Contributed by: AndyS, FreeTaxUSA Agent, Tax Pro

Typically, you’ll receive Form 1099-B or a stock summary to report your stock sales on your tax return. Some companies fill out Form 8949 for you instead. This can be confusing when preparing your tax return, since the FreeTaxUSA software prompts you to enter the information as if you received Form 1099-B. Based on your entries, the software will generate Form 8949 to attach to your tax return. Converting the information from Form 8949 (the one you received) into the format the software requires can be easy -- once you understand what you’re looking at.

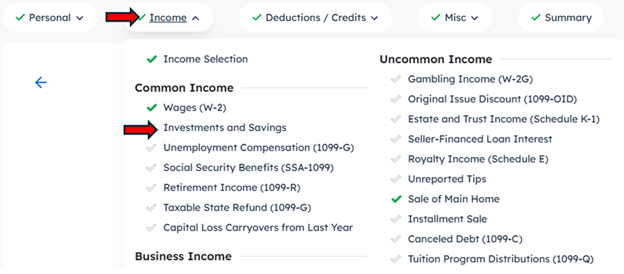

What steps do I need to take to enter Form 8949?

- Follow menu path: Income > Common Income >Investments and Savings.

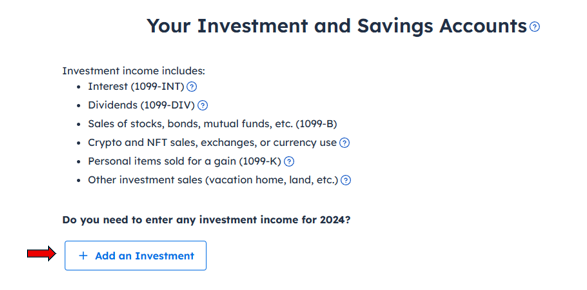

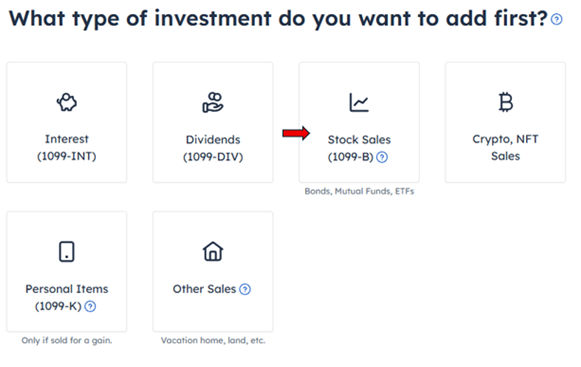

- Select Add an Investment

- Select the type of investment reported on your Form 8949. For the following example, we’ll indicate that it’s a stock sale. However, it could be another type of sale, such as a cryptocurrency sale.

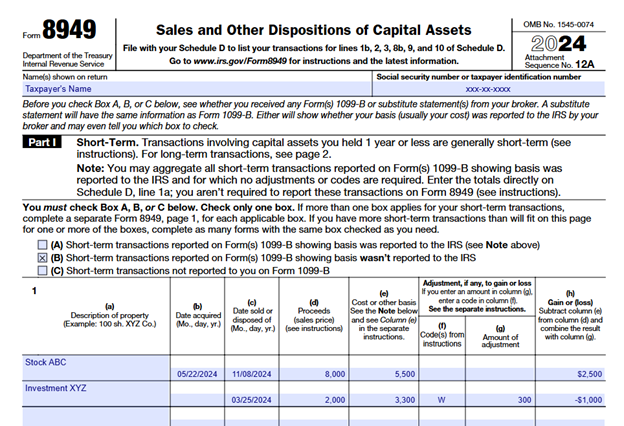

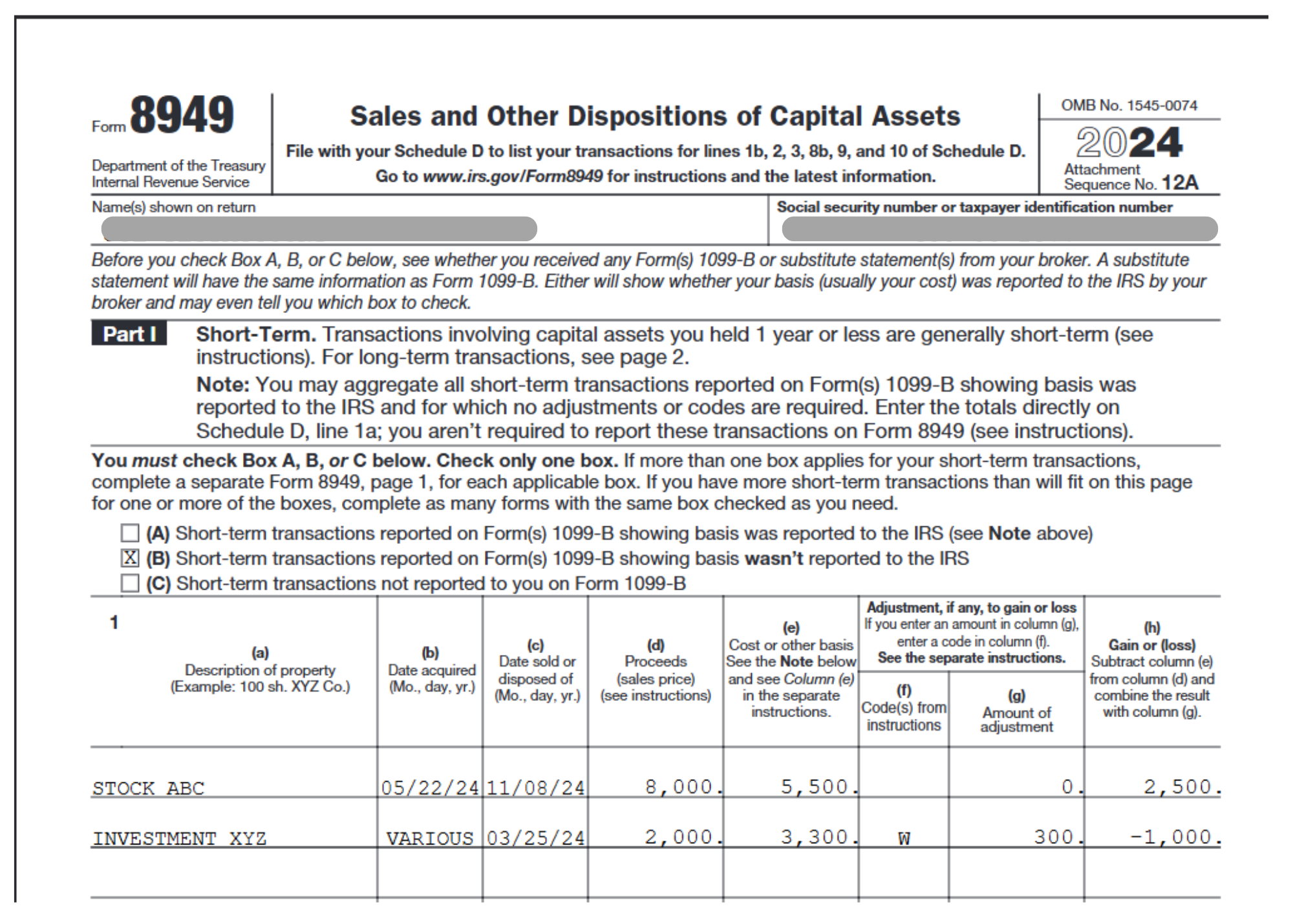

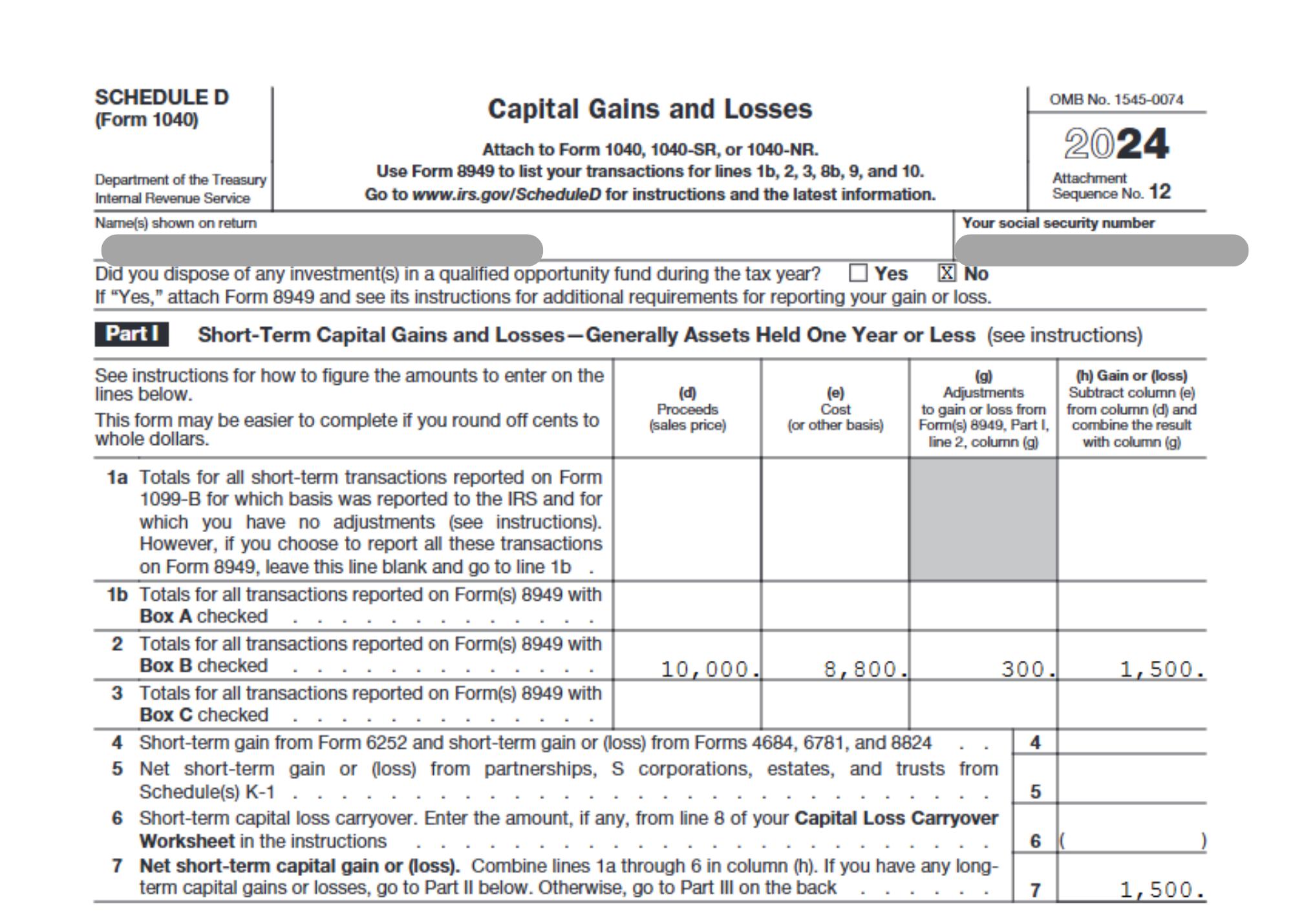

- The following screen is where you’ll need your Form 8949 to start entering information. Your Form 8949 may look similar to this example:

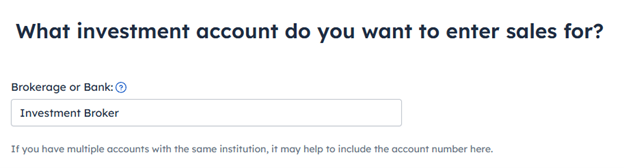

- Enter the name of your stockbroker. This is the company that prepared the Form 8949. Select Save and Continue.

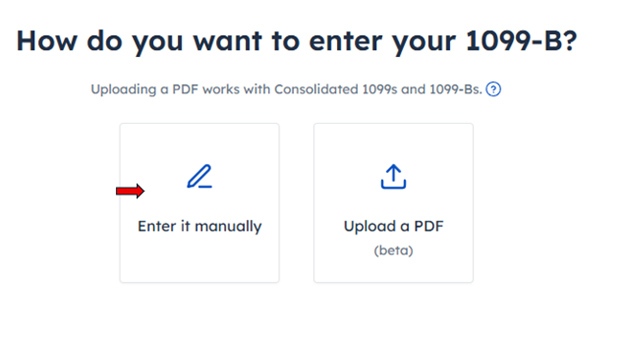

- Select to enter the sale manually since your sale was reported on Form 8949. Then select Save and Continue.

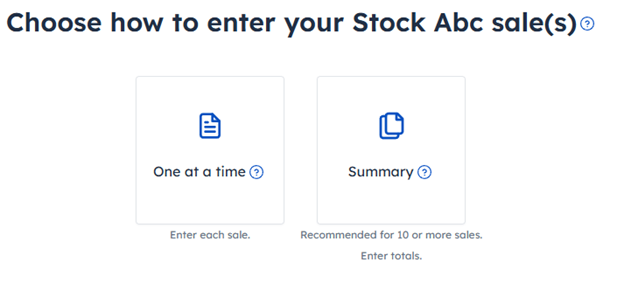

- Determine if your Form 8949 is reporting a single stock sale or a summary of sales. Typically, if there’s a purchase and/or sale date listed, it’s a single stock sale. If there aren’t dates, it’s generally a summary. If you’re not sure, you’ll want to reach out to your broker for clarification. In this example, Form 8949 is reporting two single stock sales (Stock ABC and Investment XYZ). Select One at a time to enter each sale.

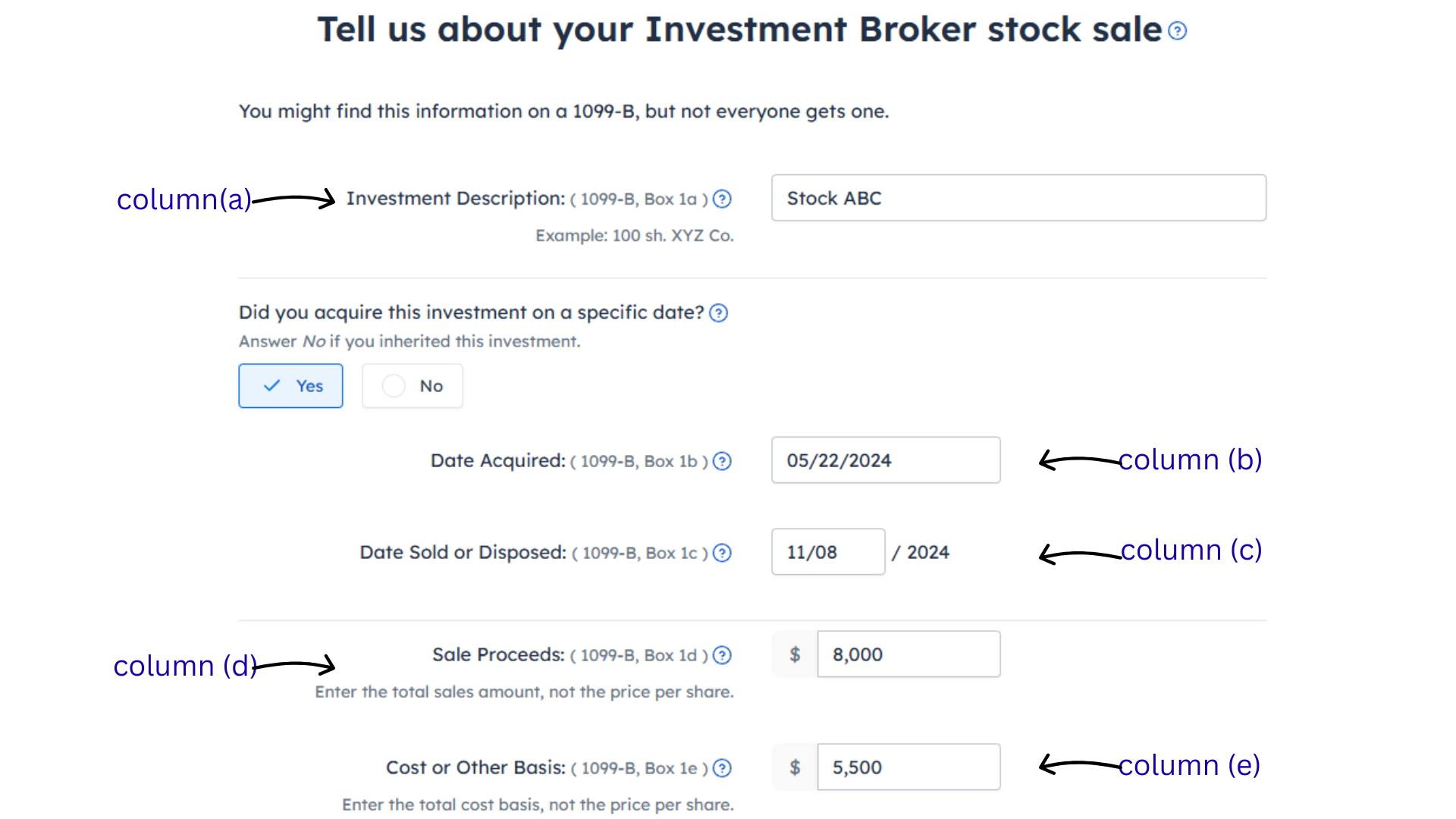

- Enter each sale separately starting with the first transaction listed on your Form 8949. Match the lettered columns of your form to the corresponding fields in the software. You can see where the information from each column should be entered in the image below.

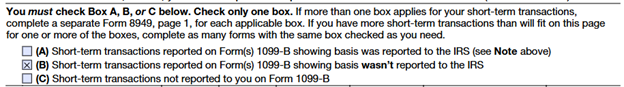

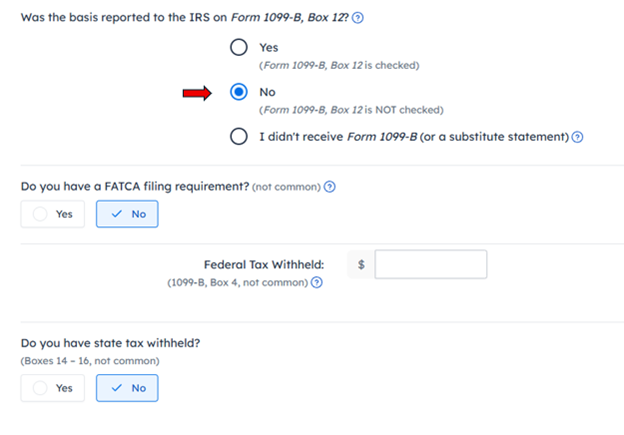

- On the same page, you’ll be asked if the basis was reported to the IRS. The Form 8949 you received is considered a substitute statement, so you'd select Yes or No. To find the answer, look above the list of stocks on your Form 8949.

In our example, (B) is selected, showing the basis wasn’t reported to the IRS. Thus, you’ll select No in the software.

In our example, (B) is selected, showing the basis wasn’t reported to the IRS. Thus, you’ll select No in the software. - For the other questions on this screen, your stock sale generally won’t be reported on Form 8949 if you have taxes withheld or FATCA filing requirements. You can move past those questions if they don’t apply. However, if you’re unsure, you may want to verify with your broker.

Select Save and Continue when you’re ready to proceed.

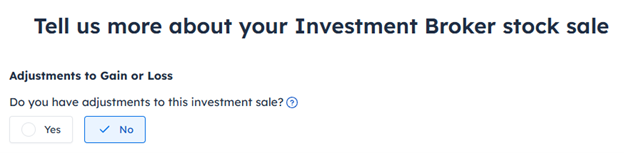

In the example Form 8949 above, you can see the adjustments in columns (f) and (g) are blank for Stock ABC. Select No when asked if you have adjustments for your stock sale, then select Save and Continue -- and you’re done entering the first transaction!

What if there’s no date acquired in column (b)?

Let’s look at how to enter the second stock sale from Form 8949. After entering information for the first transaction, you should be at the Your Sales screen, where Stock ABC is listed. Select Add a Sale to enter the information for Investment XYZ.

Follow the same steps until you’re asked if you acquired this investment on a specific date. There’s no date acquired in column (b) for Investment XYZ, so you’ll answer No.

Indicate if the stocks were acquired on various dates and held for one year or less (short-term), acquired on various dates and held more than one year (long-term), or inherited. Looking again at the section of Form 8949 above the list of stocks, (B) is selected, indicating these are all short-term transactions. Thus, you’ll select Various Dates Acquired – One Year or Less.

My Form 8949 shows an adjustment. How do I enter that?

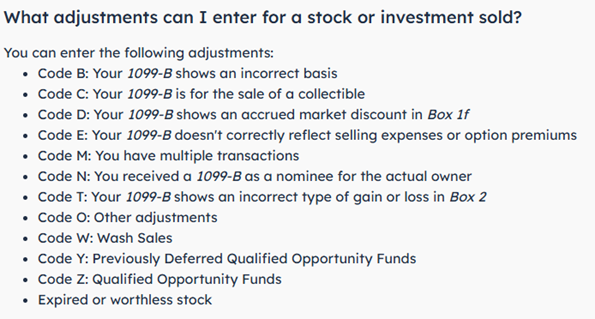

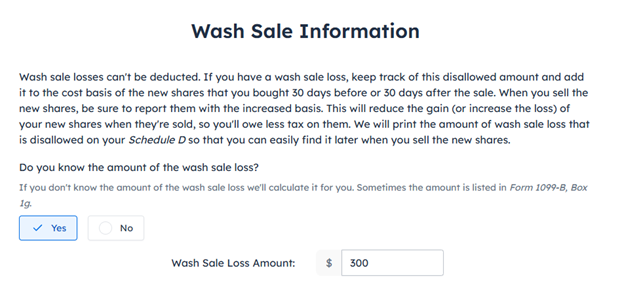

You may have noticed Investment XYZ has an adjustment. You’ll account for that when you reach the adjustment screen. The type of adjustment you have will determine how it’s entered into the software. The code in column (f) will help you know what type of adjustment you have. These are the different types of adjustments FreeTaxUSA can help you report:

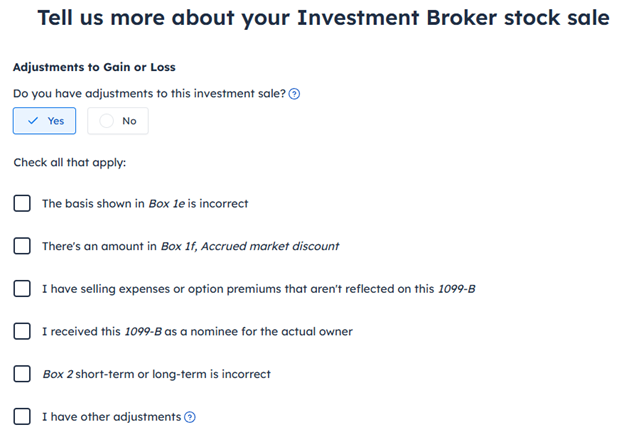

If you select Yes to having an adjustment, you’ll be provided a list of adjustment options. Choose the appropriate adjustment, and select Save and Continue to enter the amount.

The example Form 8949 has code W for wash sale. However, you may notice that wash sale isn’t showing here as an option. Wash sales are entered differently.

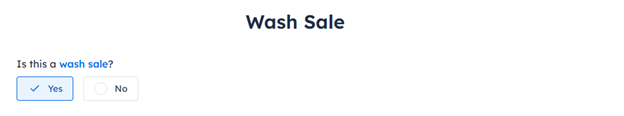

If you have a wash sale, answer No when asked if you have adjustments to this investment sale and select Save and Continue. If the software determines that a wash sale is possible (based on the sale proceeds and cost basis you’ve entered), you’ll be provided a Wash Sale screen. Answer Yes and select Save and Continue to enter the wash sale amount listed on your form.

Enter the amount from column (g) as your wash sale amount. Then select Save and Continue to finalize your entry.

How will this look on my tax return?

Based on your entries, the software will create a new Form 8949 as part of your tax return. Keep the Form 8949 you received from your broker with your tax files. Here’s what the Form 8949 generated by the software will look like:

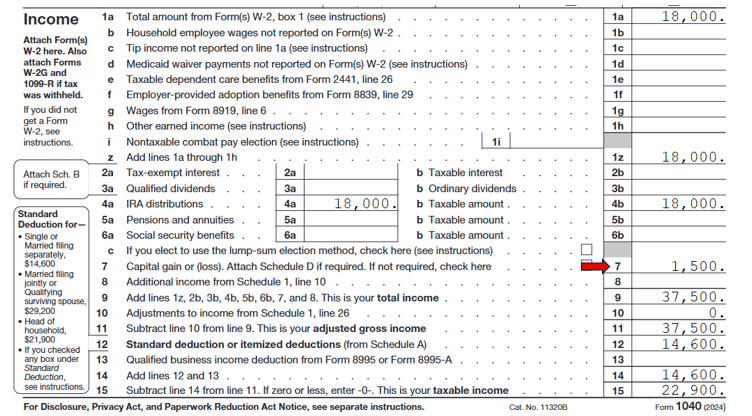

The information reported on Form 8949 will carry over to your Schedule D, where all your capital gain and loss income is reported.

You can see the totals from Form 8949 have been combined, resulting in a net gain of $1,500 on line 7. That amount will then flow to line 7 of Form 1040.

Need more help?

We know entering investment sales can be complicated at times. Our customer support team is happy to help answer any questions that come up. You can reach out to us by selecting Support at the top of the screen when working on a desktop computer. If you’re on a mobile device, select the three lines on the top left of the screen and scroll down to Support.

Related article:

I have a Wash on my 1099-B. What is a "Wash" sale and how do I report it?