Contributed by: Henry, FreeTaxUSA Agent, Tax Pro and AndyS, FreeTaxUSA Agent, Tax Pro

Did you have a significant life event that prevented you from filing your tax return on time? Or were you missing important documentation? Maybe you simply procrastinated and forgot to file. Whatever the reason, if you missed the filing deadline for a prior year tax return, it may not be too late to get it filed.

If you expect to owe taxes when you file, it’s best to submit your return as soon as possible to stop additional penalties and interest from accruing. If you’re expecting a refund, keep in mind there may be a limited window to claim it. In either case, filing your tax return promptly is a smart move.

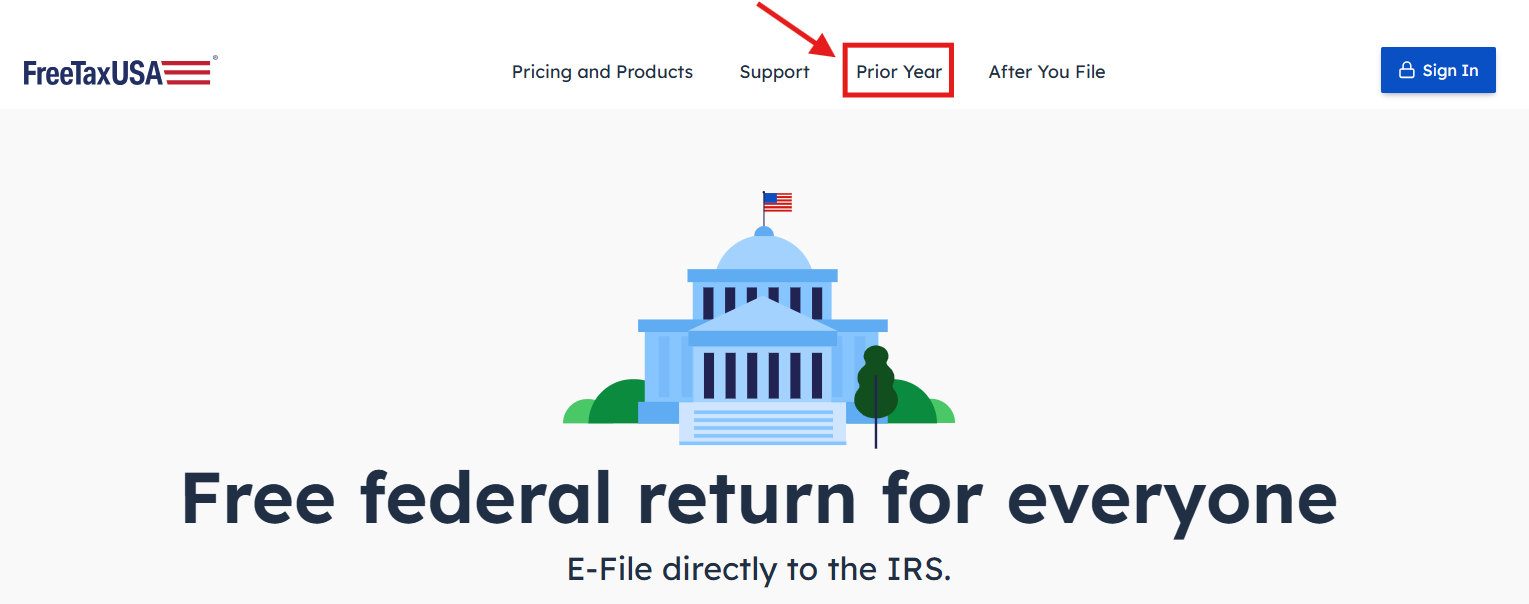

FreeTaxUSA can help!

FreeTaxUSA supports prior-year tax return preparation for up to seven years, and we’re here to guide you through the filing process. To access FreeTaxUSA software for a prior year, simply go to our homepage and select Prior Year. Then you’ll be prompted to choose the year you want to file.

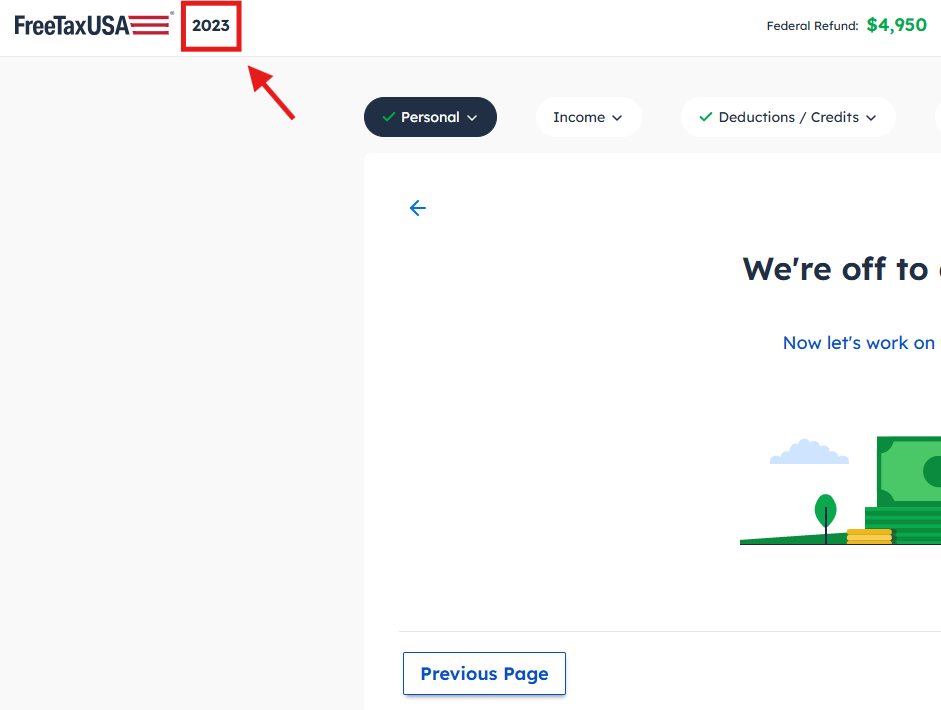

Once you sign in, you’ll see the year listed in the top left corner of the screen next to our logo, so you can always be sure you’re accessing the software for the appropriate year.

Filing considerations

- Personal information: You’ll generally want to answer the questions as they apply to your situation in the year for which you’re filing. However, when entering your address, be sure to enter your current address (even if that’s not where you lived in the year for which you’re filing). The address you enter is the one the IRS will use to communicate with you about your tax return, if needed.

- Income: If you’re missing an income form, such as a W-2 or 1099, it’s best to contact the form issuer and request another copy. If that’s not possible, you may be able to request a wage and income transcript from the IRS.

- Deductions and credits: The records you have kept for the filing year will determine which deductions or credits you’re eligible to claim. You might have received a tax form--such as Form 1098, which reports mortgage interest. You may also have saved receipts, records, mileage logs, or statements for things like charitable donations, childcare expenses, property taxes, health savings account information, retirement contributions, education expenses for college students, K-12 educator expenses, home energy upgrades, business use of your vehicle, etc. If you don’t have proof of an expense, you may not want to claim it.

- E-file or mail: The IRS requires most prior year tax returns to be filed by mail. However, if you have an identity protection PIN (IP PIN) and are filing a tax return for either of the two years prior to the current tax year, you may e-file.

- If you'd like to opt in to the IRS IP PIN program, go to the IRS IP PIN website. The IRS will issue you a new IP PIN each year, which needs to be included on any tax returns filed within that year. Once you have an IP PIN, it can be entered in the FreeTaxUSA software by following the menu path: Misc > Personal > Identity Protection PIN.

- Alternatively, if you need to file by mail, instructions will be provided for you at the end of the Final Steps section on the Check Status/Print Tax Return screen.

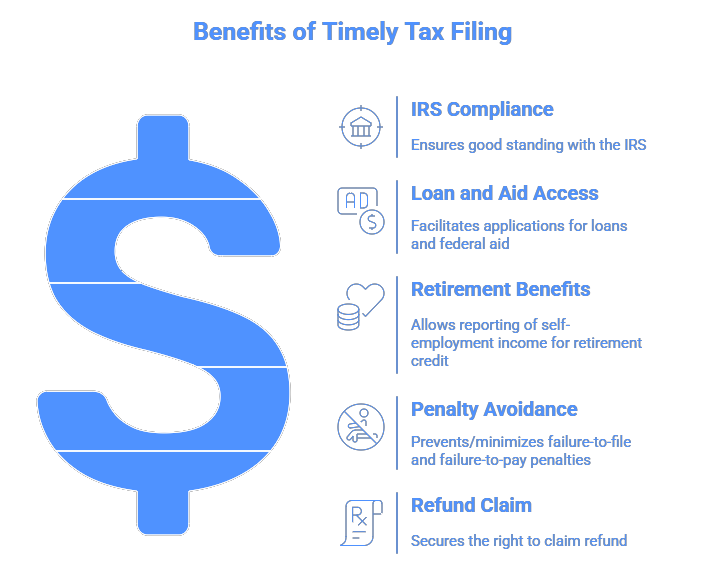

Time is of the essence

You’ll want to get your tax return completed as soon as you can. Doing so keeps you in good standing with the IRS, prevents the IRS from filing a substitute return on your behalf, avoids delays if you need to apply for a loan or federal aid, and allows you to report any self-employment income you may have to the Social Security Administration so you can receive credit toward retirement benefits.

Perhaps most critical are the immediate financial repercussions:

- If you owe taxes, you may be subject to a failure-to-file penalty, a failure-to-pay penalty, and interest on unpaid taxes and penalties. Filing your tax return stops the failure-to-file penalty from accruing—which is the steeper of the two penalties—so it’s a good idea to file even if you can’t pay the full amount owed. The IRS will determine if you’re subject to penalties after they process your tax return. They’ll send you a letter in the mail notifying you of any additional amount owed. Then you may either pay the full amount or pay what you can and set up a payment plan with the IRS for the rest.

- You typically won’t face a late fee or penalty if you’re owed a refund. However, you generally only have three years from the tax return’s original filing deadline to claim it. You risk losing your refund by waiting too long to file.

Don’t delay—take the necessary steps today to get your late tax return filed! FreeTaxUSA is here to support you through the process. Reach out to our support team if additional questions come up while filing.