Contributed by: CarlyN, FreeTaxUSA Team

We’re always working to make your experience better. Our free federal return still includes all our forms and features with no income limits. This year, we’ve also made major steps to update our software to make tax filing easier. Here are the highlights.

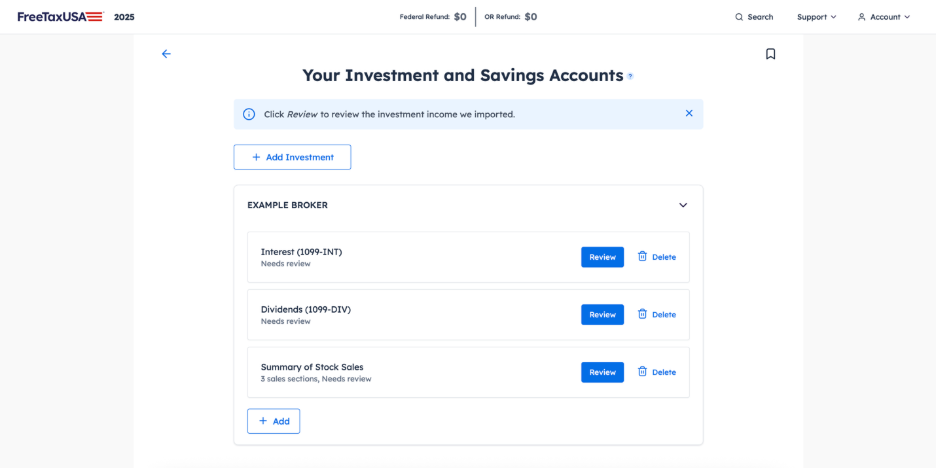

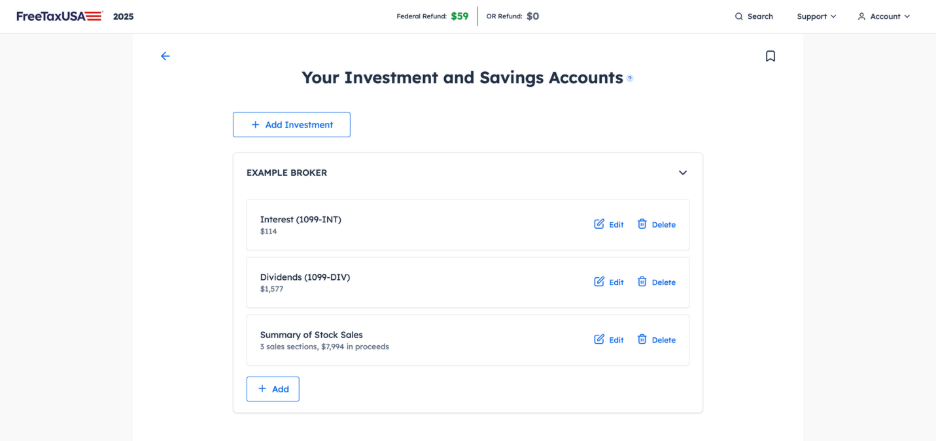

1099 importing

You can now import 1099-R, 1099-MISC, 1099-NEC, 1099-INT, 1099-DIV, 1099-DA, and Consolidated 1099s. Many file types are supported for importing, including PDFs, JPEGs, and PNGs. You can also use your phone to snap a photo to import 1099-R, 1099-MISC, and 1099-NEC.

These imports work just like our W-2 imports. First, you upload a file or take a photo of your form. Next, you double check that the imported information is correct. After that, you’re ready to move on!

This new feature makes filing your 1099 income faster and helps you avoid errors. There are no extra fees to import or file 1099s, so you can get the same easy filing experience without the high price tag.

Learn more about our importing features.

The One Big Beautiful Bill Act (OBBBA) updates

Our software is up to date with the latest tax changes introduced by OBBBA. Most filers are up for a higher refund or lower tax burden this year, and we can help you get yours.

OBBBA made a lot of changes introduced in 2018 permanent, including lower income tax rates, higher standard deductions, the expanded Child Tax Credit, and the Credit for Other Dependents.

It also introduced new tax changes. These include an additional deduction for seniors, a higher cap for state and local tax deductions, termination of energy tax credits, and a minimum threshold to deduct charitable donations. It also created new deductions for overtime pay, tip income, and auto loan interest.

Get more details about OBBBA tax changes.

New crypto form (1099-DA) supported

The IRS has introduced a new tax form, 1099-DA, to help taxpayers report their crypto sales. This new form is a lot like Form 1099-B but for digital assets. Crypto exchanges and platforms will now create and send a 1099-DA to users who sold or exchanged digital assets with their service.

This should make taxes way easier for everyone who’s got crypto. If you use FreeTaxUSA, you can even import your 1099-DA to speed up the process.

Learn more about filing Form 1099-DA.

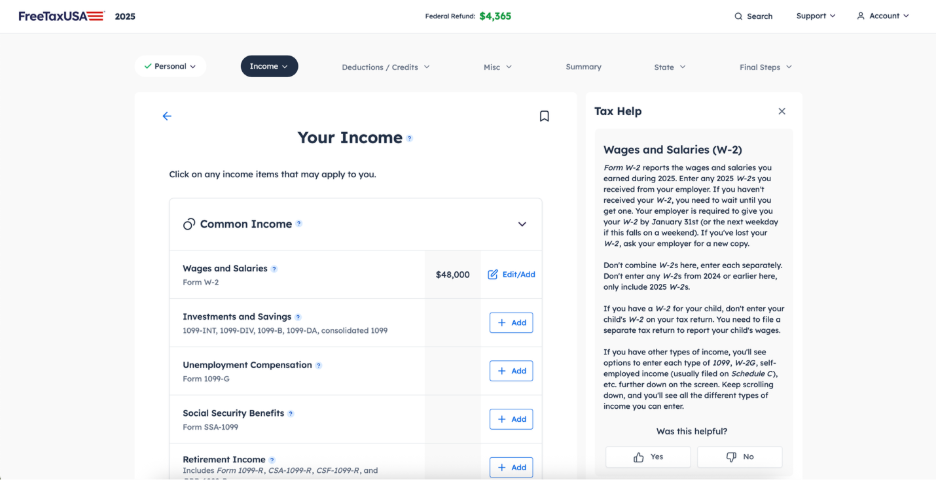

New side menu for FAQ content

Tax filing can come with a lot of questions, especially if you’re a first-time filer, or your situation has recently changed. That’s why we’ve moved our FAQ content to a convenient side menu. Now you can easily see help information as you tackle your taxes.

Price updates

The 2026 tax season is coming with some small price changes. State Tax Returns are now $15.99 each, Pro Support is $44.99, and Unlimited Amended Returns are $16.98 if you didn’t buy Pro Support or Deluxe Support. If you want to get your tax returns printed, Professionally Printed Returns are $8.96 each and Professionally Bound Returns are $17.96 each.

Our free Federal Tax Return is still the same unbeatable price. Free, for everyone, with all our forms and features included.

Conclusion

We’re working hard to make sure you get the best tax filing experience possible with FreeTaxUSA. You can count on us for easy, affordable, and accurate tax software. Let us know what updates you’d like to see next.