Contributed by: CoryF, FreeTaxUSA Agent, Tax Pro

You sold your business property and are filing your taxes, only to find out you owe a lot of money in capital gains. The most likely reason is depreciation recapture. This article will explain and/or prepare you for the reality of depreciation recapture.

When you depreciate property, that depreciation is used as an expense to lower your taxable income. Depreciation is meant to reflect the asset’s decreasing worth over time as it’s used for business purposes. It's a set deduction required by the IRS that spreads the cost of the asset across its useful life. However, when you sell business property, you know its actual worth at the time of sale based on the sales price. If the sales price exceeds the depreciated value of the asset, you may need to pay back (recapture) the unwarranted depreciation deductions you took previously.

The IRS requires recapturing depreciation at the time of sale when the sales price exceeds book value of the property. The book value is calculated by subtracting the accumulated depreciation from the original property value.

What will this look like on my tax return?

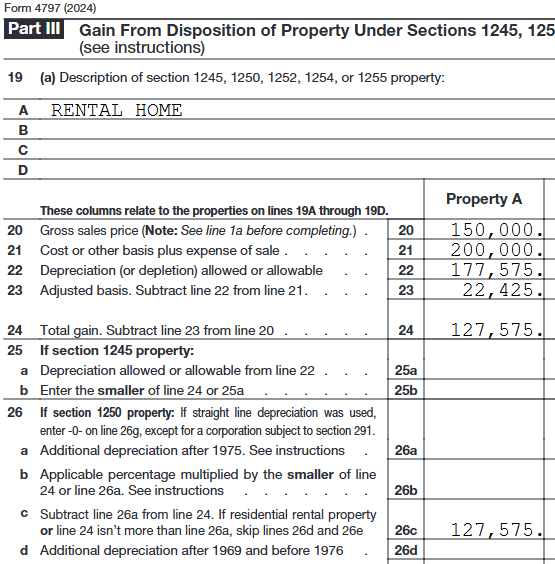

In tax year 2000, you bought a residential rental property for $200,000 and proceeded to depreciate it over 27.5 years. Your accumulated depreciation in 2024 is calculated to be $177,575. The book value is $200,000 - $177,575 = $22,425. You decide to sell this property for $150,000. The following calculations will help you understand how the sale is treated on a sample tax return.

Book Value: $22,425

Sales Price: $150,000

The realized gain is found by subtracting the book value from the sales price. $150,000 - $22,425 = $127,575. The gain in this calculation is based on the depreciation taken over the rental years.

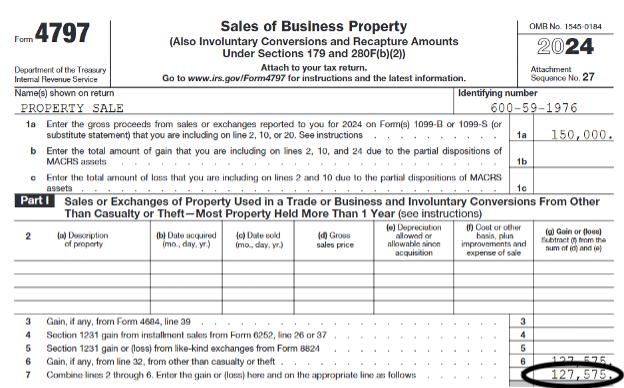

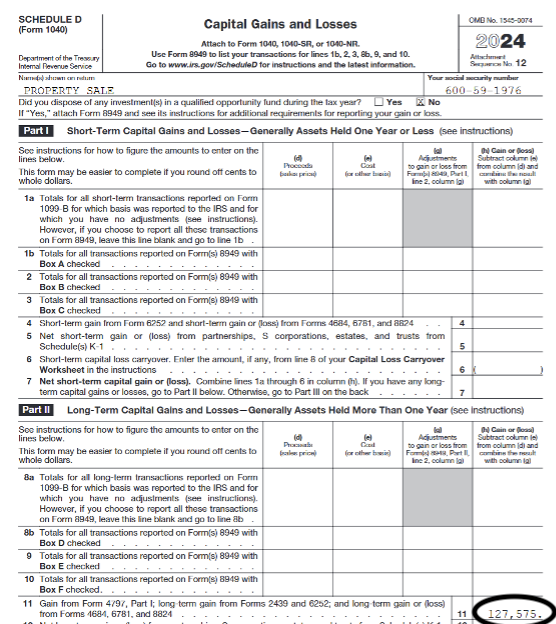

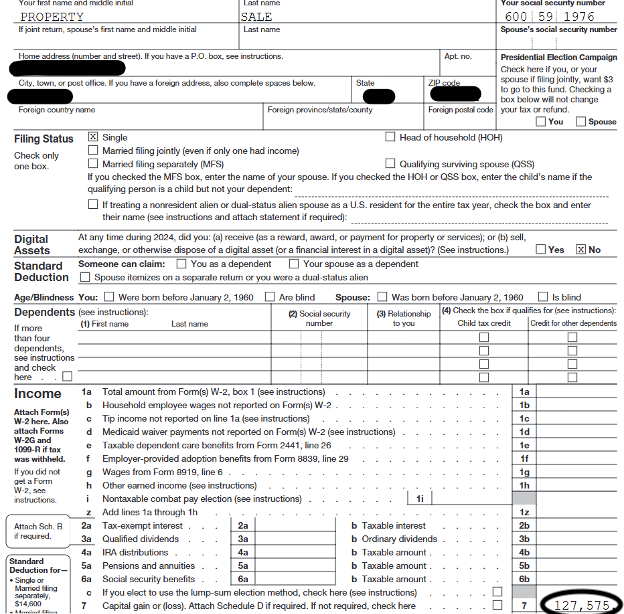

This transaction is called a sale of business property (asset) and is reported on Form 4797. Any recognized gain from the sale is calculated on this form and then carried over to Schedule D. From there, it flows to the income section on page 1 of Form 1040.

Here is Form 4797, page 2, showing the calculation of the book value (adjusted basis), sales price, and capital gain:

The capital gain flows to page 1 of Form 4797, line 7:

The capital gain is then reported on Schedule D, line 11:

And finally, the gain is reported in the income section of the tax return, Form 1040, line 7:

Conclusion

Depreciation recapture creates a capital gain in the year sold, since each year, depreciation created a direct expense that reduced rental and total income. You can prepare for the sale of the property by anticipating the taxable income from depreciation recapture. Consider adjusting your tax withholding or paying estimated tax to the IRS so you don’t owe when you file your tax return.

Additional Resources

What do I need to know about depreciation?