Contributed by: MatthewD, FreeTaxUSA Agent, Tax Pro

You inherited a set of antique silver flatware from your grandmother. You never use it and recently learned the price of silver has gone up, so you can sell it now for a good price. However, you wonder whether you need to report this on a tax return since it’s the sale of a personal item.

Although this is a personal item, it’s classified in the collectible category and is treated differently by the IRS when sold. Generally, personal items lose value over time, whereas collectibles typically gain value.

This applies to all kinds of collectibles. The sale may be for a set of valuable trading cards, a painting, a vintage wool rug, an old tapestry, or a stamp collection. When sold for a gain, a collectible creates a capital gain and needs to be reported on that year’s tax return.

Collectibles don't qualify for the lower tax rates that apply to most investment sales. Thus, you’ll pay a higher tax on the sale of a collectible than a normal investment sale. Capital gains from a collectible are taxed at a maximum rate of (or capped at) 28%.

Definition of a collectible

The IRS defines collectibles under IRC Section 408(m)(2) to include:

- Any work of art,

- Any rug or antique,

- Any metal or gem (with some exceptions)

- Any stamp or coin (with some exceptions)

- Any alcoholic beverage, or

- Any other tangible personal property that the IRS determines is a "collectible" under IRC Section 408(m).

For more information see this IRS page on investments in collectibles.

Figuring out your basis

When reporting the sale of a collectible on your tax return, you need to figure out what your basis is. This is the non-taxable cost of the collectible. Generally, the basis is the cost you paid for it. You have a few options when figuring this out.

- If you purchased the item, then your basis is the purchase price plus any additional cost, such as broker and transaction fees and/or restoration costs.

- If you inherited the item, then your basis is the Fair Market Value (FMV) at the time of inheritance. Also, add the costs you may have put into it after inheritance.

- If you received the item as a gift, read this IRS Q&A about the basis of gifts.

You may need to do some research or get an appraisal of the item to find its historical basis before you report the sale on your tax return. Be sure to keep appraisal documentation should the IRS request proof. In our first example, the scrap value of silver has been tracked for years, and the information is readily available on the internet.

Steps to reporting the sale of a collectible in FreeTaxUSA

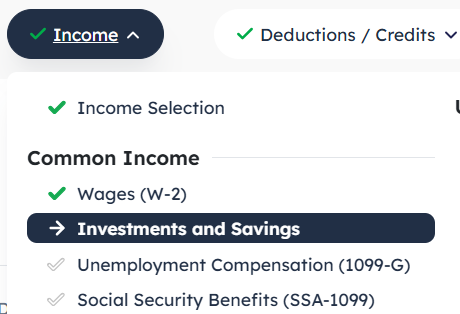

- Navigate to Your Investment and Savings Accounts under the Income menu and select the option, "Add an Investment".

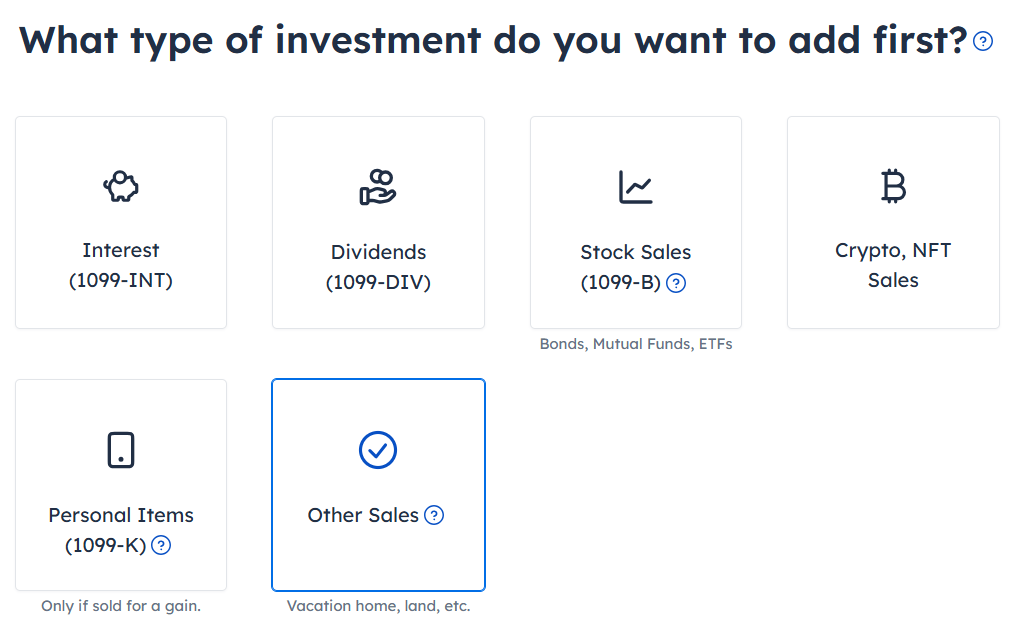

- Choose, "Other Sales", and then select, "Save and Continue".

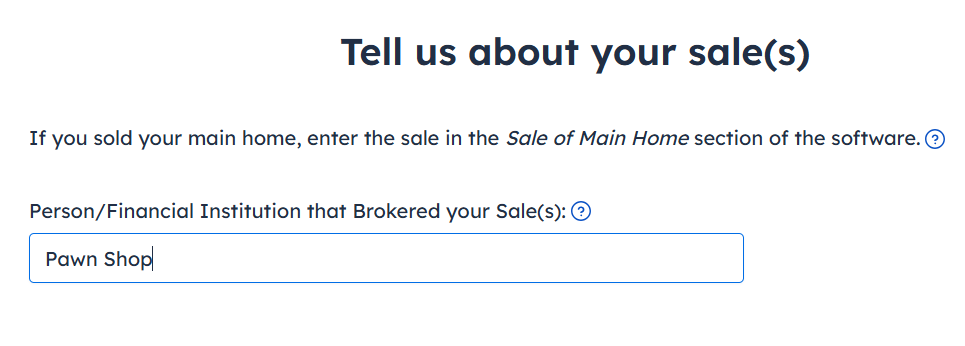

- Enter the name of the person or financial institution on the "Tell us about your sale(s)" page. This could be the person, antique shop, or other shop you made the sale to. Then select Save and Continue.

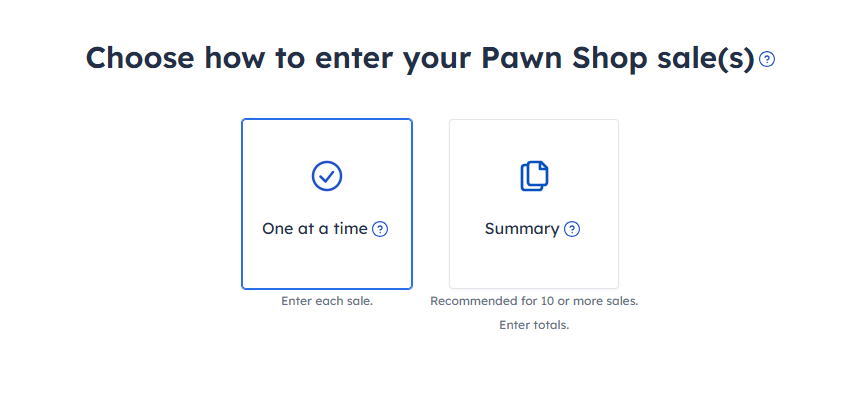

- Generally, in situations like this you will select to enter the sales "One at a time". Save and Continue.

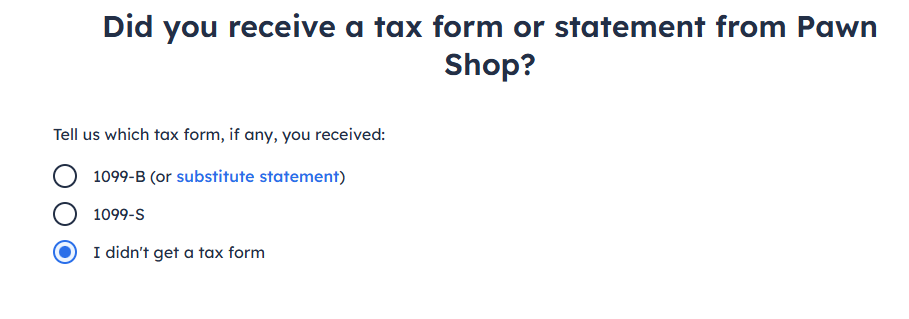

- Did you receive a tax form or statement? Generally, you will indicate you didn’t get a form. However, there is a possibility of receiving a 1099-B from the sale if it was over a certain amount.

- On the "Tell us about your investment sale" page, fill in the information.

- If you inherited the item(s) or sold multiple items, answer NO to, "Did you acquire this investment on a specific date?" and check the right option.

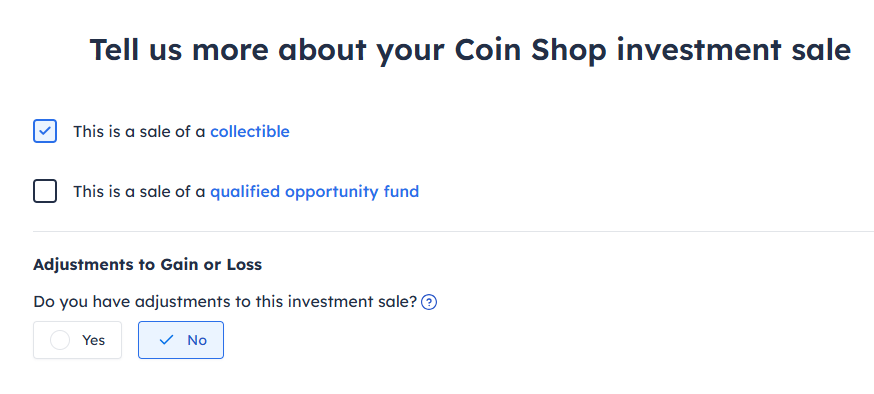

- On the "Tell us more about your investment sale" page, check This is a sale of a collectible. Save and Continue.

Conclusion

The sale of a collectible can create a windfall of cash and provide financial help when needed. However, you need to be aware of the tax consequences. Your taxes will likely go up, so consider making an estimated payment to the IRS.

Additional forms will be included in your return. When you report the sale of the collectible, the gain will be reported on Form 8949 and Schedule D, and you may see a Schedule D Tax Worksheet to calculate taxes. We’re here to help you with any additional questions.