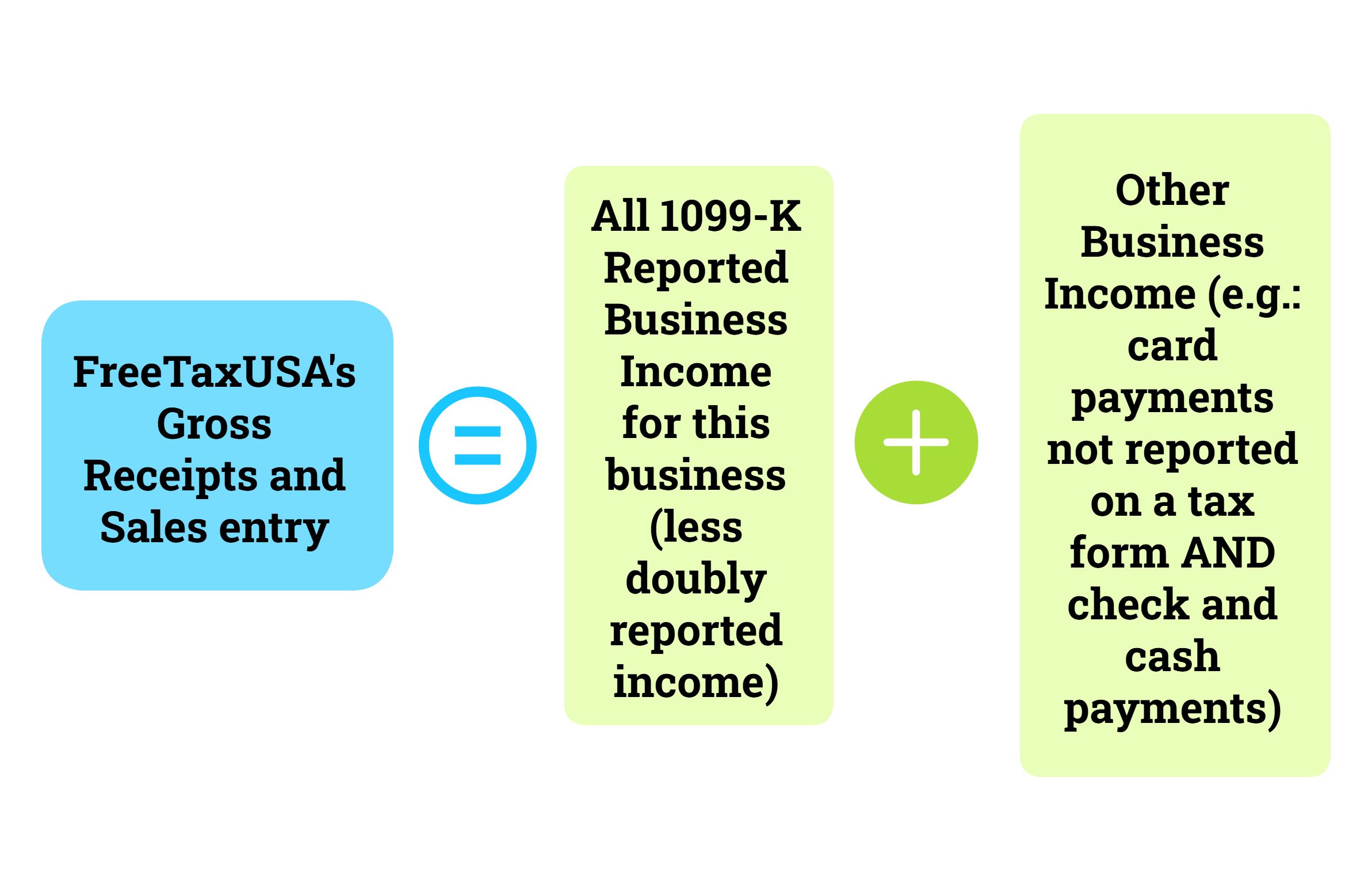

- It’s a sum entry. The Gross Receipts and Sales entry includes income reported on Form 1099-K and other business income not reported on a 1099-NEC/1099-MISC. You will need to ADD together:

- 1099-K business income (less doubly reported income)

- Electronic payments that didn’t appear on a received tax form (they didn’t meet a reporting threshold),

- Check and cash payments (direct payments not reported on a tax form)

FreeTaxUSA’s Gross Receipts and Sales entry screen may look like this:

As detailed above and can’t be stressed enough:

Finally, if box 1a included any of the following items, you’ll include them in our Gross Receipts and Sales entry even though they’re not income you kept:

- Rebates

- Refunds to your customers

- Returned sales

- Transaction fees

- Taxes (i.e. sales tax)

- Tips

- “Cash Back”

These items will be subtracted later through other entries. Use your records to help identify if these items are included in box 1a. When they’re included in box 1a, find the appropriate entry field within FreeTaxUSA’s Schedule C entry to enter them.

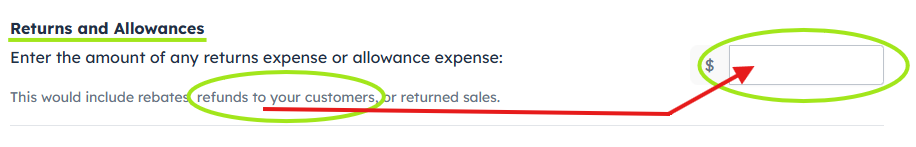

For example, if you refunded a customer and the amount refunded is included in box 1a, you’ll keep it included with gross receipts and sales. Then subtract the amount in a later entry. Because you initially did receive the payment, you’ll report receiving it, and then later report it didn’t remain business income. Currently, refunded amounts are included in FreeTaxUSA’s Returns and Allowances entry as shown here:

Another example, if box 1a includes any collected state sales tax, you’ll first include it with gross receipts and sales because you did receive it and then subtract that amount with a later entry. Currently in FreeTaxUSA software, the total state sales tax amount is included within the Taxes and Licenses entry field in Schedule C’s Common Expenses section as shown here:

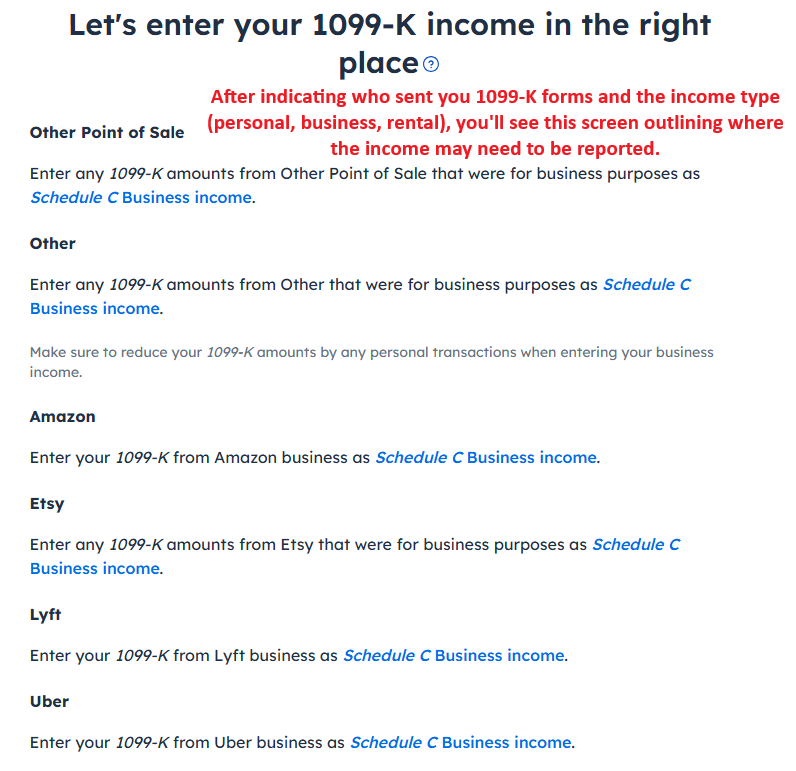

TIP and extended example: At present, completing FreeTaxUSA’s 1099-K section may provide a helpful outline for entering all your 1099-K information. Use menu path: Income > Business Income > 1099-K Income. After entering information from your forms, a summary page will list instructions for where to enter each type of income for each 1099-K marked as received. Use this outline to view how each 1099-K needs to be split by income type. The outline screen may look a little like this:

The image above shows a taxpayer with six 1099-K issuers (shown above as Other Point of Sale hereafter referenced as Payer A, Other hereafter referenced as Payer B, Amazon, Etsy, Lyft, and Uber). For simplicity, each is only reporting business income—no personal or rental income. The instruction to enter business income as Schedule C Business income repeats six times because there are six identified issuers each marked as including business income.

The number of Schedule C entries needed depends on the number of businesses the taxpayer operates, not the number of 1099-K forms that include business income. For example:

- If this taxpayer operates one rideshare business, both Lyft and Uber’s 1099-Ks can be combined into a single Schedule C entry for the rideshare business.

- If outside of the rideshare business, this taxpayer only has one retail business, the 1099-Ks from Payer A, Payer B, Amazon, and Etsy, can all be combined under a single Schedule C for the retail business.

In this example, though each of the six 1099-Ks has business income to be entered on a Schedule C, only two Schedule C entries are needed.

In cases where a taxpayer has multiple businesses (e.g., retail and therapy) reporting on a single 1099-K, box 1a income will be split between multiple Schedule C entries. In this instance:

- If this taxpayer’s 1099-K from Payer B reports business income from both their retail business and their work as a therapist, they will split Payer B’s box 1a between two separate Schedule C entries accordingly. They will have a Schedule C for the retail business and a Schedule C for the therapy business and include only the portion of Payer B’s box 1a that belongs to each within its respective Schedule C.

In this last case, a single 1099-K can result in multiple Schedule C entries—Payer B’s 1099-K alone requires a Schedule C for retail and a Schedule C for therapy. In the total scenario, the taxpayer has six 1099-Ks and sees the instruction to enter business income as Schedule C Business income six times. They will only need three Schedule C entries because they only have three businesses—rideshare, retail, and therapy.

The key is to know your business. You should know how many businesses you operate and what portion of every 1099-K box 1a amount belongs to any one business. Despite having six 1099-Ks, this taxpayer only needs two or three Schedule C entries—dependent on whether Payer B’s box 1a is for one or two businesses.

Conclusion

Though the process is multi-stepped, knowing your 1099-K box 1a total’s sources and making simple subtraction and addition calculations as outlined above will yield a complete and accurate report. If you’ve got complete and accurate business records, FreeTaxUSA can help you successfully enter and report your 1099-K business income.

Other FreeTaxUSA Community articles you may find helpful:

I received a 1099-NEC, but I don’t think I am self-employed

Self-employment tax: What is it?

How do know if I am self-employed or an employee?

What is the IRS Gig economy tax center

What do I need to report from my 1099-K?

What if my 1099-K amount is wrong?

How do I report a 1099-K for a loss on the sale of personal items?