Contributed by: PhillipB, FreeTaxUSA Agent, Tax Pro

There are many reasons people may choose to convert a home into rental property instead of selling. For example, during the Great Recession, housing prices dropped below what many people had paid for their properties. In some cases, homeowners had to decide between selling at a loss, surrendering the home to the bank, or turning the property into a rental to help cover mortgage costs. As housing prices recovered, some of these individuals chose to reclaim the rental property, making it their primary residence again. In such cases, there are tax consequences to be considered.

What happens when I convert my home to a rental?

When a home is converted from personal to rental use, the owner needs to figure out their correct cost basis. A few definitions are helpful for this discussion:

Adjusted Basis: To figure your adjusted basis, start with the amount you originally paid for your home. Then consider any adjustments to that basis such as major remodels or improvements you’ve made to the home. The IRS lists several adjustments in Publication 527.

Fair Market Value: The amount your property would sell for on the open real estate market.

Cost basis for depreciation is the smaller amount between your adjusted basis and fair market value of the home when it’s converted to rental use.

In most cases, the adjusted basis will be the number you use as the cost basis for depreciation. The exception to this rule could include situations like housing prices tanking during the Great Recession. During this time, the fair market value would’ve been less than the original purchase price and would be the correct amount to use as the cost basis for depreciation. For this article, we’re going to assume all people reading will use the adjusted cost basis.

While the home is a rental property, the building portion of the home is depreciated at a rate of 3.64% per year (depreciating the entire cost basis over 27.5 years). Land is not depreciable. If your home cost includes land that your home sits on, you must subtract the value of the land from your original cost. For example, Bob rents his former residence. He paid $150,000 for the home including the lot the home is on. The land value at the time of his purchase was $50,000. His correct cost basis for the home is $100,000 (excluding the $50,000 cost of land). He’ll deduct $3,636 each year until he either sells the home, stops using it as a rental, or the home is completely depreciated after 27.5 years. Bob will need to track his total depreciation taken over the years he rents the home because it will be reported if he disposes of the home in the future.

What happens when I convert the rental back to my home?

When a rental property is converted back to personal use, the adjusted cost basis should be calculated. Adjusted cost basis is used to calculate gains if the home is sold while the property is being used for personal purposes. The adjusted basis of a rental converted to personal property is as follows:

- Original cost basis: $100,000

- Depreciation (10 years): $36,360

- Original cost basis minus accumulated depreciation: $63,640

- Adjusted Cost Basis: $63,640

Assuming the rental property needs sprucing up after 10 years of wear and tear as a rental property, it’s important to remember that the cost of improvements and additions made after the conversion is included in the adjusted cost basis amount. Continuing with Bob’s example, we’ll assume he made $10,000 of post-conversion improvements. This would bring the adjusted cost basis to $73,640.

What happens if I convert it back to a rental property?

Even though it seems like things are getting complicated, the situation is manageable. If you did the work, recalculating your adjusted cost basis after the conversion from rental to personal use, and you’ve tracked costs of improvements and additions, you already have the most important number calculated.

Going back to Bob, he has already calculated his adjusted cost basis in the home to $73,640. If Bob makes additional improvements to make the property suitable to rent, he can add those expenses to the adjusted cost basis before he starts renting his home again.

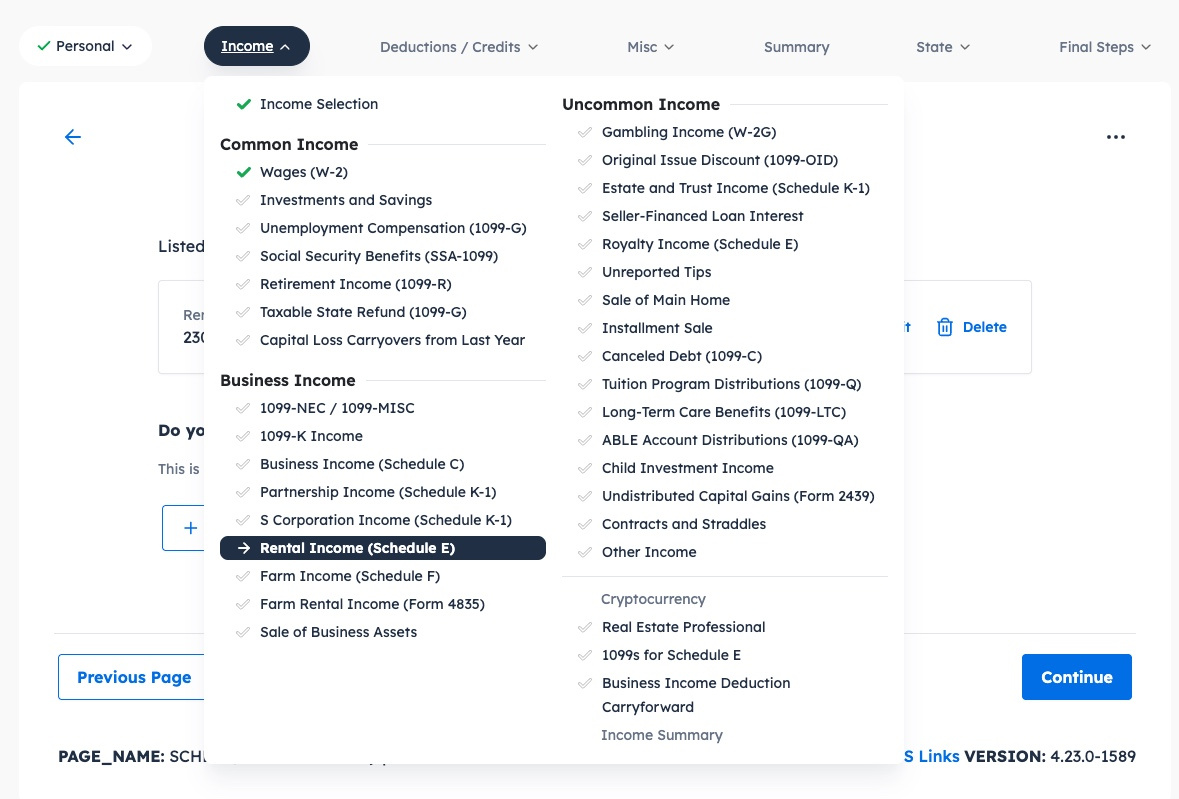

In FreeTaxUSA, Bob will start a Rental Income (Schedule E) entry. In the depreciable assets section, he’ll need to follow these steps:

- Follow menu path: Income > Business Income >Rental Income (Schedule E). Click +Add a Rental.

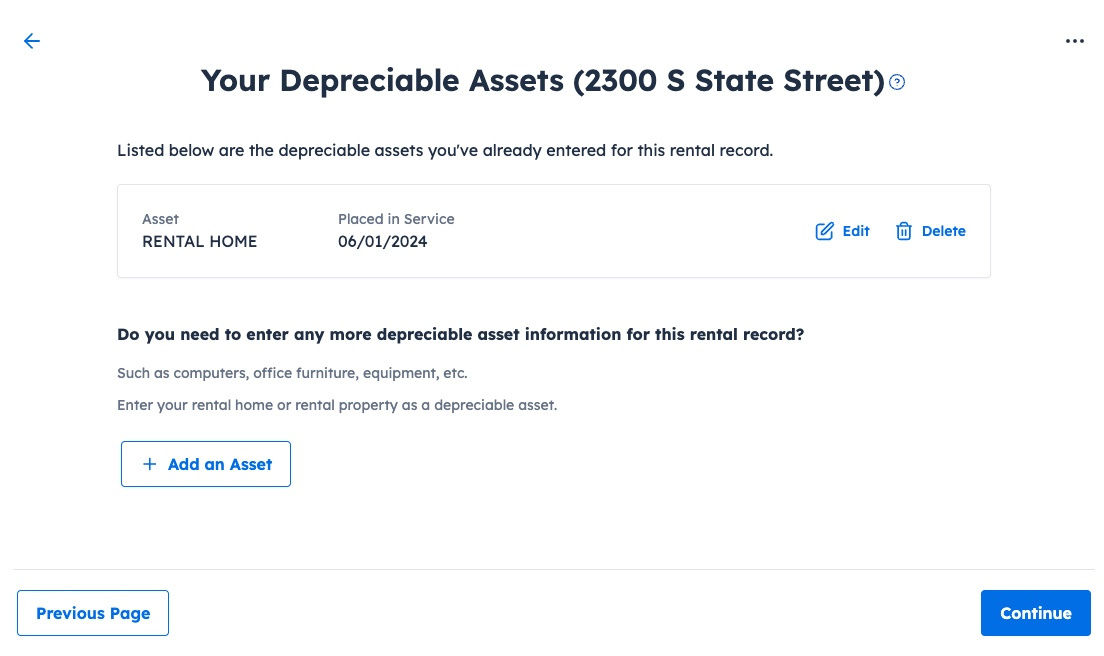

- Continue to the Your Depreciable Assets screen and click + Add an Asset.

- If you’ve already entered a rental, select Edit next to the rental entry. On the Your Rental screen, select Start/Edit next to Depreciable Assets.

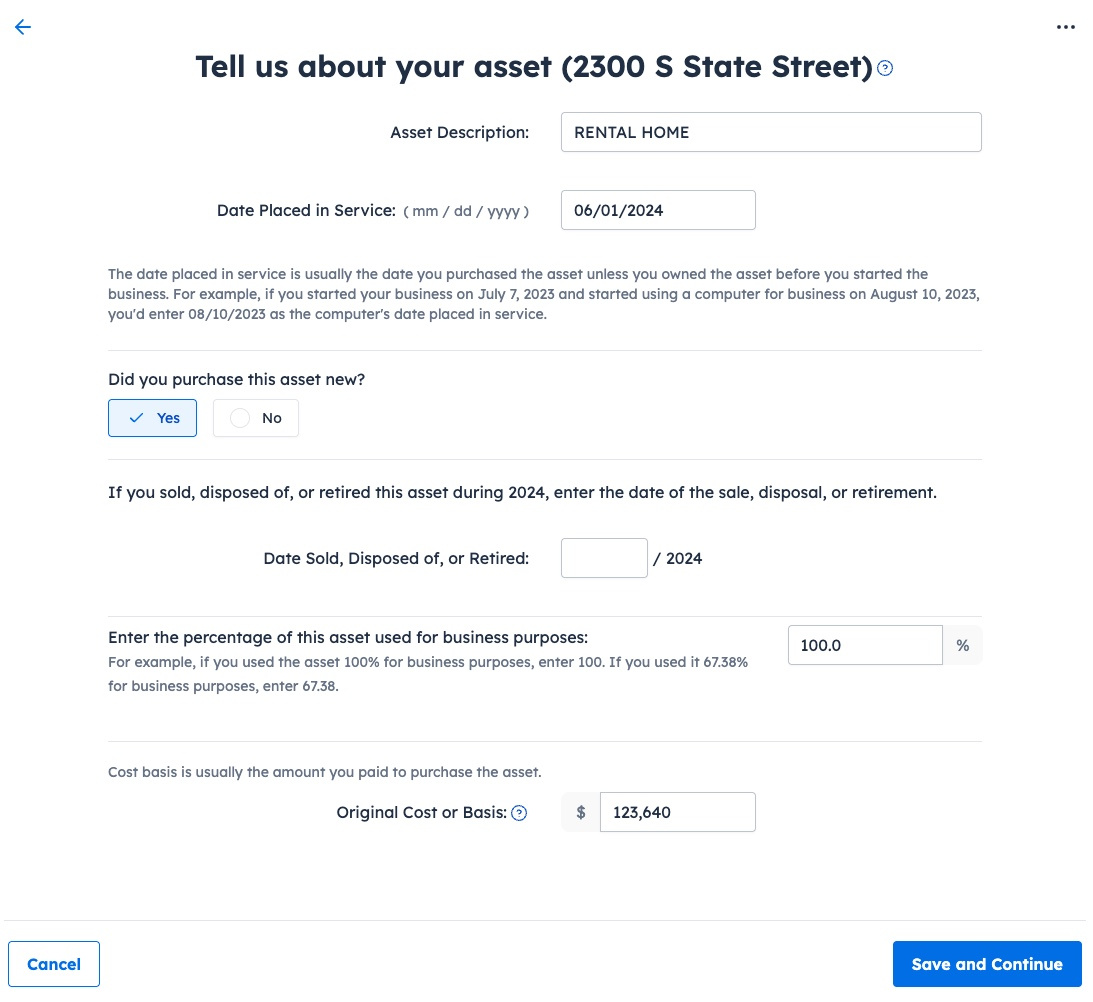

- On the screen labeled Tell us about your asset, Bob will need to enter the following:

- Date Placed in Service - date of conversion from personal to rental use. We’ll say June 1 for our example.

- Enter the Original Cost or Basis. This would be the adjusted cost basis Bob calculated. Here’s how he determined the amount to enter:

- Adjusted cost basis after converting from rental to personal use (excluding land cost),

- Expenses – Improvements made while living in it or just before Bob rented it out again,

- Original cost of the land – Unless the rental is part of an apartment structure not wholly owned by Bob.

Adjusted cost basis = $63,640

+Expenses = $10,000

+Land value = $50,000

=Total adjusted basis = $123,640

- Bob will continue through the subsequent screens, showing the property is Real Estate, and that the property is Residential Real Estate.

- On the Additional Depreciable Asset Info screen, he’ll need to enter the $50,000 original cost of land which will be subtracted from the $123,640 cost basis amount previously entered. He should then continue through to the end of the section.

- The Depreciation Deduction Summary will show Bob’s depreciation for a little more than half the year is $1,450. The next year, his depreciation will be $2,678. The converted property is treated like an entirely new rental property able to be depreciated over another 27.5 years but using his new adjusted cost basis.

It’s not as bad as you thought

Converting from personal to rental and back to personal use may have seemed like a complicated scenario, but it wasn’t that bad, right? Just remember to do the math as you go when you’re converting real estate. Each time you convert a property one way or the other, you’ll need to recalculate your adjusted basis. Unless there are some difficult economic times, initial adjusted basis in simplest terms will usually be the price you pay for a property plus or minus any of the adjustments mentioned earlier.

If the fair market value when you convert property is lower than what it cost you, you’d most likely use fair market value as the basis for depreciation. The adjusted cost basis after conversion from rental to personal use is the initial cost basis minus depreciation deducted while the home was a rental property. If you convert it to a rental again the new adjusted cost basis is the same adjusted basis after converting it to personal use, plus costs of improvements. The date placed in service and the number of years the property will be depreciated will start over every time you convert a property from rental to personal use.