Contributed by: JoshuaC,FreeTaxUSA Agent, Tax Pro

There are several situations that may require a taxpayer to file two or more state income tax returns. These situations include (but are not limited to):

- You moved from one state to another during the year.

- You live in one state while working in another.

- You earned income from work performed in multiple states.

- You temporarily live in a state other than your resident state, such as for school.

- You own rental property or other business interests across state lines.

Whatever the reason, FreeTaxUSA software is equipped to walk you through filing one or multiple state returns, depending on your situation.

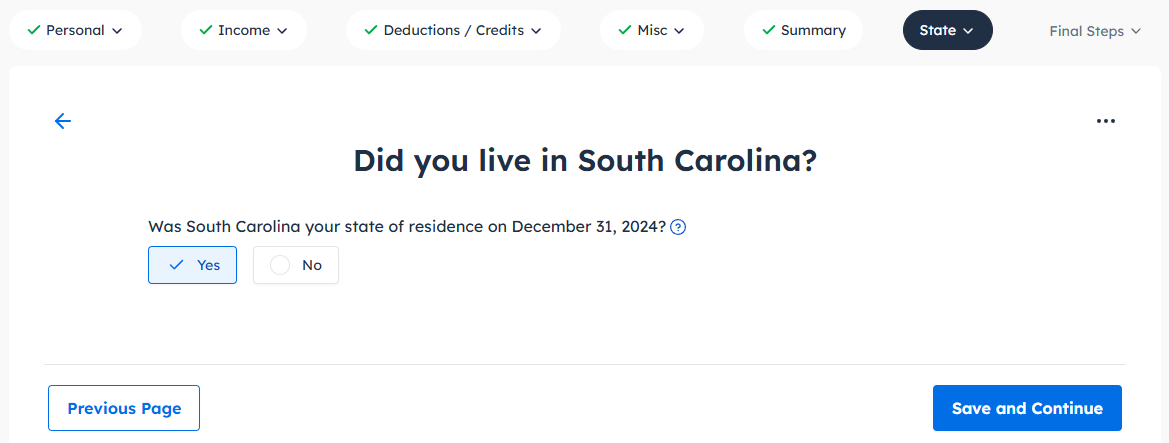

Once you have entered all required information for your federal tax return, you’ll continue to the State section of the website. FreeTaxUSA will always start asking questions about the state listed in your address on the Personal Information screen. The first question will confirm if this is the state you lived in at the end of the tax year. The program will assume this is your state of residence, but you can answer No and change it if needed.

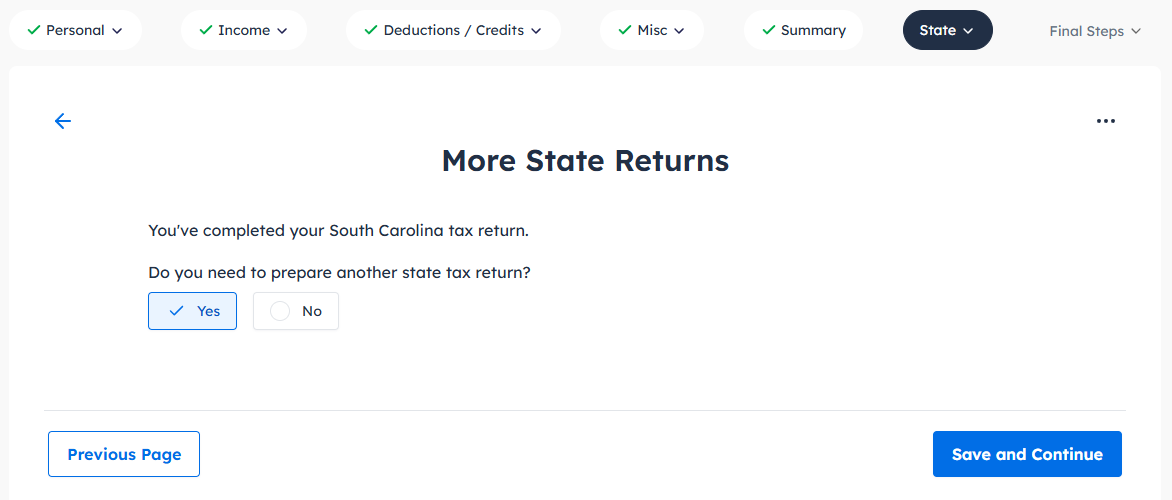

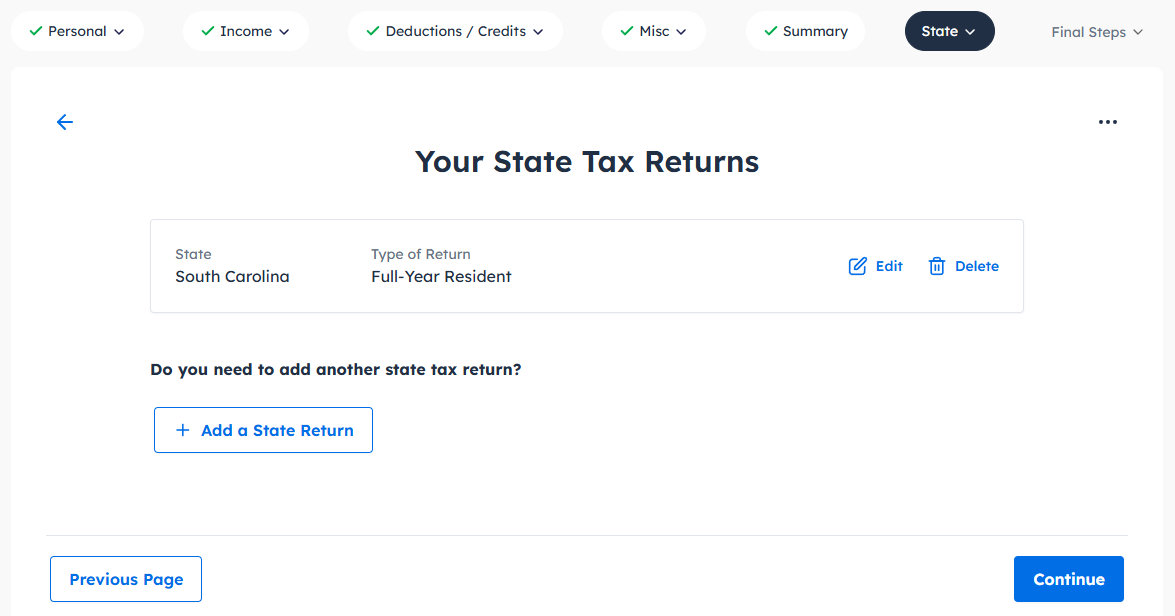

From here, you’ll go through the screens for your state of residence at the end of the year, answering questions and providing information needed to prepare the tax return for that state. Once your first state return is complete, you’ll see another screen asking if you need to prepare any additional state tax returns.

You may see some additional wording on this screen if you’ve already entered some information about income or taxes in other states, such as taxes withheld for another state on your W-2. In either case, simply answer Yes to this question and you’ll be taken to the screen where you can view your existing state return(s) and add any more state returns you might need.

When you click the button to Add a State Return, you’ll be asked to select the state for which you want to prepare a return. After that step, the process will repeat as you continue through the screens entering necessary information to prepare the second state’s return.

Keep in mind some states (such as: Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, and Wyoming – verify these states for filing requirements) do not have state income tax, so a state tax return doesn’t need to be prepared if you live or make money in these states.

Summary

Filing multiple state returns is common in many situations, and FreeTaxUSA will take you step-by-step through selecting your resident state, adding additional state returns, and reporting income and withholding for each jurisdiction. Be sure to confirm your state of residence, enter all W‑2 withholdings correctly, and claim any credits for taxes paid to other states to avoid double taxation. Also, remember to verify whether a state has no income tax. If you have questions, use the software’s help resources or contact support for guidance.

Related articles: