Contributed by: TriciaD, FreeTaxUSA Agent, Tax Pro

The Oregon tax system is unique because, unlike most states, it doesn’t impose sales tax but uses a progressive income tax system. Oregon enacted a law for the management of government spending. The law is known as the "2% surplus kicker" (or "kicker") and was intended to prevent the state from accumulating excessive surpluses. Any projected state general fund revenue that exceeds the forecasted amount by more than 2% is returned to the taxpayers who contributed to it.

This article outlines the details of the kicker system, which is often subject to misunderstanding.

What’s the “kicker” tax credit?

The kicker law splits all the money from the general fund into two pots:

- Corporate income tax, and

- Personal income tax, plus all other (non-corporate) revenue, often called the “all other” or “personal”).

At the end of each two-year budget cycle, each **** is calculated. If the “all other” **** is more than the forecasted income tax revenue by more than 2%, the excess is returned to personal income taxpayers as a credit on their next odd-year tax return.

Oregon Department of Revenue announces whether the kicker credit is available on an odd-year return and provides a calculator on its official website to help taxpayers estimate their kicker amount.

Note: Typically, the kicker credit isn't taxable income for Oregon or federal purposes.

Am I eligible for the credit, and how is it calculated?

The kicker credit amount is based on each person’s income tax from the prior year (even-numbered year), which is tax before credits (excluding credit for taxes paid to another state), tax payments, or withholdings.

Anyone who pays personal income taxes — like individuals, trusts, estates, and nonresident individuals included in a pass-through entity tax return — can claim a kicker credit.

To be eligible for the credit, you must have the following:

- File the prior year’s return before the current year’s tax return,

- You won’t be eligible for a kicker credit until the prior year return has been filed.

- If the prior year return is filed after the current year return for which the kicker is available, the state processes the prior year return first to determine the kicker credit amount. Both returns must be processed before issuing the refund with the credit on the current year return, which may result in additional processing time.

- Have an Oregon tax liability in the prior year,

- File a current Oregon return, even if you don’t have a filing requirement.

The kicker credit is determined as a percentage of a taxpayer's liability (before applying credits) for the year in which the surplus revenue was collected.

For instance, if Oregon approves a 5% kicker credit at the end of 2025, and if Jane has filed a 2024 tax return with a tax liability of $1,000, she would be eligible for a $50 kicker credit on her 2025 state tax return.

Note: You can use the Oregon Department of Revenue’s online calculator or FreeTaxUSA software calculates the “kicker” credit for you when preparing an odd-numbered year Oregon tax return.

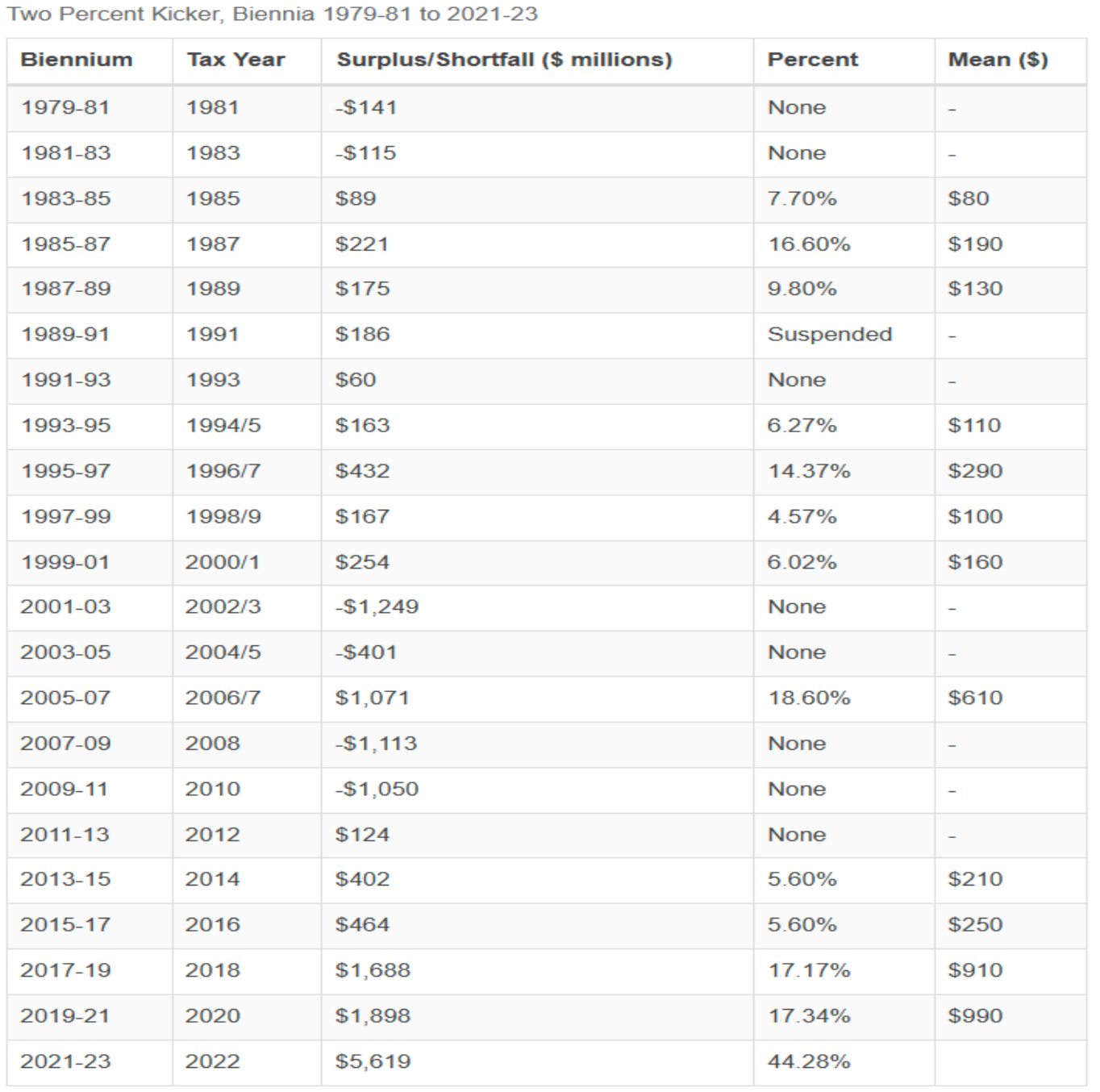

Below are Oregon's historical kicker percentages since the law began:

How do I receive the kicker credit?

The kicker is considered a state income tax refund. If you itemized deductions for state taxes on a previous federal return, part or all of your kicker may be taxable federally. You'll receive a Form 1099-G showing your total kicker amount, even if you donated it or used it to pay taxes or debts.

Federal tax instructions will specify whether any kicker amount must be reported as income. If the kicker amount is included on your federal return, it should be subtracted on your Oregon return.

If you anticipate receiving a refund and request direct deposit, the funds will be deposited into the bank account provided in FreeTaxUSA. If you opt to have your refund mailed, it'll be sent to the address listed on your account.

How do I include the kicker in FreeTaxUSA?

Once you begin the State section in your account, the software will prompt you regarding the kicker credit if it's available during the filing year. Please respond to the questions as prompted to determine your eligibility for the credit and enter the requested information as you proceed through the state screens. The credit will be calculated according to the information entered.

Recent updates and legislative changes

Oregon’s tax laws are subject to annual updates and revisions. For 2025, changes may include new deduction limits, updated income thresholds, and adjustments to credit percentages. Be sure to check the “Newsroom” section of the Oregon Department of Revenue site before filing.

Conclusion

Understanding Oregon’s “kicker” credit, staying informed about updates, and taking advantage of online tools can help you file accurately and receive timely refunds. If you have questions, please reach out to our Customer Support agents, and they'll be happy to help you.