Contributed by: KelliP, FreeTaxUSA Agent, Tax Pro

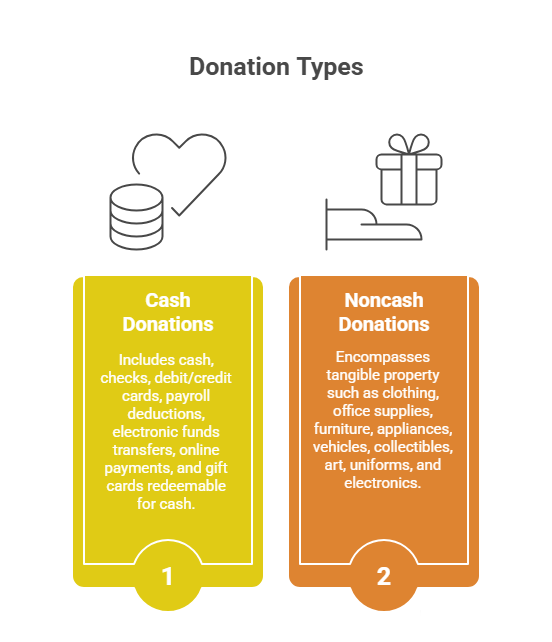

Sometimes understanding the difference between a cash and noncash charitable contribution can be confusing. This article provides clarification.

What is a charitable contribution?

A charitable contribution is a donation. It’s donating gifts of money, tangible property, and travel to a qualified organization.

What is a cash contribution?

Cash contributions are the giving of money. This can include physical cash, check, debit/credit card payments, payroll deductions, electronic funds transfer, and online payments. And yes, this would include Venmo, CashApp, PayPal etc.

What is a noncash contribution?

Noncash contributions are donations of tangible property or goods, rather than money. This can include household items such as clothing and furniture, appliances, vehicles, electronics, art, collectibles, stock, real estate, etc.

Recordkeeping

If you donate $250 or more in a single contribution, you'll need to get a record of acknowledgement from the organization the donation was made to. This can be a receipt with what was donated and their organization information. Be sure to keep these records. If you made a non-cash donation of more than $500, you'll need to include Form 8283 with your tax return.

Conclusion

For tax purposes, keep documentation of the donations you make and the records you receive. If you’re not sure if an organization qualifies, ask them. This is something they should be aware of. Remember, a cash donation is giving money and noncash is giving goods.

FreeTaxUSA software can help you get your charitable donations reported correctly. You'll be prompted to enter your cash and noncash donations as you go through the Deductions/Credits screens, and based on your entries, Form 8283 will be generated and included with your tax return if it's applicable to your situation.