Contributed by: PhillipB, FreeTaxUSA Agent, Tax Pro

Anyone can make contributions to a traditional IRA if they have compensation. Most commonly, compensation includes income from working a W-2 job or from self-employment, either as a sole proprietor or through a pass-through entity. There are a few other rare forms of income that qualify as compensation. These include nontaxable combat pay, taxable alimony, certain disability income, certain union strike benefits, and some other uncommon forms of income.

However, not everyone qualifies to take a deduction for their traditional IRA contributions. If you make traditional IRA contributions that don’t qualify to be deducted, you have nondeductible IRA contributions.

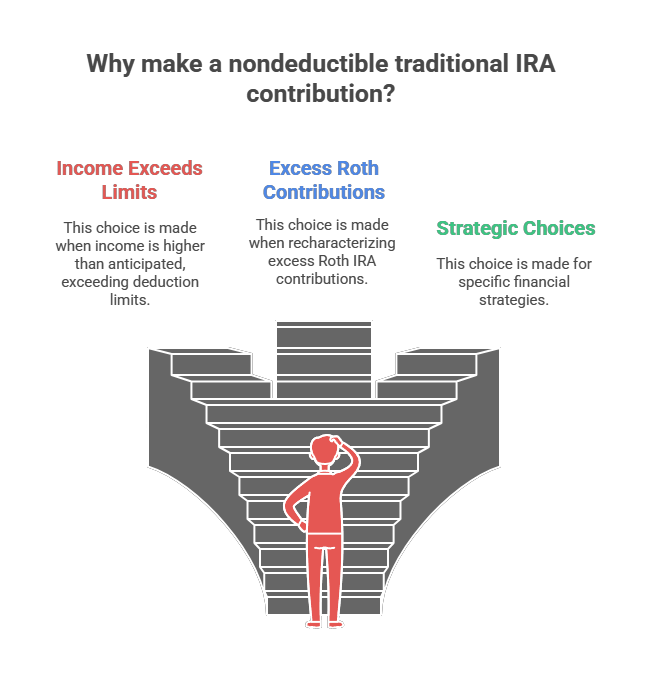

If you or your spouse are covered by an employer-sponsored retirement plan, your ability to deduct IRA contributions depends on your modified adjusted gross income (MAGI), which may be limited or phased out at higher income levels. Why would anyone make a nondeductible traditional IRA contribution? Here are some reasons:

- Income exceeds limits: Occasionally people end up making nondeductible contributions because their income was higher than anticipated and they exceed income limitations.

- Excess Roth contributions: Sometimes people have nondeductible traditional IRA contributions because they had to recharacterize excess Roth IRA contributions.

- Strategic choices: In certain situations, individuals may opt to make nondeductible contributions rather than deductible contributions, for reasons that will be discussed below.

Are there benefits to making nondeductible contributions?

Yes. Nondeductible IRA contributions don’t get the tax benefit of being deducted on your tax return. The benefit is the contribution has “basis,” which means the money in the account has already been taxed. Contributions already taxed can be withdrawn tax free.

If you make deductible and nondeductible contributions to your traditional IRA, you will have traditional IRA income that is partially taxable.

If you must open a traditional IRA to recharacterize an excess Roth IRA contribution, all the money in the traditional IRA would have basis. This opens the door for making a tax-free backdoor Roth conversion. A backdoor Roth conversion simply means if your income is too high for a Roth contribution, you can get around the income limit by making a nondeductible traditional IRA contribution and converting the traditional IRA to a Roth IRA.

You may choose not to take the traditional IRA deduction to keep basis in your contribution, even if you are eligible to claim it. This either allows a tax-free (or partially taxable) Roth conversion or results in more partially taxable traditional IRA income when you retire. Here's an example of where this may be a good idea: Think of a taxpayer getting a tax refund regardless of their withholding because their income and family situation provide them with large refundable tax credits. If the traditional IRA deduction isn’t making a difference in their tax return, they could choose to save the tax benefit from the IRA contribution to be used more advantageously in the future.

The pro rata rule

The catch to making both deductible and nondeductible IRA contributions is that the basis must be prorated to all your combined traditional IRAs. For these purposes, “IRA” includes traditional IRA, traditional SEP, and traditional SIMPLE IRAs.

For example, due to income limits, you made a $6,200 excess Roth IRA contribution that you recharacterized as a nondeductible traditional IRA contribution. Besides the new traditional IRA created by the recharacterized Roth IRA contribution, you also had a SEP IRA from being self-employed in the past. The balance of the traditional and SEP IRA at the time of the conversion to the Roth IRA was $15,000. Since your basis was $6,200, and only 41.33% of the combined traditional IRA has basis, you can’t convert the traditional IRA to a Roth IRA tax-free using the backdoor method. Instead, 41.33% must be applied to the $6,200 Roth conversion—meaning your tax-free portion of the conversion is $2,563, while the remaining $3,637 is taxable.

People often choose to convert traditional IRAs with basis to Roth IRAs. Conversions of traditional IRAs without basis are fully taxable, so partially taxable or non-taxable Roth conversions are a great deal. If the taxpayer doesn’t make a conversion, and the money stays in the traditional IRA account until retirement, the prorated calculation for all their post-retirement distributions would continue to apply.

Reporting nondeductible contributions

You're required to include Form 8606 to report nondeductible traditional IRA contributions, Roth IRA conversions, and taxable income from Roth distributions. You can generate Form 8606 on your return for nondeductible traditional IRA contributions by doing the following:

If you qualify to take an IRA deduction

- Report your traditional IRA contributions by following this menu path: Deductions / Credits > Common Deductions / Credits > IRA Contributions.

- Answer Yes to the question, Did you or your spouse make any traditional or Roth IRA contributions? Click Save and Continue.

- Enter your traditional IRA contribution and click Save and Continue.

- Continue completing each screen until you reach the screen labeled Do you want to take an IRA deduction. Answer No to the question, Do you want to take your IRA deduction?

- Enter the amount of the traditional IRA contribution you want to be nondeductible and click Save and Continue.

If you don’t qualify to take the IRA deduction

- Report your traditional IRA contributions by following this menu path: Deductions / Credits > Common Deductions / Credits > IRA Contributions.

- Answer Yes to the question, Did you or your spouse make any traditional or Roth IRA contributions? Click Save and Continue.

- Enter your traditional IRA contribution and click Save and Continue.

- Continue to the screen labeled IRA Basis and Value and answer all the questions on the screen. Basis is equal to all your prior nondeductible IRA contributions, the value of all your IRA accounts is referring to the balances of your traditional IRA, traditional SEP, and traditional SIMPLE retirement accounts, and you would need to report the portion of your contribution made after the calendar tax year ended. Click Save and Continue.

- The software will tell you your contribution isn’t deductible.