Contributed by: LynR, FreeTaxUSA Agent, Tax Pro

A Roth IRA can be a great investment vehicle for retirement savings. However, it’s important to know the rules for how much and when you can contribute to a Roth. Mistakes can always be fixed, but there may be penalties if they’re not corrected by the tax deadline.

Common excess contribution situations

#1. Not funded with taxable compensation

Contributions to a Roth IRA must be funded with taxable compensation, such as wages or self-employment income. Investment income and passive income, such as rental income, can't be used to fund a Roth IRA. Your Roth IRA contribution can’t exceed your taxable compensation for the year.

#2. You made too much money

Since Roth IRAs are tax-favored plans, there are rules about how much income you can make and still contribute. If your income for the year exceeds the income limit, you can’t contribute. The income limit changes each year, so it‘s important to be familiar with the current year’s income limit for contributing to a Roth IRA.

For 2025, your modified AGI (MAGI) must be under the following amounts to contribute:

- Single/Head of Household/ Married Filing Separately and living apart all year: $165,000

- Married Filing Jointly: $246,000

- Married Filing Separately, spouses live together: $10,000

If your MAGI is over these amounts and you still contribute to your Roth IRA, you will have an excess Roth contribution.

#3. You exceeded the amount that can be contributed in a given year

Each year there’s a maximum amount you can contribute to a Roth IRA. It may be adjusted from year to year, so it’s recommended to check the current year’s limit before contributing. For 2025, the contribution limit is $7,000 for those under age 50, and $8,000 for those 50 and older. However, your Roth contribution can be limited based on your MAGI or if you’re also contributing to a traditional IRA.

If you’ve made an excess Roth contribution, there are ways to correct it. If you don’t correct the excess contribution, you’ll owe an excise tax of 6% on the excess amount each year the excess remains in the account.

Correcting an excess Roth contribution BEFORE the tax deadline

If you’ve discovered the excess Roth contribution before the due date of your tax return, you have 4 options:

- Withdraw the excess contribution and any earnings the contribution has accumulated. Have the contribution and the earnings returned to your bank account. If performed before the tax deadline, no excise tax will be owed.

- Recharacterize the contribution and any earnings to a traditional IRA. A recharacterization essentially removes the contribution and its earnings from the Roth and puts it into your traditional IRA. A recharacterization will change the nature of the original contribution from a Roth contribution to a traditional IRA contribution. You’re still subject to the annual contribution limits for both the traditional and Roth IRA. If performed before the tax deadline, no excise tax will be owed.

- Apply the contributions to the following year. You can opt to keep the funds in your Roth account and apply them to the following year’s contribution. You’ll still have to pay the 6% excise tax for not removing the funds in the current tax year. This is only a good idea if you believe you’ll be eligible to contribute to a Roth in the following year. The excess will count towards your annual contribution for the next year, so you’ll need to be sure to include the excess amount in your overall contribution the following year.

- Recharacterization followed by a backdoor Roth conversion. If your excess contribution is due to your income being too high to contribute directly to a Roth IRA, you can recharacterize your original Roth contribution to move the money to a traditional IRA. Then proceed to do a backdoor Roth conversion to move the money back into your Roth IRA. Although you couldn’t contribute directly to your Roth IRA due to your high income, the IRS does allow you to convert funds from your traditional IRA (or other retirement accounts) to your Roth. The result is the same as contributing directly to a Roth, but it’s an allowable loophole that lets high income individuals put money into a Roth account. If the recharacterization portion of this strategy is performed before the tax deadline, no excise tax will be owed. The Roth conversion can happen after the tax deadline without a penalty.

If you’re unfamiliar with how to perform a withdrawal, recharacterization, or backdoor conversion, please speak with your financial advisor or a representative from your investment bank or brokerage. We have several articles, listed at the end of this article, that explain how to report these different situations using our software.

Correcting an excess Roth contribution AFTER the tax deadline

Your excess contribution may have gone unnoticed or unrealized in the year you made it. It could be a year or more after the initial excess contribution when you realize you inadvertently made an excess contribution. What should you do?

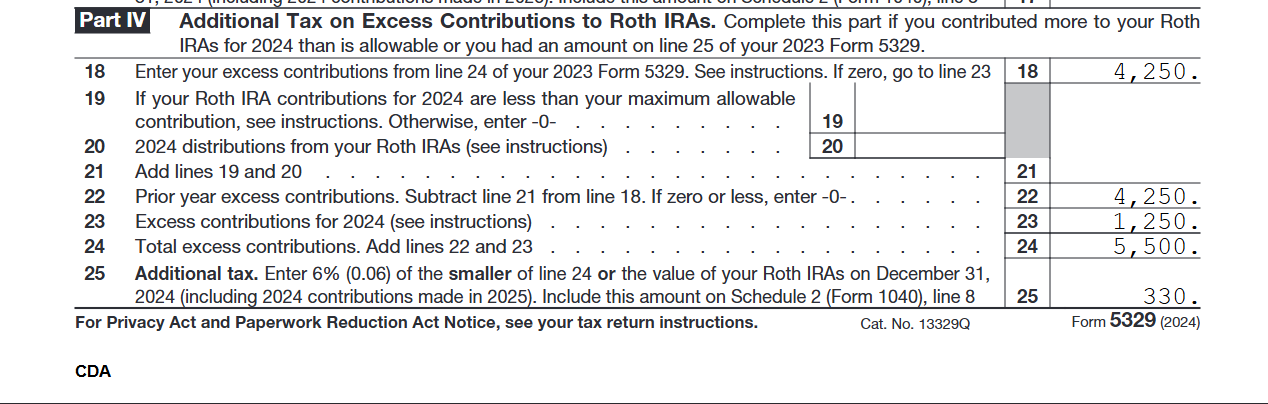

First, make sure you’ve paid the 6% excise tax for each year’s tax return during the time the excess contribution was in your Roth IRA. This tax is calculated on Form 5329, Part IV. Check your prior year returns to see if this form was included and the tax was assessed. If it wasn’t, you’ll need to amend each year’s return for which the excess contribution remained in the Roth IRA.

Second, you’ll need to correct the excess contribution if you wish to stop paying the 6% excise tax. Since the tax year has now passed when you made the original contribution, your only option is to withdraw the funds plus any earnings. You can’t recharacterize the contribution once the tax deadline has passed for the year of the original contribution.

How do I report an excess contribution in FreeTaxUSA?

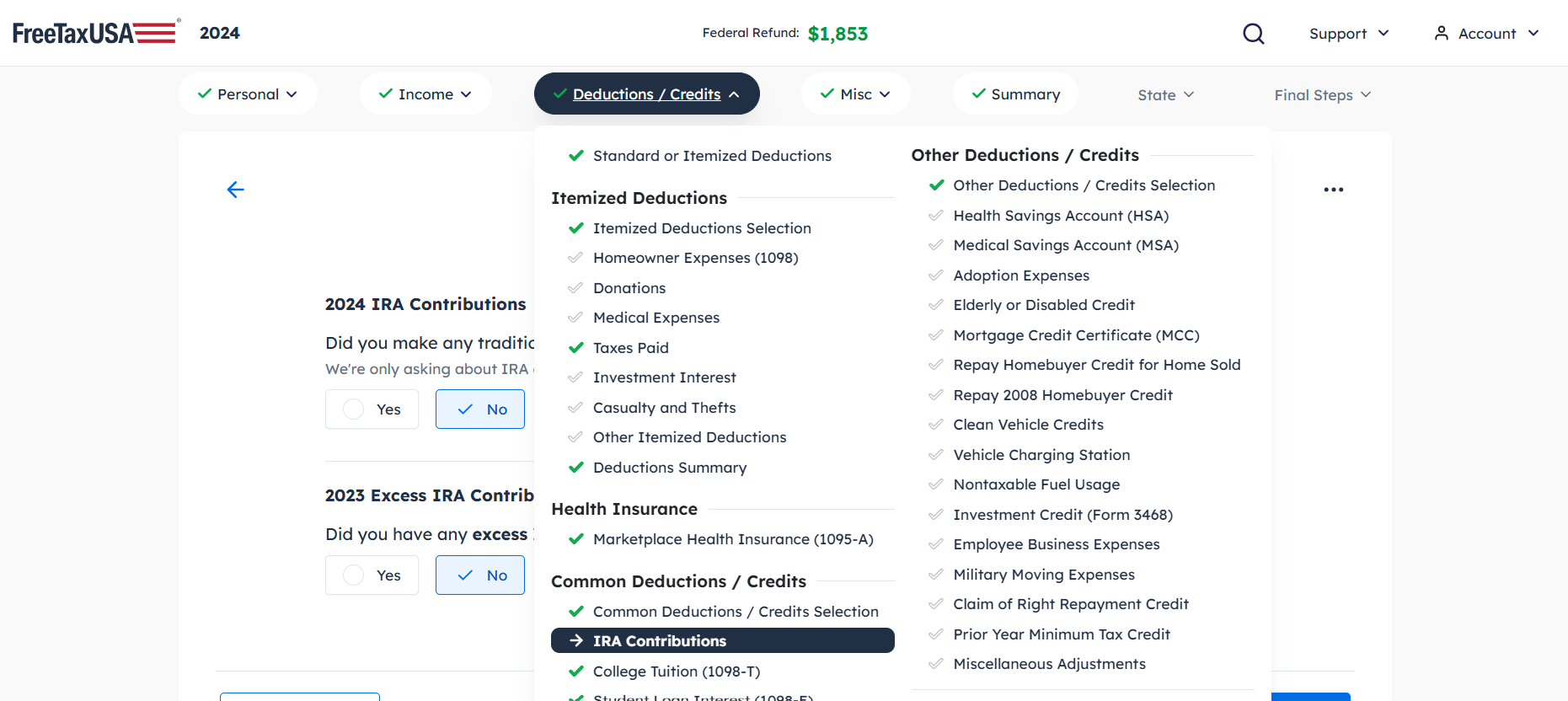

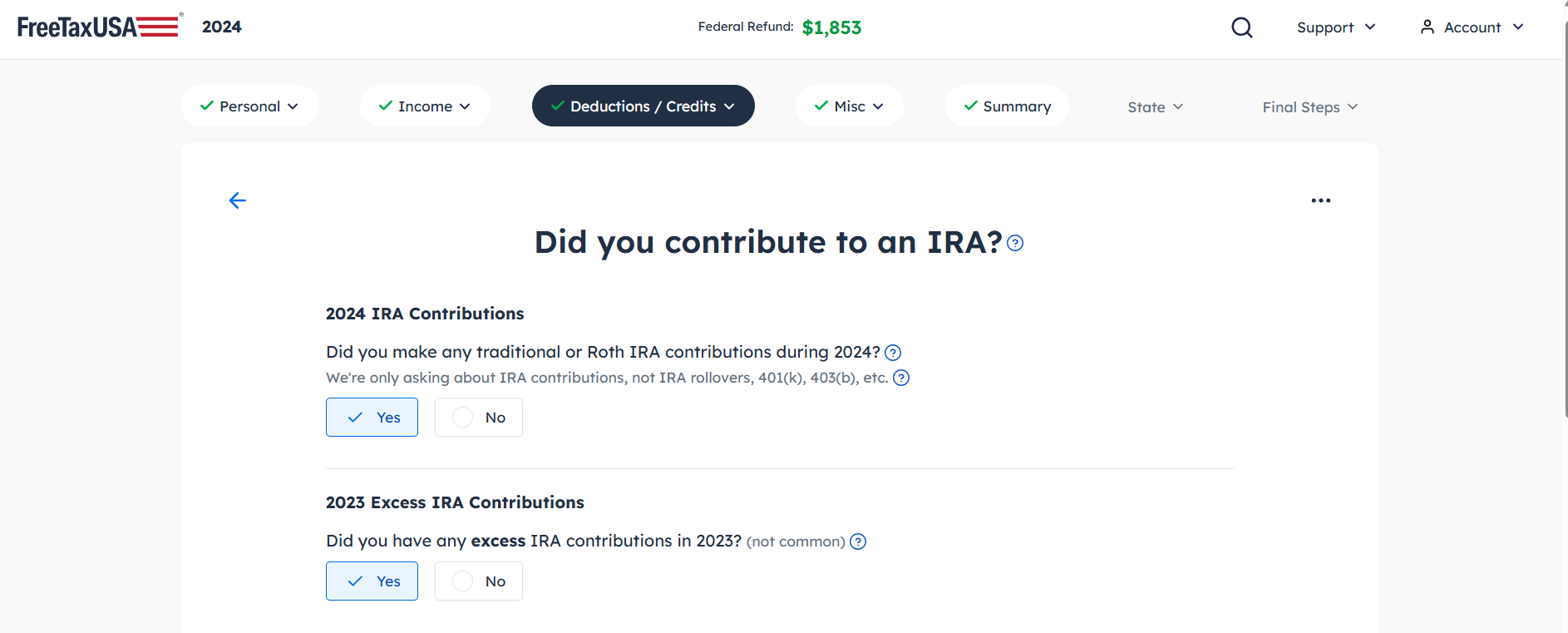

Report all your IRA contributions by following menu path: Deductions/Credits > Common Deductions/Credits > IRA Contributions.

If you contributed to an IRA in the current tax year, answer Yes to the first question. If you have an excess IRA contribution from a prior year tax return, that you haven’t withdrawn, answer Yes to the second question.

From here, the software will take you through screens where you can report information regarding the current year’s contributions and any prior excess contributions. You’ll also be asked if you’ve withdrawn the excess before the tax deadline. If you haven’t withdrawn the excess contribution from the current or a prior year, Form 5329 will be included with your return, and the 6% excise tax on the excess will apply. Excess contributions to traditional IRAs are reported in Part III of Form 5329, and excess contributions to Roth IRAs are reported in Part IV. Lines 17 and 25 show the amount of excise tax due on excess contributions.

Take aways

When contributing to your Roth or any kind of IRA, it’s important to be clear on the rules of when and how much you can contribute. If you make a mistake and overcontribute, it can be corrected. To get you started on your IRA journey, you can review these IRS FAQs. If you need any help entering your excess contributions, recharacterizations, or conversions, our team of Tax Pros are here to help.

Related articles:

What is an IRA recharacterization?

Reporting a Backdoor Roth – Basic Scenario (2024 and later)

Backdoor Roth Plus a Recharacterization – Basic Scenario (2024 and later)

Can I withdraw money from my retirement account without having to pay the 10% penalty?