Contributed by: KelliP, FreeTaxUSA Agent, Tax Pro

Congratulations, you have successfully filed an extension! Now what?

- Pay any amount due with the extension, if you haven’t already.

- Did you choose to have the funds electronically withdrawn? If so, you don’t need to pay again. If not, then you can go to the IRS website and make payment (be sure to select it is an extension payment). Make your state payment as well, if needed.

- Continue gathering all needed documents.

- Enter additional tax information into the software as you receive/gather it, or wait until you have all the information needed.

- When ready, return to your account to file the full return.

- Remember, the filing extension is for six months, and the full return needs to be submitted by October 15th.

Ready to enter information

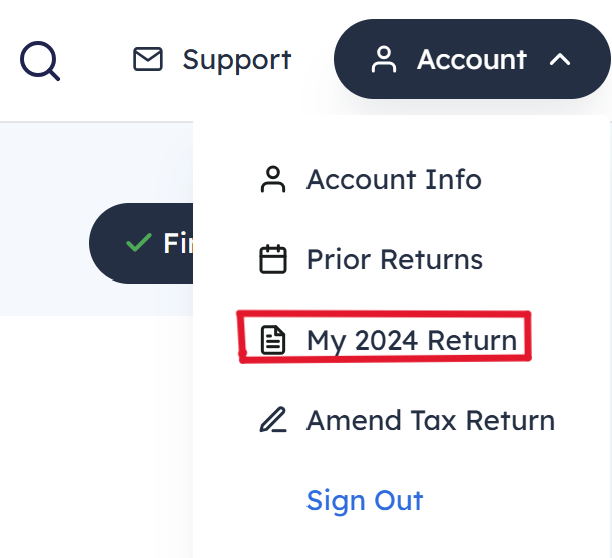

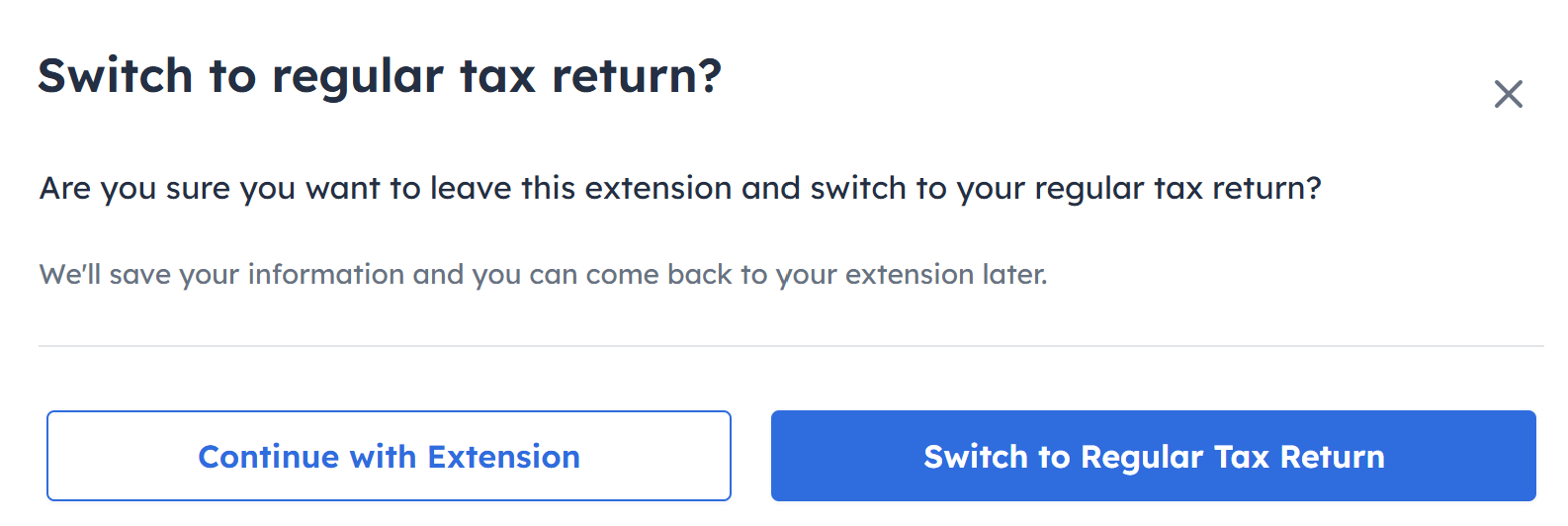

When you’re ready to enter your tax return information, sign in to your FreeTaxUSA account, select Account > My 2024 return, and choose Switch to Regular Tax Return.

You’ll now go through the software and enter any additional information you have. Be sure to review all previous entries for completeness and accuracy to avoid missing any important details.

I made an extension payment. Where do I enter it?

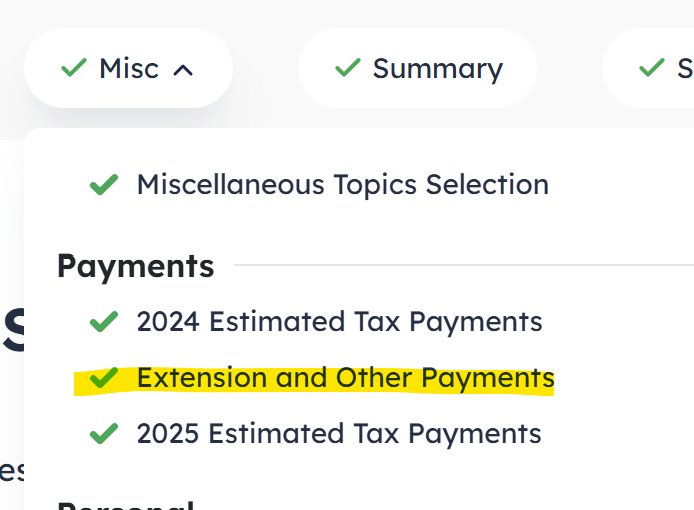

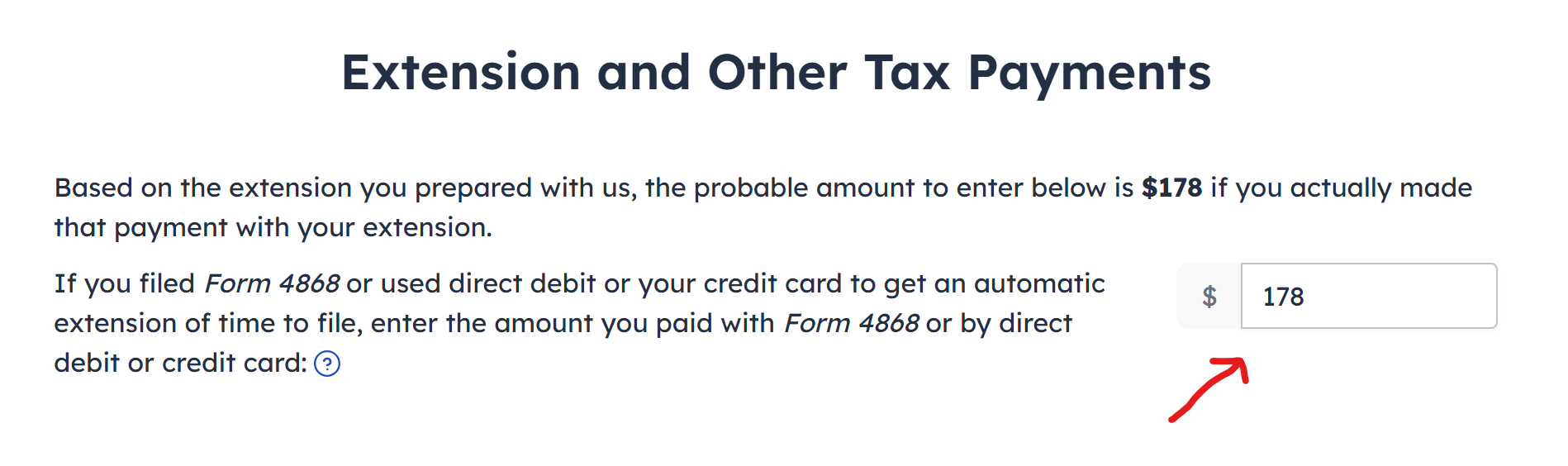

The extension payment will be entered as a credit on your tax return by choosing the menu path: Misc > Payments > Extension and Other Payments.

If you have an extension with a payment in your account, the software will alert you to do this before finalizing.

Enter the amount you paid with your extension.

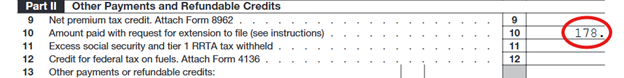

Your entry will show on Schedule 3, line 10:

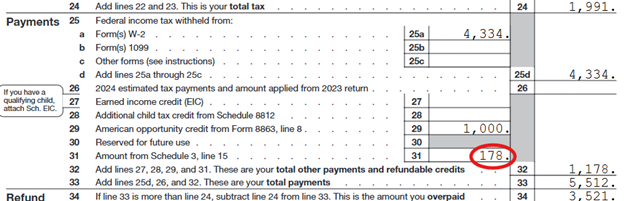

From there it flows to Form 1040, line 31, where it will be credited towards your tax bill:

If you paid more than you owe with your extension, you’ll be able to claim a refund of the excess amount.

Filing your tax return

After entering all your information, go through the Final Steps screens to finalize your return. If you’re filing by the extension deadline and are filing a current year tax return, you’ll typically be able to e-file the return. If you’re filing after the October 15th deadline, and the IRS e-filing system is open, you may need an identity protection PIN (IP PIN) in order to e-file. If you don’t have an IP PIN or the IRS e-filing system is closed (typically from November through late January) you’ll need to print, sign, date, and mail your tax return to file.