Contributed by: MatthewD, FreeTaxUSA Agent, Tax Pro

When a stock or security becomes worthless, you have a capital loss, not a bad debt. A bad debt is created when you lend money or sell something on credit and don’t have an expectation to be paid back.

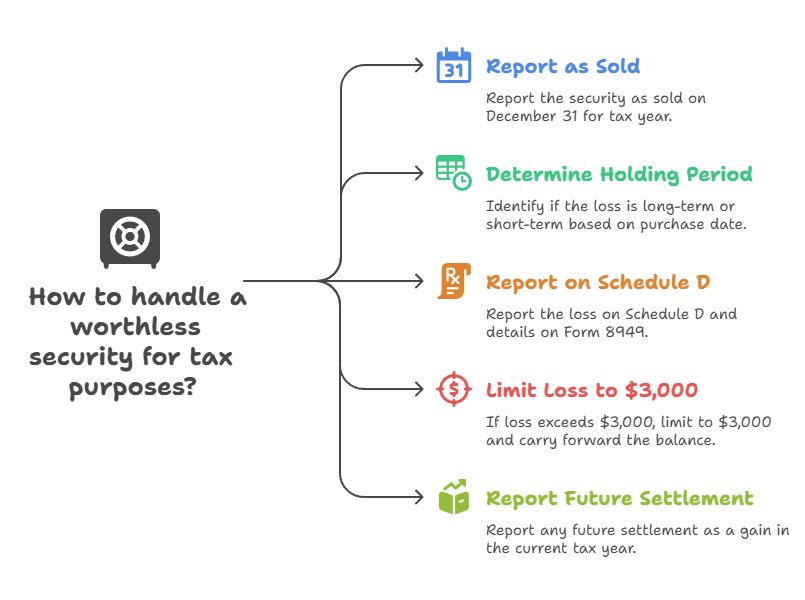

When a security is worthless, here are some things to keep in mind:

- Report it as if it were sold on the last day of the tax year (December 31).

- You must determine the holding period, which is based on when it was purchased. Whether you have a long-term or short-term loss is determined by the holding period.

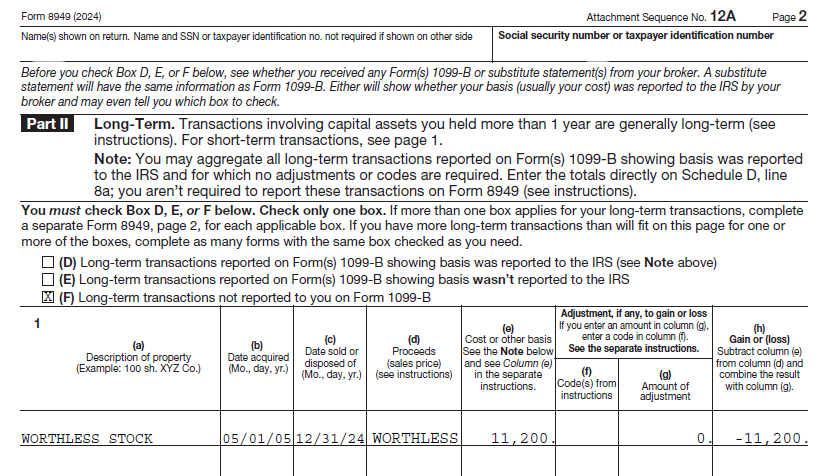

- The loss will be reported on Schedule D, and details will be reported on Form 8949.

- If the loss is greater than $3,000 and you don’t have any other capital gains, your loss is limited to $3,000 a year, and the balance is carried forward.

- After you report the total loss, any money you later receive as a settlement must be reported as a gain on your current year's tax return.

Reporting worthless stock in FreeTaxUSA

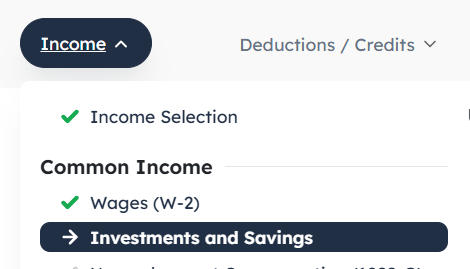

- Follow menu path: Income> Common Income > Investments and Savings.

- Click on Add an Investment and select Stock Sales (1099-B).

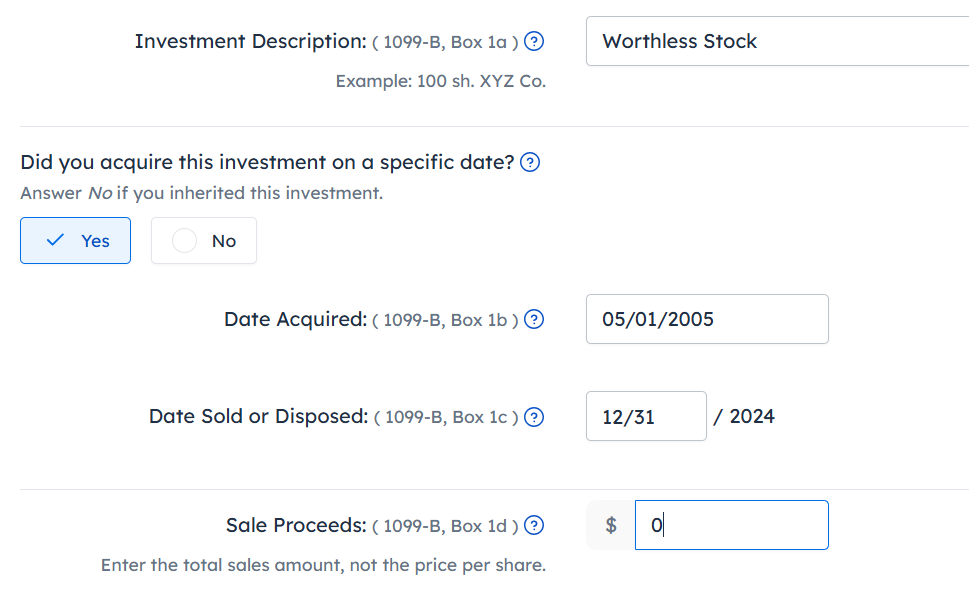

- Enter the name of the brokerage.

- In most cases, you will enter the sale manually, one at a time.

- Enter a description and date you acquired the stock. Enter 12/31 as the disposal date.

- Enter your cost or basis in the stock (usually the amount you paid).

- Answer the question, “Was the basis reported to the IRS on Form 1099-B, Box 12?“ and other questions if applicable.

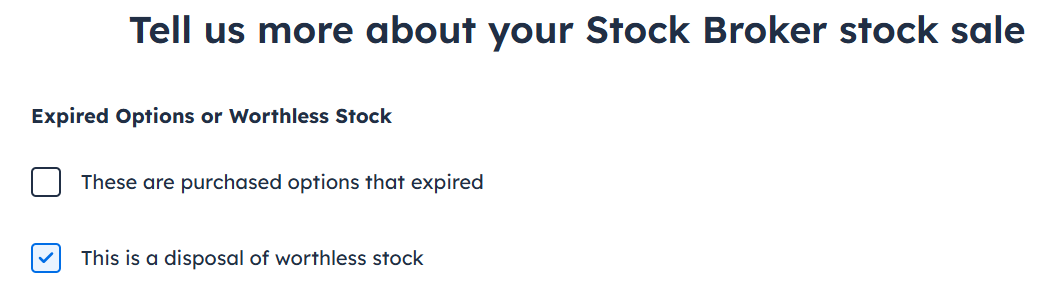

- On the Tell us more about your stock sale page, check This is a disposal of worthless stock.

- On the Wash Sale page, answer No (if it’s worthless, it’s not a wash sale).

Review tax return

When you review your tax return, note the following entries:

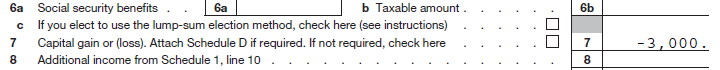

- Form 1040, Line 7, you’ll have a capital loss--unless you have other gains to offset the loss.

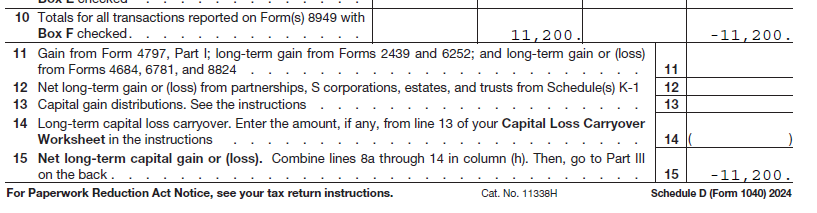

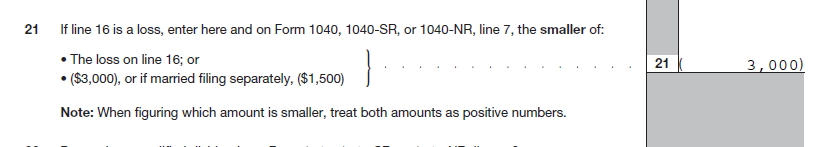

- Schedule D shows the total long-term loss on line 15 and the $3,000 loss limit on line 21.

- Form 8949 reports the transaction details and total loss.

What if you can’t claim all your losses because of the $3,000 loss limit?

If you use your same FreeTaxUSA account to prepare your tax return year after year, any capital losses you have will be carried forward automatically. Otherwise, use the Capital Loss Carryover Worksheet from the Schedule D instructions to calculate and use the balance of your losses.

Handling capital loss carryovers

Capital loss carryovers are entered into FreeTaxUSA software by following menu path: Income > Common Income > Capital Loss Carryovers from Last year.

Carryover losses can be used to offset capital gains the next year. The $3,000 capital loss limit will continue to apply each year, but you can carryforward unused capital losses indefinitely until they are fully used up.

In conclusion

Reporting worthless stocks or investments accurately on your tax return is an important step in managing your financial portfolio and maximizing tax benefits. By understanding the correct procedures, such as treating the disposal as a sale on December 31, using the appropriate forms and software tools, and tracking capital loss carryovers, you can ensure compliance with IRS regulations and make the most of available deductions. Careful recordkeeping and consistent use of your FreeTaxUSA account will help you offset future gains, utilize losses efficiently, and avoid overlooking valuable opportunities to improve your financial outcomes year after year.