Contributed by: KelliP, FreeTaxUSA Agent, Tax Pro

You might feel that you pay a significant amount out of pocket for medical expenses. Did you know you may be able to claim these expenses on your tax return? They can be reported as an itemized deduction on Schedule A. However, this will depend on your situation, as there are limitations. It also depends on whether you take the standard deduction or choose to itemize.

Have you tried claiming medical expenses in the past without seeing them show up on your tax return? If so, you may feel unsure of what can be deducted as it never shows on your Schedule A.

Medical expenses can be stressful, and understanding what’s deductible and for whom you can deduct the expenses may seem overwhelming. Let’s go through some details to help you find the answers.

Itemizing deductions

When you file your federal tax return, you choose between claiming the standard deduction and itemizing your deductions. If your itemized deductions (such as mortgage interest, state taxes, and medical expenses) exceed the standard deduction, itemizing makes sense. To deduct medical expenses on Schedule A, your expenses must exceed 7.5% of your adjusted gross income (AGI). For example, if your AGI is $52,000, you would need to have medical expenses over $3,900 to be deductible. If you paid $5,000 in medical bills out of pocket, then $1,100 ($5,000 - $3,900) of those expenses can be deducted and added to Schedule A as an itemized deduction.

What is a medical expense?

A medical expense is an out-of-pocket payment made to a doctor, dentist, hospital, eye doctor, or other healthcare provider for the diagnosis, cure, treatment, or prevention of a disease. The care you receive must be related to something affecting any part or function of the body. It includes services that help relieve or prevent physical or mental disability or illness.

Your expenses can also include the miles driven to and from the appointment office. If you used your car for medical purposes, the IRS provides a specific mileage rate each year.

Typically, expenses for general health benefits, such as vitamins or a vacation, aren’t considered medical expenses.

What expenses can be deducted?

You can claim only the expenses paid within the current tax year on your tax return. If you didn’t deduct an expense that was paid in a prior year, you can’t include it on this year’s tax return. For example, if your AGI was too high in 2023 to deduct the cost of your child's braces paid in that year, then you can’t apply the deduction from 2023 to 2025 just because your AGI is smaller in 2025. Only out-of-pocket expenses paid in 2025 can be deducted on your 2025 tax return. The same rule applies if you forgot to include the amount in 2023. You would need to go back and amend the 2023 tax return to include the missing expenses in order to claim them.

Refer to IRS Publication 502 for specifics on when various forms of payment are considered paid.

Whose expenses can you deduct?

Generally, you can deduct the expenses paid for yourself, your spouse, and your dependents.

What if you’re divorced and both parents pay your child’s expenses?

- In this case, you would typically include on your tax return only the amounts you paid out-of-pocket, but not the amounts paid by the other parent.

What if you pay the medical expenses for your aging father, and you, your brother, and your sister all support him?

- If you have a multiple support agreement and are entitled to treat your father as your dependent, you can deduct the amount you personally paid out of pocket as long as it wasn’t reimbursed by your siblings.

What if you file married filing separately?

You live in a non-community property state.

- You can include the amounts YOU actually paid. If you have a joint account and the amounts were paid from the account, this is typically considered to be paid equally by each of you, unless proven otherwise.

Example: You had a hospital bill of $1,200. You paid this amount from your joint checking account. The amount you can include on your separate return is likely $600; your spouse can claim the other $600.

You live in a community property state.

If you have a joint account, you each generally include half of the expenses. If you have separate accounts, then you can deduct the amounts actually paid by you from your account.

What are common expenses?

- Prescriptions

- Doctor visits

- Medical and dental co-pays

- Medical supplies

- Dental expenses

- Insurance premiums

- Hospitalizations

- Medical exams, X-rays, diagnostic testing

- Ambulance

- Contact lenses and glasses

- Chiropractor

- Surgery (typically not cosmetic)

Refer to IRS Publication 502 for a more comprehensive list and to review the general guidelines regarding what constitutes a medical expense (if a particular expense isn’t included in the list).

Are insurance premiums deductible?

- If you paid premiums through your employer's plan, you can only deduct the premiums if you paid them with after-tax dollars and your employer included the premiums as wages inBox 1 of your W-2. This isn’t common because most employer plans are paid with pre-tax dollars. Therefore, premiums you paid through your employer are generally not tax deductible.

- If you’re receiving social security benefits due to age or disability and are enrolled in Medicare Part A, the payroll taxes you previously paid for Medicare are not deductible. If you aren't receiving social security benefits or didn't pay Medicare tax, you can voluntarily enroll in Medicare Part A. In this situation, you can deduct the premiums you paid for Medicare Part A.

- You can deduct the premiums you paid for Medicare Part B, which is supplemental medical insurance. The information you received from the Social Security Administration should indicate what your premium is.

- You can deduct the premiums you paid for Medicare Part D, which is a voluntary prescription drug insurance program.

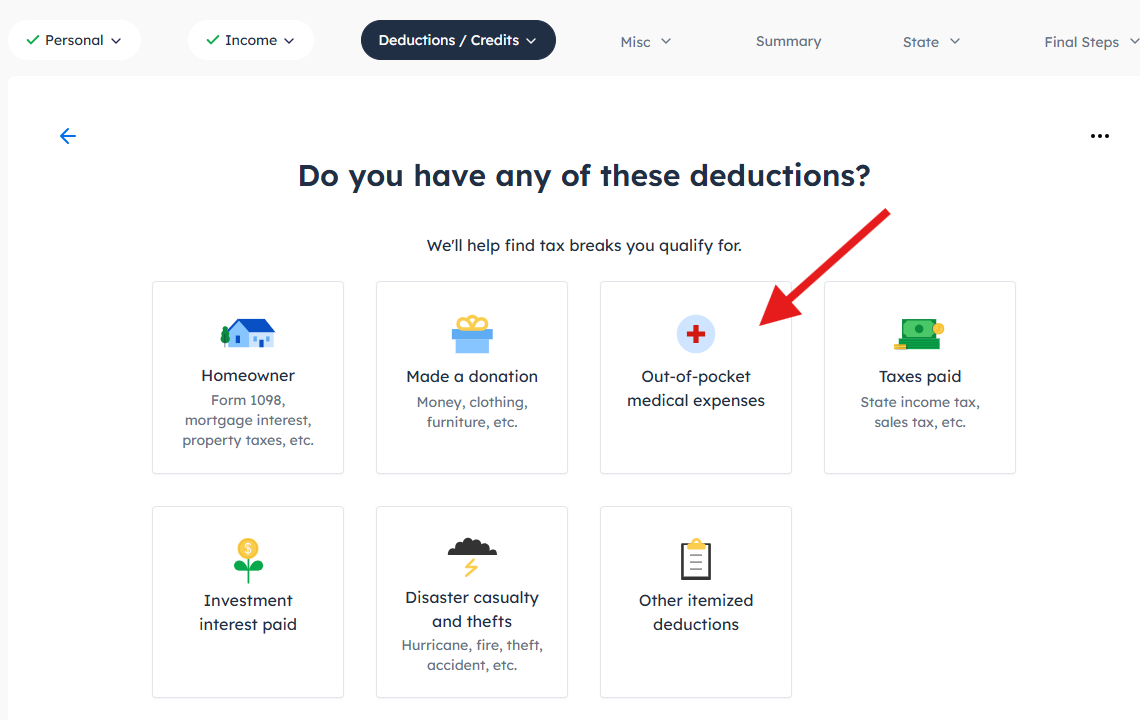

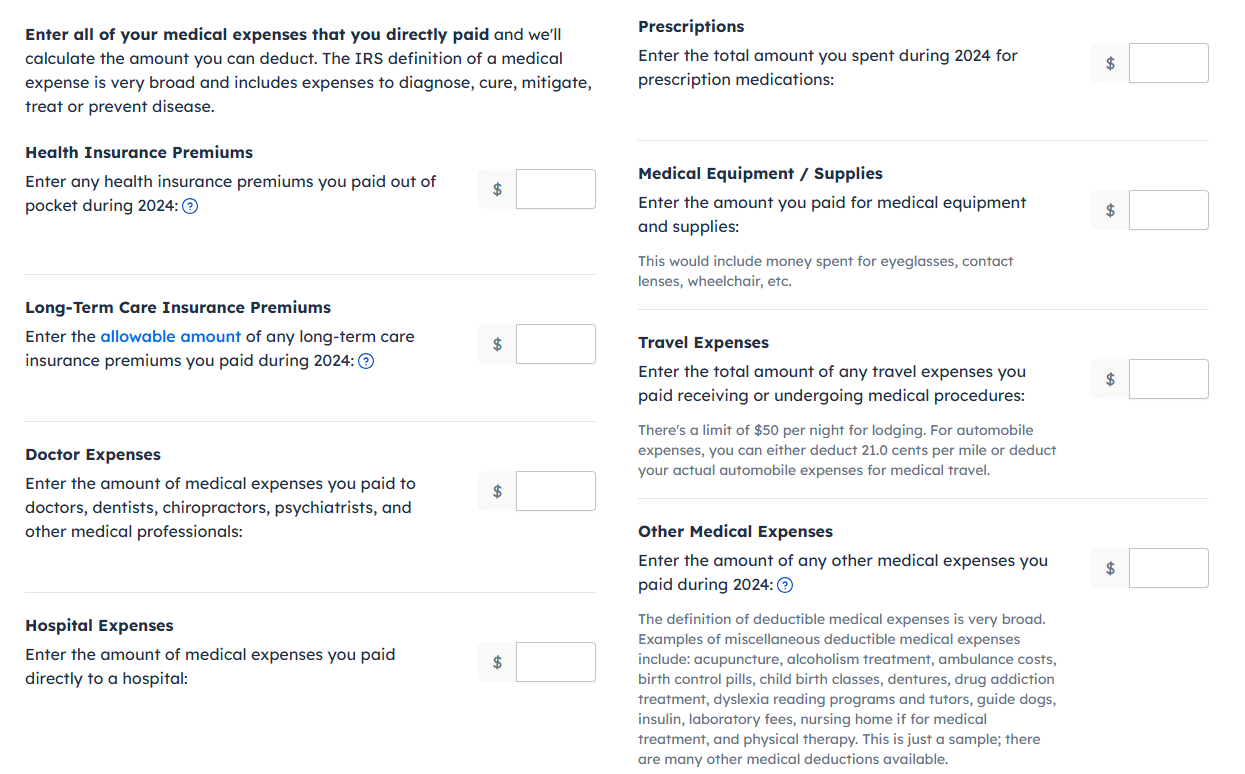

How to enter medical expenses in FreeTaxUSA

To report your medical expenses, follow the menu path Deductions/Credits > Standard or Itemized Deductions. As you go through the software, you’ll be guided to this section, which will allow you to indicate that you have out-of-pocket medical expenses. By making this selection you will then be taken to the screen to enter the medical expenses you had for the year.

The software will calculate the amount you can deduct based on the information you’ve already provided about your income.

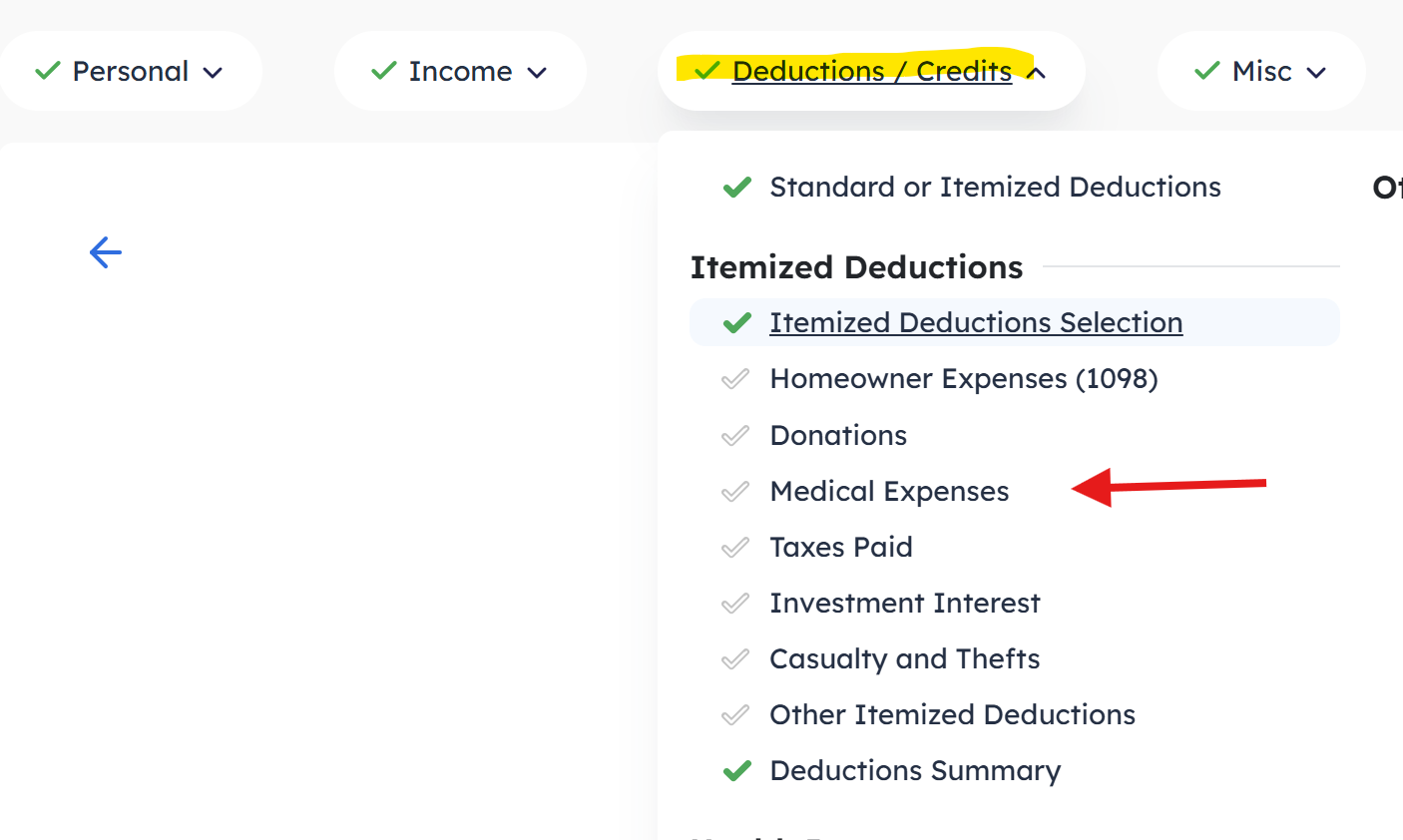

If you happen to pass the Deductions screens you can get back to the medical expenses by selecting Deductions/Credits and clicking on Medical Expenses.

Conclusion

Medical expenses can be tricky. Remember that to claim them, you must itemize, and the expenses must exceed 7.5% of your AGI.

Remember to keep records of your medical and dental expenses to support your deduction. If needed, you can usually get a copy of payment records from the medical offices where the payments were made.