Contributed by: KristineS, FreeTaxUSA Agent, Tax Pro

Congratulations! Your sports prowess was just monetized into an NIL deal!

Not only do you get to do cool things like endorse national brand labels, drive a sports car from a major car dealership, eat at up-scale restaurants or a local favorite hamburger joint, wear name-brand sportswear or use top-of-the-line cosmetics, you’re getting paid to do it as a student-athlete.

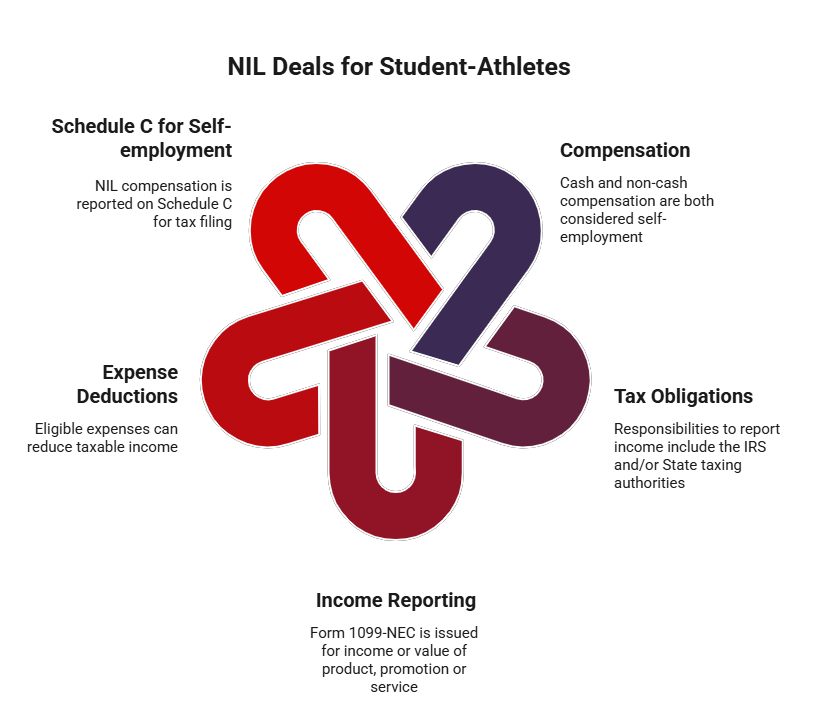

NIL deals are exciting and fun, but they come with new responsibilities, including the need to report your NIL compensation to the IRS. You may also need to file one or more state tax returns, especially if you’re attending high school or college in a state different from your home state.

NIL deals have caught a lot of student-athletes off guard because the compensation or value of the product is considered self-employment income by the IRS. Income of $400 or more is considered self-employment that must be reported. Since many NIL deals are worth thousands or tens of thousands of dollars and higher, both income tax and self-employment tax are almost certainly due.

Student-athletes that don’t form a business entity such as an S-Corp or C-Corp, will claim their NIL income on Schedule C, Profit or Loss from Business (Sole Proprietorship), and file it with their personal income tax return.

Fortunately, FreeTaxUSA can help many student-athletes take care of their federal and state filing responsibilities, including the reporting of NIL deals on Schedule C.

Sources of NIL income include cash and non-cash compensation

Student-athletes can receive both cash and non-cash compensation. These include everything from gifts, wearing athletic wear and cosmetics, drinking sports drinks to endorsement of products or getting paid for promotional/social media appearances at an event. The IRS has a good starting list on the What is NIL income? FAQ, but it may not be inclusive of all deal types.

Reporting cash payments from NIL deals is more straightforward to report on a tax return. Non-cash deals, however, also have a monetary value set by the company that needs reporting.

For example, if cosmetics you wear for promotion are valued at $5000, or a years’ worth of athletic gear you’re required to wear at sporting events for your school is valued at $15,000, these are treated like you were paid the same amount in cash.

And as stated above, both cash and non-cash compensation are reported to the IRS as self-employment income.

Reporting NIL as self-employment income

Student-athletes’ NIL deals are generally reported to the student-athlete on Form 1099-NEC, which is considered self-employment income and reported on Schedule C, Profit or Loss from Business. This means both income and self-employment tax may need to be paid when the tax return is filed.

In FreeTaxUSA software, you report self-employment income by following this menu path: Income > Business Income > Business Income (Schedule C) > Add a Business.

After preliminary information is entered about the business, which may or may not have a formal name, any expenses related to making the income that was paid out of pocket, are eligible deductions. This may include the expense of paying lawyer fees for contract review, travel expenses that were not covered or reimbursed, or hiring a social media manager. Expenses reduce income.

If the student-athlete has a profit, both income and self-employment tax will automatically be calculated by FreeTaxUSA software and entered on the appropriate forms. If the student-athlete hasn’t paid estimated tax during the year, taxes may be due at filing.

FreeTaxUSA is glad to support student-athletes in correctly reporting their NIL income and maximizing both expenses and deductions to pay the least amount of tax due or receive the largest refund possible.