Contributed by: CoryF, FreeTaxUSA Agent, Tax Pro

You’ve heard about the new ”No Tax on Overtime” deduction from the One Big Beautiful Bill Act (OBBBA), and you have your 2025 W-2. Now you’re wondering what this deduction means for you and how to apply it to your tax return. This article will help you understand the deduction and how to easily calculate your portion to enter in your 2025 FreeTaxUSA account.

The Law

The OBBBA allows people who are paid overtime (OT), based on the Fair Labor Standards Act (FLSA), to deduct up to $12,500 of the portion of their qualified overtime pay that exceeds their regular pay. The overtime income deduction phases out when income reaches certain levels. For most taxpayers, the phaseout begins when their modified adjusted gross income (MAGI) exceeds $150,000 (or $300,000 for married taxpayers filing jointly). The deduction is reduced at a rate of $100 for every $1,000 of income that exceeds the limitation. This means the deduction is fully eliminated for most taxpayers when their income reaches $275,000 (or $425,000 for married taxpayers filing jointly).

Determining your qualified OT

Your employer will generally be responsible for tracking and reporting your qualified OT. However, with this being a new law, the IRS has provided transition relief for the 2025 tax year, so reporting may vary this year. Some employers may provide the amount of your qualified OT in Box 14 of your W-2. Others may issue a separate year-end statement with your W-2 that details the amount of qualified overtime you received during the year. If your employer doesn't provide a separate figure on your W-2 or in an accompanying statement, you can calculate the amount yourself using your pay stubs or earnings statements.

Scenario 1: time-and-a half overtime

You can often easily find your OT by downloading/viewing your last paystub for 2025. Here is an example earnings statement:

Locate your year-to-date overtime amount. On this statement, it’s $935.34. This is the total OT earnings throughout the year and represents a “time-and-a-half” rate of pay. Remember, you can only deduct the portion of the overtime pay that exceeds your regular rate of pay. To find the deductible portion, simply divide the total OT earnings by 3. This results in the deductible amount of $311.78.

$935.34 / 3 = $311.78

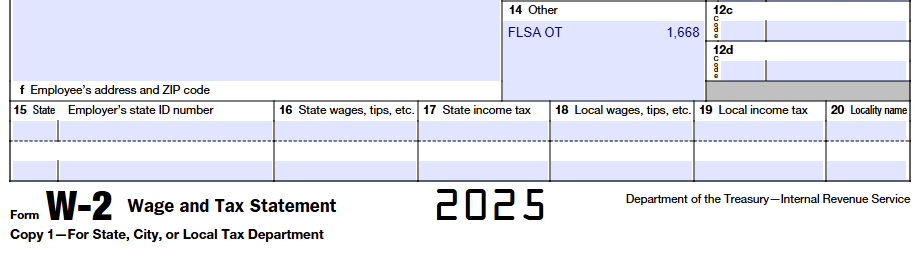

Now let’s look at a sample W-2 where the Fair Labor Standards Act OT is listed in Box 14. This amount must be divided by 3 to arrive at the “half” portion of the “time-and-a-half” compensation and properly claim the overtime deduction.

$1,668 / 3 = $556

Claiming the overtime deduction in FreeTaxUSA

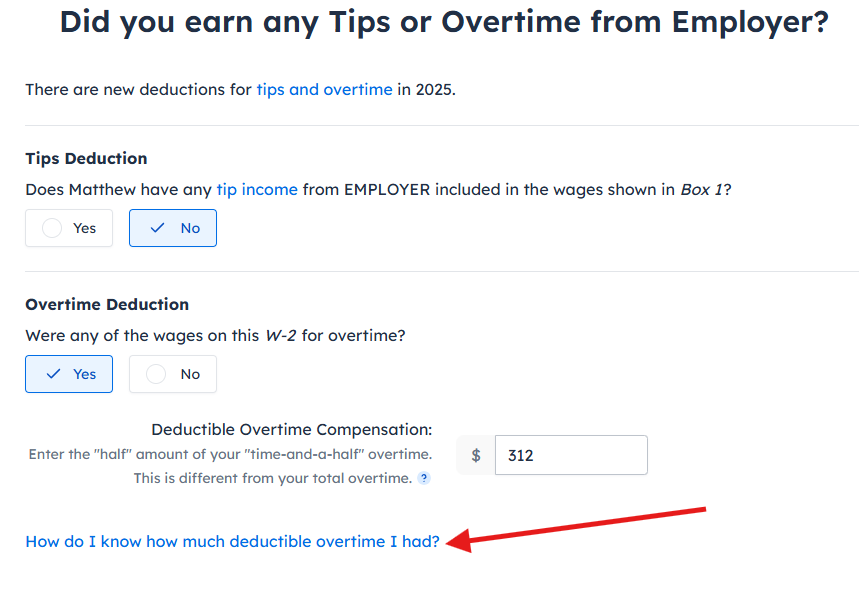

Enter your W-2 as normal, and click Save and Continue. The next screen will show the following:

- Answer “Yes” to the second question: “Were any of the wages on this W-2 for overtime?”.

- A deduction box will appear.

- Click on the question, “How do I know how much deductible overtime I had?”, since there are several options to figure out your deductible overtime.

- Enter the deductible portion of your OT on the line for Deductible Overtime Compensation. We’ll use the amount from the example earnings statement above to demonstrate:

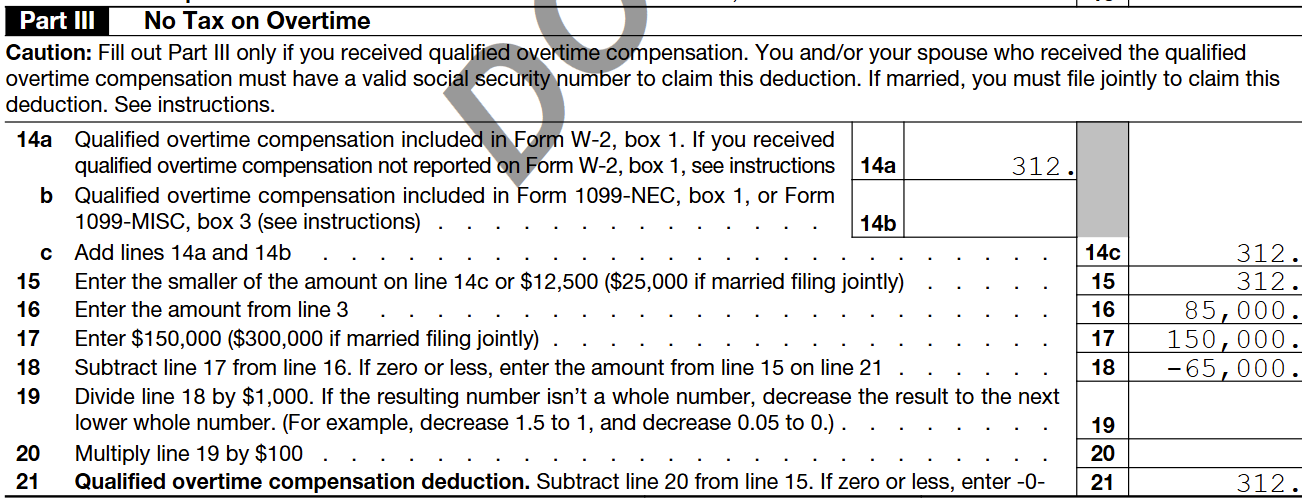

This amount will be applied to your tax return on the new Schedule 1-A Part III.

Scenario 2: overtime that exceeds the deductible limit

What if your deduction for overtime pay is more than the $12,500 limit? For example, say you earned $45,000 in qualified overtime wages (year to date). Using the above exercise, your deductible portion would be $45,000 / 3 = $15,000. The screen from above would look like this:

Moving forward, the Schedule 1-A will show this calculation:

The deduction will be limited to $12,500 (see Line 15) and will be reported on your tax return (on Line 13b of Form 1040).

Scenario 3: double overtime

What if you were paid double (2x) overtime? Let’s assume Joan is required to work two Sundays a month at her job as a waitress. On those days, she is paid double (2x) her regular rate of pay. This overtime still qualifies for the “No Tax on Overtime” deduction; however, the deduction applies only to the FLSA overtime premium, which is calculated as 0.5 times the regular hourly rate. Any additional pay beyond that premium -- such as the second "half" of double overtime -- is not eligible for this federal deduction.

Joan’s rate of pay:

- Regular Rate: $20 per hour

- FLSA Overtime Rate (Time-and-a-Half): $30 per hour ($20 regular rate + $10 premium)

- Double Overtime Rate (2x): $40 per hour ($20 regular rate + $20 extra)

In this example, for every double-overtime hour Joan works, only the $10 premium (0.5x the regular rate) qualifies for the new tax deduction, not the full $20 extra she earned.

Simple formula: divide the total yearly double (2x) overtime by 4, or multiply it by 0.25, to get the allowable deduction. Then add this amount to the deduction calculated for time-and-a-half (1.5x) overtime to arrive at the total allowable deduction. The total is what Joan will enter in the software when prompted to provide her Overtime Compensation on the Did you earn any Tips or Overtime? screen.

Conclusion

The deduction for "No Tax on Overtime" requires you to calculate the “half” portion of the “time-and-a-half” of OT pay. Refer to your last paystub or your W-2 (if your company adds that information to your W-2) and follow the steps provided in this article to claim the deduction correctly. As always, you can contact the FreeTaxUSA customer support team if you have further questions.

Video Tutorial: