Contributed by: Henry, FreeTaxUSA Agent, Tax Pro

The IRS allows homeowners to claim a mortgage interest deduction for mortgage interest and points paid on a loan secured by your home, whether it’s your main home or a second home. However, to prevent disproportionately benefiting higher-income homeowners, the IRS has set certain limits on this deduction. Your deduction may be limited based on your total mortgage debt, your filing status, and the timing of your loan(s).

Mortgage interest deduction limits

According to the IRS, you can deduct home mortgage interest on the first $750,000 ($375,000 if married filing separately) of indebtedness. The limit is $1 million ($500,000 if married filing separately) if you’re deducting mortgage interest from indebtedness incurred prior to December 16, 2017. There is no limit for loans taken out on or before October 13, 1987.

Before claiming a deduction for loans taken out after October 13, 1987, you need to figure the average balance of each mortgage for the year using one of the methods described in IRS Publication 936. If your overall average mortgage balance exceeds the applicable limit, you may only deduct the interest on the portion of the debt up to the limit. FreeTaxUSA makes this process easy for 2024 and later years, helping you calculate your average mortgage balance and then applying the appropriate limit based on the information you provide about your mortgage(s). For 2023 and earlier years, you’ll need to determine the deductible portion of your mortgage interest and enter the appropriate amount in the FreeTaxUSA software.

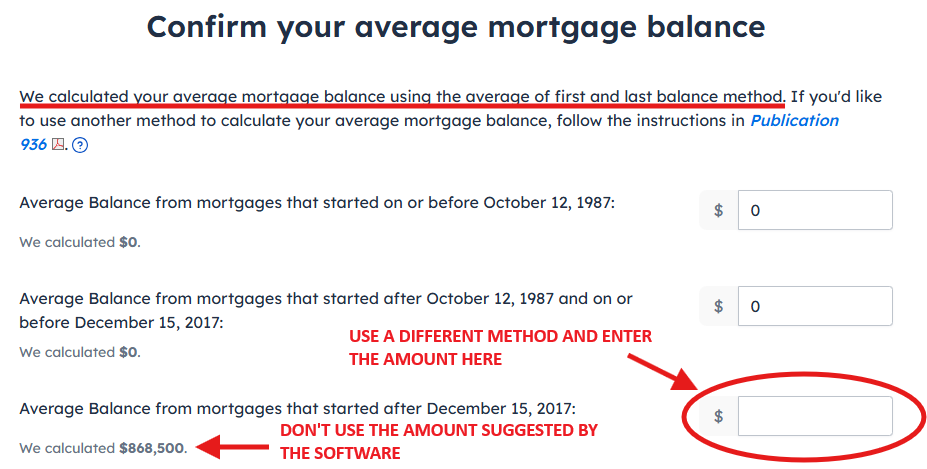

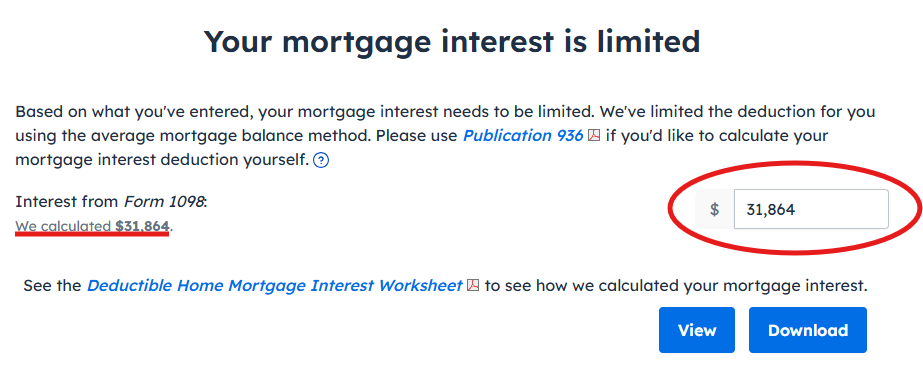

Keep in mind that for 2024 and later years, our software uses the average of first and last balance method to figure your average mortgage balance. If you don’t qualify to use this method, you’ll need to use a different method and enter the appropriate amount in the software when prompted, as shown below.

Let's look at some possible scenarios.

Example 1 (one loan, deduction limited):

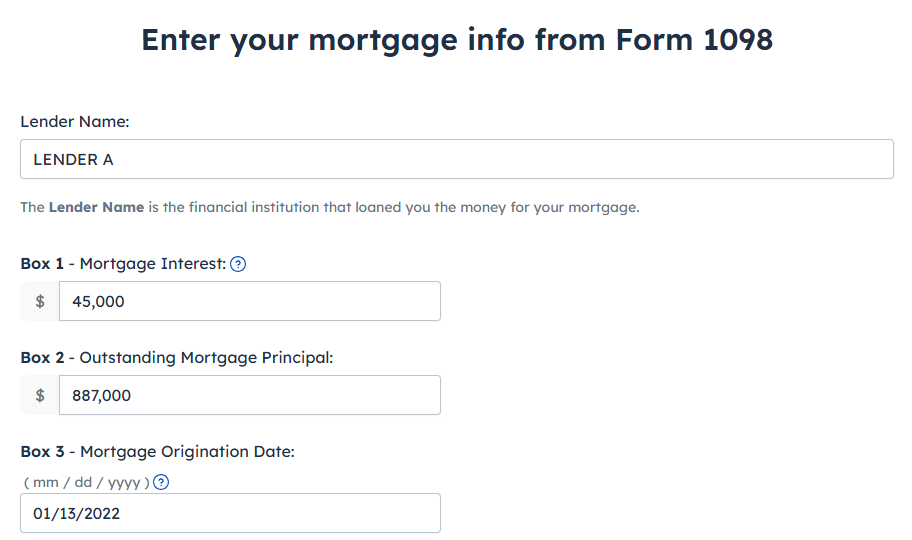

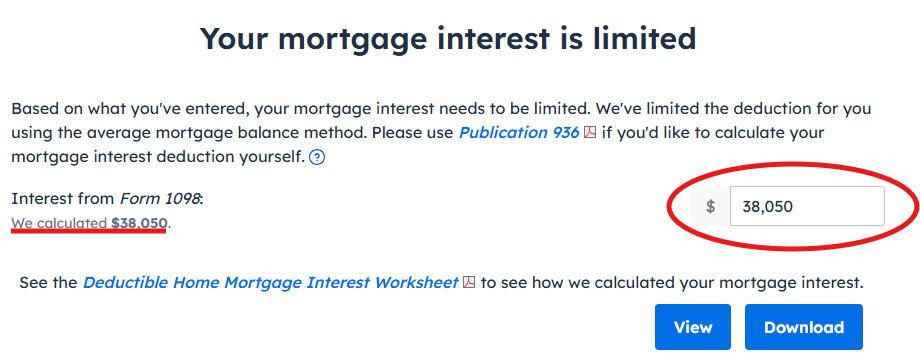

Amanda took out a $950,000 loan to buy her main home in 2022. During 2024, her average mortgage balance for the loan was $854,000. On her 2024 tax return, Amanda can only deduct the mortgage interest paid on $750,000 of the loan; the interest paid on the remaining $104,000 is not deductible. She should receive a 2024 Form 1098 from her lender, reporting the total mortgage interest she paid for the year. She’ll enter the form in the software as it appears, including the full amount of mortgage interest in Box 1.

Since her deduction is limited, Amanda should only report the deductible portion of the mortgage interest on her tax return, rather than the full amount shown on her Form 1098 ($45,000). After entering the 1098 information, she’ll be prompted by the software to enter the deductible amount of mortgage interest, as indicated here:

Example 2 (two homes, two loans):

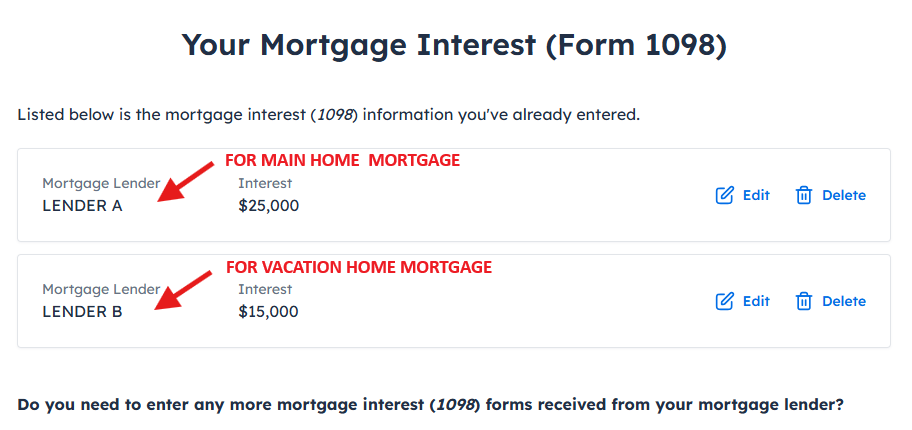

Forrest took out a $525,000 loan to buy his main home in 2022. He took out another loan of $475,000 to buy a vacation home in 2023. During 2024, his average mortgage balance for the two loans was $949,000. On his 2024 tax return, Forrest can only deduct the mortgage interest paid on $750,000 of the loans; the interest paid on the remaining $199,000 is not deductible. He should receive a 2024 Form 1098 for each loan, reporting the total mortgage interest he paid for the year. He’ll enter both forms in the software as they appear.

However, since his deduction is limited, only the deductible portion of Forrest’s total mortgage interest should be reported on his tax return, rather than the full amounts shown on his 1098 forms ($25,000 + $15,000 = $40,000). After entering the 1098 information, he’ll be prompted by the software to enter the total deductible amount of mortgage interest.

Example 3 (mortgage refinanced or sold to another lender during the year):

Kayden took out a $550,000 loan with Bank A to buy his main home on April 12, 2020. On June 1, 2024, Bank A sold his outstanding mortgage of $460,000 to Bank B. Kayden received a 2024 Form 1098 from Bank A with $478,000 in Box 2 (the amount of outstanding principal on the original mortgage as of January 1, 2024). He also received a 2024 Form 1098 from Bank B showing $460,000 in Box 2 (the outstanding mortgage principal as of June 1, when the loan was acquired by Bank B).

Although the amounts in Box 2 on Kayden’s 1098s add up to $938,000 (above the $750,000 limit), his average mortgage balance was only $451,000 (well below the $750,000 limit). Thus, his mortgage interest deduction shouldn’t be limited. He'll need to enter his 1098 information correctly in the FreeTaxUSA software, so the total mortgage debt isn’t overstated and his ability to deduct the full amount of his mortgage interest isn’t limited. Refer to this article for step-by-step instructions.