Contributed by: MatthewD, FreeTaxUSA Agent, Tax Pro

A disaster loss is when something unexpected happens and you lose a personal item like a car, home, shed, barn, or other things with value. For example, you have a barn on your property that burns down when a severe storm comes through your area and the barn is struck by lightning. If you carry insurance, they may pay you for the loss. The government may also help your situation when you file your tax return by allowing a deduction to reduce your taxable income.

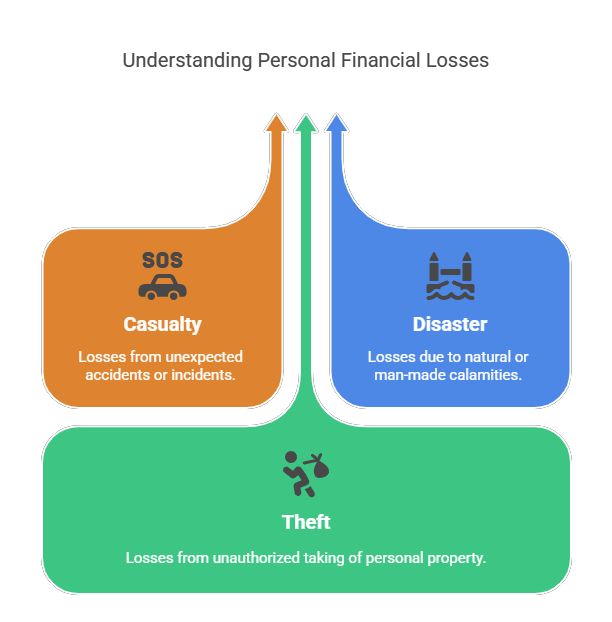

In IRS Tax Topic no. 515, personal casualty losses are losses from:

- Casualty,

- Disaster, and

- Theft,

which are not connected to a trade or business, or a transaction entered into for profit.

Over the years the rules for claiming a casualty loss have been changed by Congress. A casualty loss is only available if you’re in a federally declared disaster area. See FEMA Disasters and Other Declarations.

With those basics in mind, let's talk about what happens if your house burns down. Can you deduct that loss on your tax return? First you must ask the following questions:

- Was the casualty in a federally declared disaster area?

- Did you have insurance on the property in question, and were you compensated?

Itemized Deduction

If your house was in a federally declared disaster area at the time of the fire, then you can claim an itemized deduction for the difference between the adjusted basis of your property and the insurance proceeds received, plus any salvage value. For example, the adjusted basis of your home is $527,000 and after the fire it was a complete loss ($0 salvage value). Insurance paid $490,000 to rebuild the house. The net amount is a $37,000 loss ($527,000 - $490,000 = $37,000).

To calculate your casualty loss for property held by you for personal use, the IRS requires you to subtract $100 from the net loss amount and subtract 10% of your adjusted gross income (AGI).

If your AGI was $70,000, your allowable casualty loss will be $29,900 ($37,000 – ($100+$7,000)). When you use FreeTaxUSA, the program will calculate all this for you. The calculations will show on Form 4684, Casualties and Thefts.

Non-Itemized Deduction

If your casualty loss was due to a qualified disaster, you may deduct the loss without itemizing your deductions. The IRS says, “A qualified disaster loss includes an individual's casualty or theft loss of personal-use property that is attributable to a major disaster declared by the President...” To summarize, to be a qualified disaster, it must be a personal-use asset and be in a federally declared disaster area at the time the casualty loss occurred. Your net casualty loss doesn't need to exceed 10% of your AGI, but you reduce each casualty loss by $500 after any salvage value and reimbursement. Using the same example, your allowable casualty loss will be $36,500 ($37,000 – $500). Again, when you use FreeTaxUSA, the program will calculate this, and Form 4684 is included with your return.

Not in a federally declared disaster area

If your house was not in a federally declared disaster area at the time of the fire, then you cannot claim a casualty loss on your tax return. Work with your insurance company to get a reimbursement.