Contributed by: AndyS, FreeTaxUSA Agent, Tax Pro

Sometimes there’s confusion about retirement income and if it’s taxable on your Alabama state tax return - especially since most retirement income is taxable on your federal tax return. The type of retirement income you have will determine if it's tax exempt or not.

How will I know if my retirement income is tax exempt?

Not all retirement income reported on Form 1099-R is tax exempt. Alabama specifically lists pensions, annuities and endowments as taxable income on your state return. While these are some of the most common types of retirement income, there are several other kinds that Alabama does allow to be tax exempt:

- United States Civil Service Retirement System benefits

- State of Alabama Teachers Retirement Systems benefits

- State of Alabama Employees Retirement System benefits

- State of Alabama Judicial Retirement System benefits

- Military retirement pay

- Tennessee Valley Authority Pension System benefits

- United States Government Retirement Fund benefits

- Payments from a Defined Benefit Retirement Plan in accordance with IRC 414(j)

- Federal Railroad Retirement benefits

How do I report that my retirement income is tax exempt?

Once you’ve determined if your retirement income is tax exempt, you’ll need to report the exempt amount in FreeTaxUSA, so it’s entered correctly on your return.

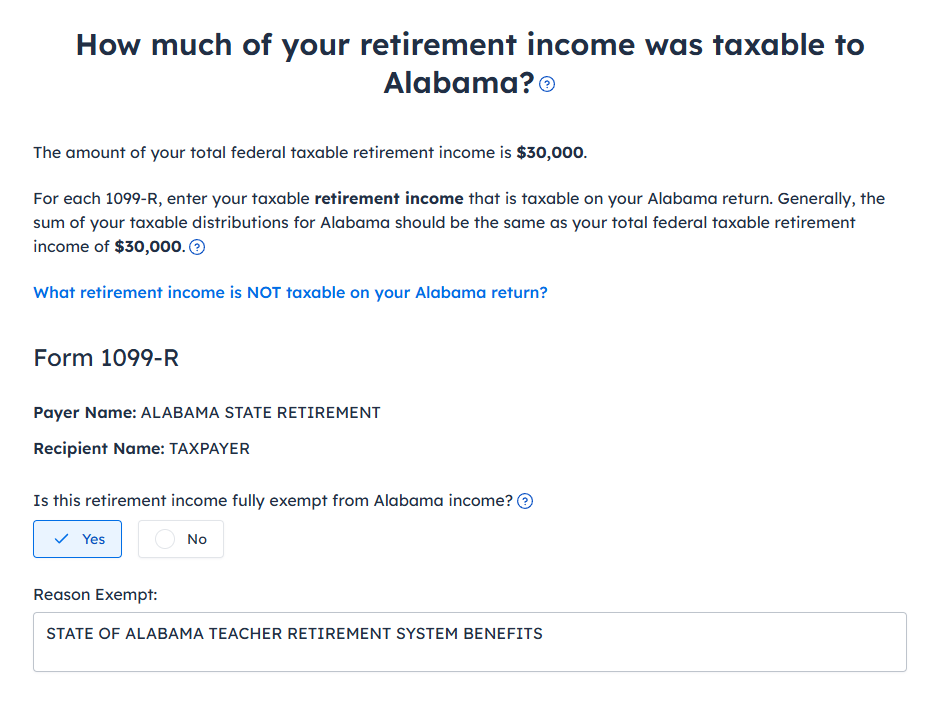

Follow the menu path: State > Alabama > Retirement Income to navigate to the correct screen. Once there, you’ll see all the 1099-R income you entered in the federal section of the software. If all your 1099-R income is tax exempt, you’ll answer Yes to the question "Is this retirement income fully exempt from Alabama income?"

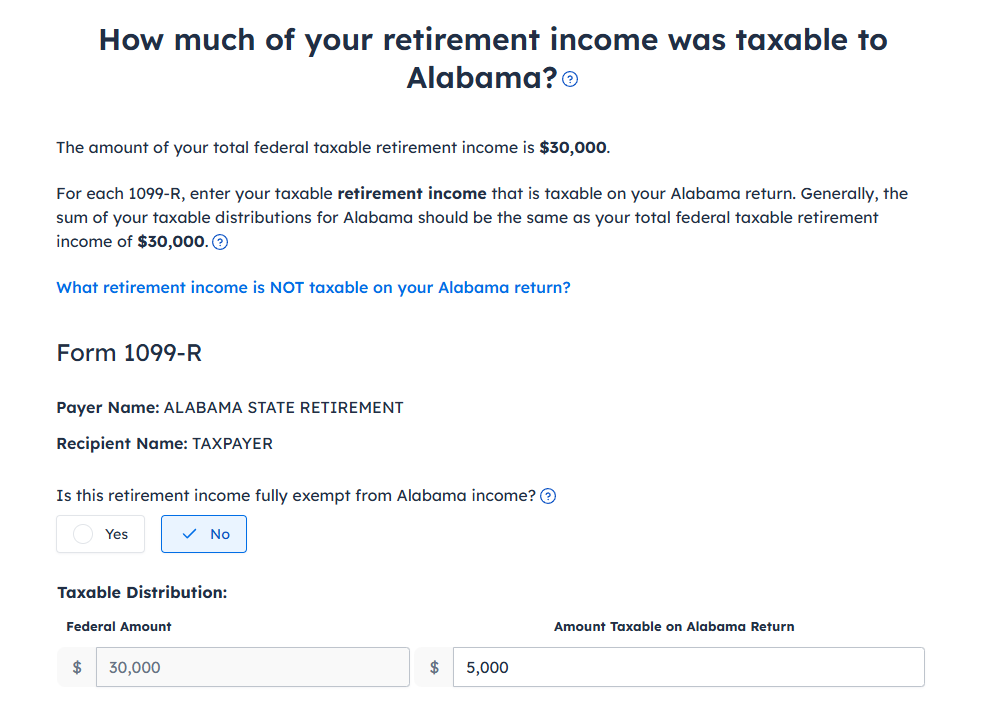

If only part of your retirement income is exempt from Alabama tax, or none of it's tax exempt, you will select No to the question, "Is this retirement income fully exempt from Alabama income?" which will open a box for you to enter the amount of your retirement income that is subject to state tax.

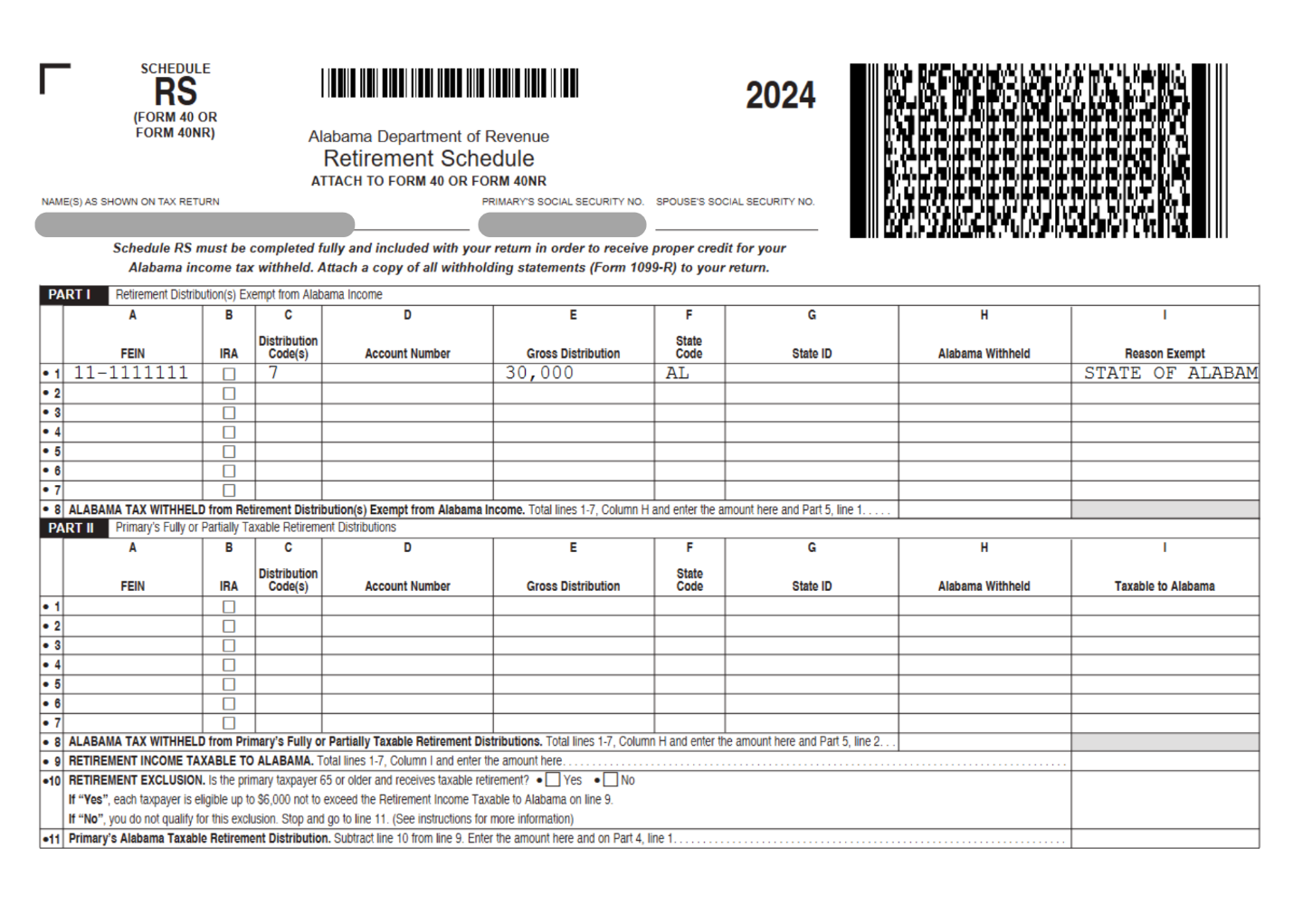

You’ll be able to look at the PDF of your state tax return to see how your retirement income is reported by looking at Schedule RS. If it’s not taxable, you’ll see your retirement income listed in Part I.

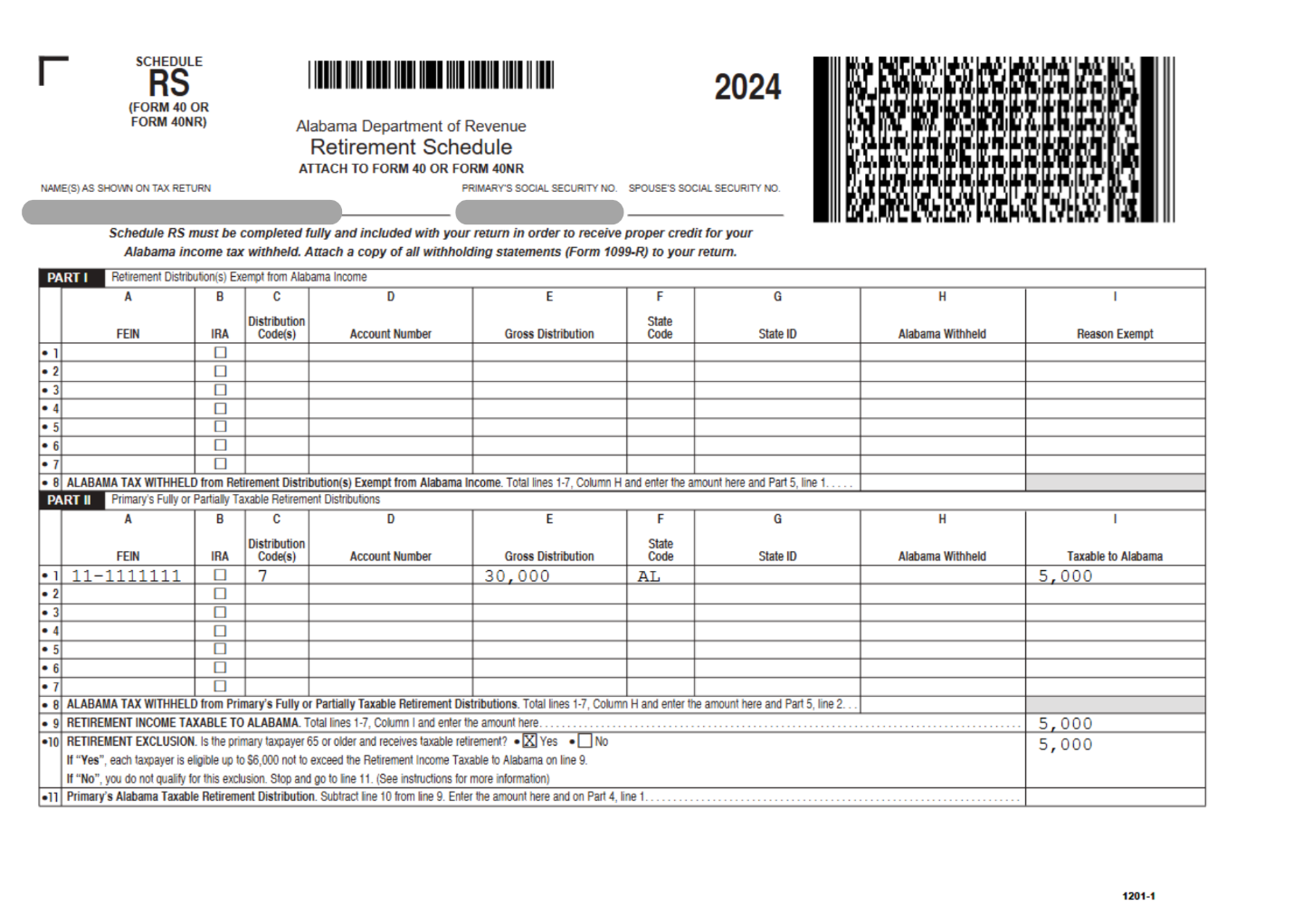

When your retirement income is taxable or partially taxable, you’ll see the portion that is taxable listed in Part II.

You may have noticed in the image above the retirement exclusion. If you’re age 65 or older, you have the added bonus of qualifying for the retirement exclusion, which means you may exclude up to $6,000 per eligible taxpayer (up to $12,000 if Married Filing Jointly and both spouses qualify). Even if your retirement income is considered fully taxable by the state, it can be reduced a bit to give you a lower taxable income.

Knowing the tax rules for your retirement income in Alabama is important for understanding how your tax return is prepared and calculated. By understanding which types of retirement income are tax-free and how to report them correctly, you can follow state tax laws and possibly lower your taxable income. Whether your retirement income is fully or partly tax-free, using the available exclusions and reporting your income accurately will help you handle Alabama's tax system with ease.